/Meta%20Platforms%20by%20Primakov%20via%20Shutterstock.jpg)

Meta Platforms (META) is once again making headlines. CEO Mark Zuckerberg recently announced that Instagram has surpassed 3 billion monthly active users, a milestone that reflects the benefits of Meta’s aggressive push into artificial intelligence (AI). The company’s strategy of integrating AI into its social media platforms and ads is already delivering results, enhancing user engagement, refining content recommendations, boosting ad efficiency, and ultimately supporting revenue growth.

Meta’s Strong User Engagement Across Platforms

Notably, daily active users across Meta’s family of apps increased to approximately 3.48 billion in the second quarter. This solid base of daily active users (DAUs) reflects the stickiness of Meta’s platforms and the potential for continued monetization. Meta credits AI-driven improvements in its recommendation systems for a noticeable uptick in engagement. These enhancements have translated into measurable results, including a 5% increase in time spent on Facebook and a 6% increase on Instagram in Q2.

Video, a priority for the company, is proving to be one of the key catalysts for growth. Instagram users globally spent more than 20% more time watching videos compared to a year ago, while U.S. audiences on Facebook showed a similar increase. These gains reflect Meta’s ongoing optimization of content ranking systems, which ensures that users are presented with the most relevant material. On Instagram, over two-thirds of recommended content in the U.S. now originates from original posts, a trend that Meta aims to expand.

Meta’s Monetization Boosted by AI

The uptick in engagement is translating into stronger monetization. Meta’s AI-powered ad systems are driving efficiency and improved outcomes for advertisers. In Q2, the company improved its new Generative Ads Recommendation System across its platforms. This resulted in approximately 5% more ad conversions on Instagram and 3% on Facebook.

Ad impressions across Meta’s platforms grew 11% in the quarter. This growth reflects tailwinds from engagement on both Facebook and Instagram. Average ad prices increased 9% as higher demand followed better performance.

Overall, Meta is increasingly leveraging AI to drive both user growth and ad revenues. In the second quarter, the company’s total revenue from its Family of Apps reached $47.1 billion, reflecting a 22% increase year-over-year. Advertising revenue was $46.6 billion, up 21%, reflecting the importance of ads to Meta’s earnings engine. Geographically, growth was strong in Europe and the rest of the world, where ad revenues surged 24% and 23%, respectively. At the same time, North America and Asia-Pacific also contributed solid gains, reflecting Meta’s ability to scale its advertising platform globally.

Meta Is Investing in the Future with AI

Meta is doubling down on AI for long-term growth. For 2025, the company projects capital expenditures between $66 billion and $72 billion, up about $30 billion year-over-year. A significant amount will be allocated to expanding AI infrastructure, indicating that AI remains Meta’s key long-term growth driver.

Notably, Meta AI, its generative AI assistant, reported over a billion monthly active users in Q2. Moreover, the company is focused on deepening the user experience, refining its models, and positioning Meta AI as a leading personal AI assistant. Engagement metrics are trending upward, suggesting that future iterations of these models could further enhance both user experience and monetization.

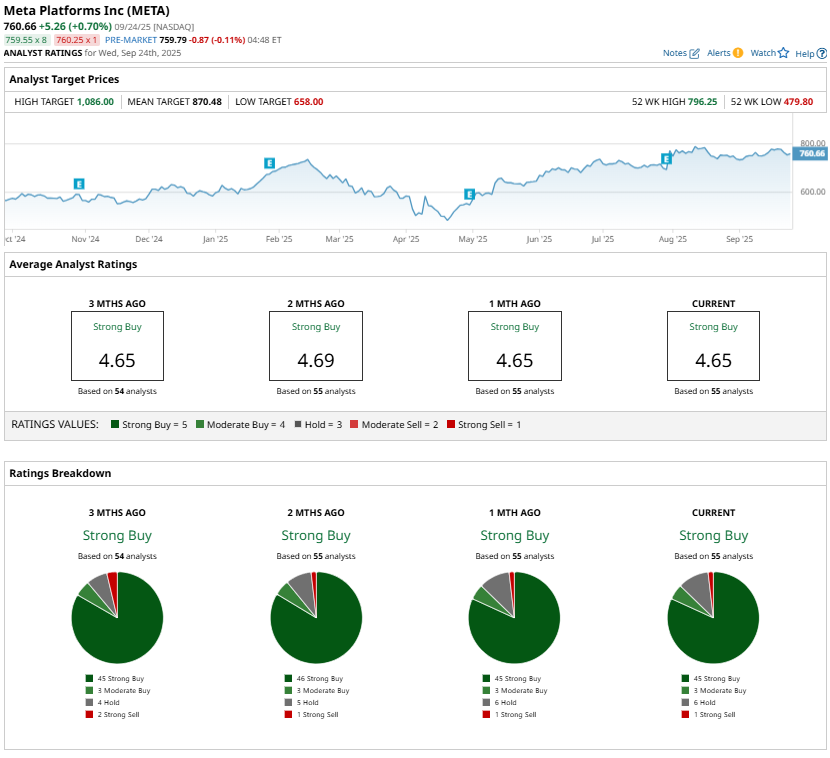

Here’s What Wall Street Recommends for Meta Stock

Thanks to the AI-driven tailwinds, Meta stock is up about 28% year-to-date. With accelerating user growth, stronger engagement, and AI innovations driving content and advertising, Meta appears well-positioned for solid growth.

Analysts maintain a “Strong Buy” consensus rating, with the Street’s high price target at $1,086, indicating roughly 45% upside potential.

Conclusion: Is Meta Stock a Buy?

Meta’s recent milestones in user growth and engagement reflect the effectiveness of its AI-driven strategy. With Instagram surpassing 3 billion monthly active users, strong daily engagement across its platforms, and AI innovations enhancing ad efficiency, Meta is translating its capital expenditures into tangible revenue growth.

The company’s focus on video, generative AI, and global ad expansion positions it well for continued growth. These catalysts, along with Wall Street’s bullish outlook, make Meta stock a buy for long-term investors.