/MGM%20Resorts%20International%20hotel%20by-%20atosan%20via%20iStock.jpg)

MGM Resorts International (MGM) is a multinational hospitality, sports and entertainment company. Headquartered in Las Vegas, Nevada, the company owns and operates a portfolio of resorts, casinos, hotels and entertainment venues both in the U.S. and internationally. Its market cap hovers around $9.5 billion.

Companies with a valuation between $2 billion and $10 billion are typically labeled “mid-cap stocks.” MGM Resorts International fits into this category, underscoring its significant presence and influence within the global hospitality and gaming industry.

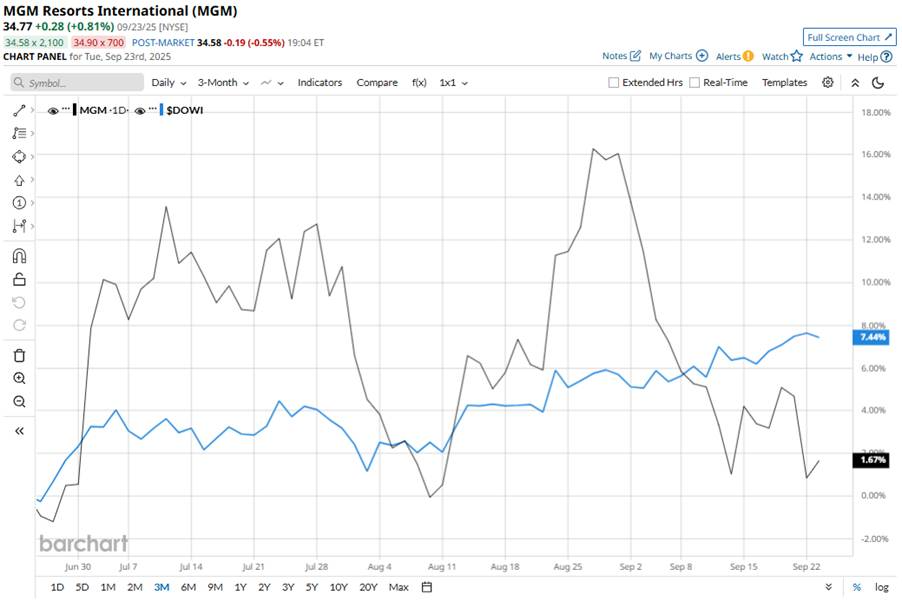

However, MGM is currently trading 18.3% below its 52-week high of $42.53, reached on Oct. 29, 2024. Also, over the past three months, MGM stock has gained 4.6%, underperforming the Dow Jones Industrials Average’s ($DOWI) 8.7% gains during the same time frame.

The stock demonstrated similar underperformance in the longer term. MGM rose marginally on a year-to-date (YTD) basis, while DOWI climbed 8.8%. Meanwhile, the stock has declined 5.6% over the past 52 weeks, compared to Dow Jones’ 9.9% returns over the same period.

MGM’s technical picture tells a shifting story. For much of the past year, the stock lingered under its 50- and 200-day averages. Momentum turned in late April as it crossed above the 50-day MA, holding ground until August’s brief slip. Yet, since July, it has remained anchored above the 200-day line, signaling underlying resilience.

Over the past year, shares of MGM Resorts have declined largely due to softer results in its Las Vegas operations. Also, resorts have been pressured by room remodels and lower table-games performance. Additionally, concerns about consumer spending and increased competition from regional casinos have amplified doubts about its growth sustainability and have further weighed on the share price.

MGM has also underperformed its rival, Las Vegas Sands Corp. (LVS). LVS stock rose by 3.3% on a YTD basis and climbed 26% over the past 52 weeks.

Despite MGM's weak performance over the year, analysts remain moderately bullish. The stock has a consensus rating of “Moderate Buy” from the 20 analysts covering the stock, and the mean price target of $47.56 suggests an upside potential of 36.8% from its last closing price.