/Micron%20Technology%20Inc_logo%20and%20website-by%20Mojahid%20Mottakin%20via%20Shutterstock.jpg)

As artificial intelligence (AI) workloads continue to surge and data‑center infrastructure expands, the global semiconductor landscape enters a pivotal phase, one where memory specialists like Micron Technology (MU) take center stage. Recognized for its high‑bandwidth memory capabilities and innovative DRAM solutions, Micron stands at the crossroads of growth potential and cyclical risk.

Micron has gained substantial momentum recently, supported by strong analyst endorsements, robust demand for AI-driven memory products, and solid financial indicators.

About Micron Stock

Micron Technology (MU), the semiconductor powerhouse headquartered in Boise, Idaho, operates as the only U.S.-based manufacturer of DRAM, NAND, and NOR memory technologies. Micron designs and fabricates high-performance memory and storage solutions under the Micron and Crucial brands for AI, data centers, mobile, automotive, and industrial markets. The company currently boasts a market cap of around $129.7 billion.

Micron’s decade-long run has been nothing short of commanding, delivering over 500% returns to its shareholders. Now, the chipmaker is back in the spotlight, riding a winning streak that pushed it to a YTD peak of $117.26. In just five days, MU surged 8.9%, far outpacing the tech-heavy Nasdaq Composite’s ($NASX) modest 1.8% gain. With MU stock now up 37.5% on a YTD basis, analysts and investors alike are rallying behind its rising relevance in the AI-powered memory race.

From a valuation standpoint, MU stock currently trades at 18.1 times forward adjusted earnings - a discount compared to the sector median as well as its own historical average.

Micron’s Q2 Results Surpassed Projections

Micron delivered a standout second quarter for fiscal 2025 on March 20, with revenue climbing 38.3% year over year to $8.1 billion, surpassing the consensus estimates. Driven primarily by data-center demand, DRAM revenue rose 47% annually, making up roughly 76% of total sales, while NAND revenue grew around 18%. Impressively, Micron’s high-bandwidth memory (HBM) crossed the $1 billion mark, reflecting surging AI-driven adoption.

Profitability showed significant improvement, with non‑GAAP net income reaching $1.8 billion or $1.56 per share, a substantial increase over prior-year levels and topping analyst estimates by 9.5%. Non‑GAAP gross margin expanded to 37.9%.

On the cash flow front, Micron generated $3.9 billion in operating cash and invested $3.1 billion in capex, leading to $857 million in free cash flow. The company concluded the quarter with roughly $9.6 billion in cash and marketable securities.

Meanwhile, management anticipates Q3 revenue to be around $8.8 billion, while non-GAAP EPS is projected to land somewhere between $1.47 and $1.67.

Analysts monitoring the company remain optimistic, predicting its Q3 EPS to be around $1.41, up 227.9% annually. Looking ahead to fiscal 2025, the bottom line is projected to surge by 986.2% year over year to $6.30 per share, before growing by another 65.9% to $10.45 in fiscal 2026.

What Do Analysts Expect for Micron Stock?

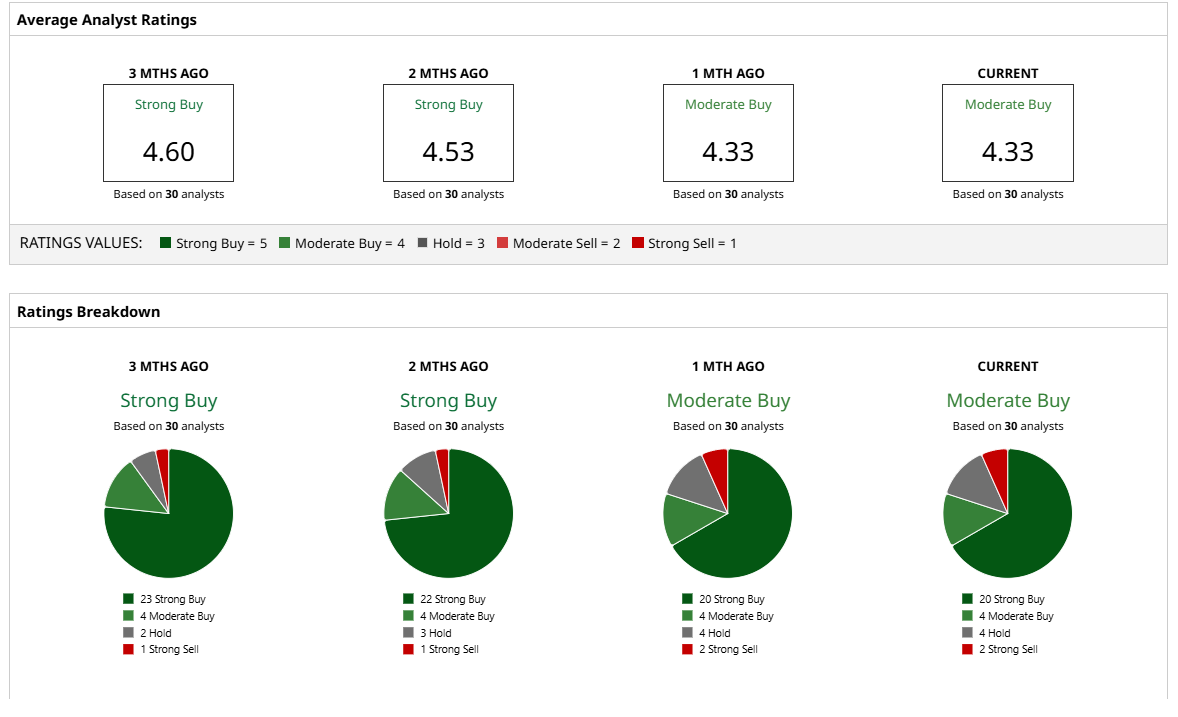

MU stock has a consensus “Moderate Buy” rating overall – a balanced stance that signals confidence in its trajectory, yet not without measured caution. But that’s a downgrade from the “Strong Buy” rating two months ago. Out of 30 analysts covering the AI chip stock, 20 recommend a “Strong Buy,” four advise a “Moderate Buy,” four analysts stay cautious with a “Hold” rating, and two have a “Strong Sell” rating.

The average analyst price target for MU is $127.07, indicating a potential upside of 9.5%. The Street-high target price of $172 suggests that the stock could rally as much as 48.3%.