Legacy media and entertainment companies witnessed a big spike in their “Growth” scores over the past week alone, hinting at a potential turnaround in the sector.

3 Media And Entertainment Companies With The Biggest Improvement

Benzinga’s Edge Stock Rankings assign scores to stocks based on their Value, Momentum, Growth and Quality. The Growth score is determined by the pace at which revenue and earnings have grown historically, with a focus on both long-term trends as well as recent performance.

Over the past week, a handful of stocks have witnessed a big surge in their Growth scores in Benzinga rankings, and a sector that stood out among them is media and entertainment.

Here are three companies in the sector that have seen big improvements over the past seven days, alongside our reasoning behind the same.

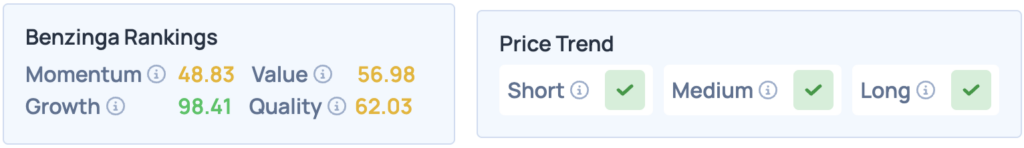

1. News Corp.

Famed mass media conglomerate, News Corp. (NASDAQ:NWSA), saw its growth score surge by 71.07 points, from 27.15 to 98.22.

The company’s growth was primarily led by its Dow Jones subsidiary, on the growing demand for its professional information services. This was, of course, magnified by the company’s efforts to move out of non-core, low-growth assets, allowing it to refocus its efforts on assets that mattered.

News Corp shares score high on Growth, and while they lag on other metrics, they also feature a favorable price trend in the short, medium and long terms. Click here for deeper insights into the stock.

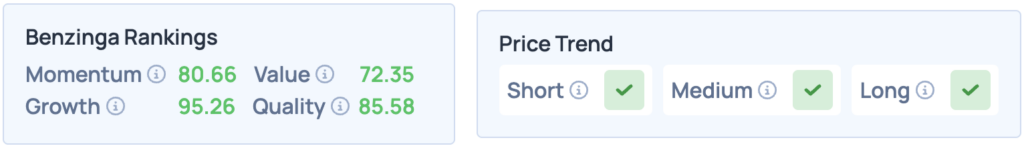

2. Fox Corp.

Another Murdoch Family-owned company, Fox Corp. (NASDAQ:FOX), is up by 61.12 points in its Edge score over the past week alone, hitting 94.61.

This surge was the result of its robust fourth quarter and full-year performance early this month, with the company posting a clean beat on consensus estimates, alongside strong year-over-year revenue growth of 17%.

The company also has a new direct-to-consumer growth catalyst, Fox One, that is set to make its debut this week. This marks the company’s foray into streaming, with potential for strong recurring revenue.

The stock scores well across the board, whether it is Momentum, Value, Growth, or Quality, and has a favorable price trend in the short, medium and long terms. Click here for more insights on the stock and the company.

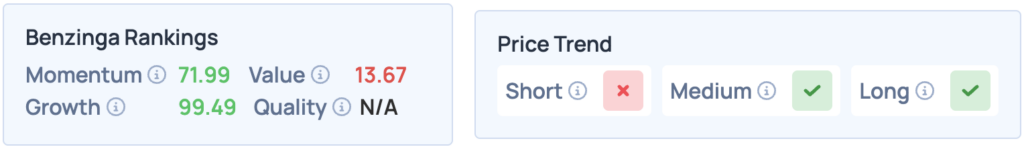

3. Formula One Group

The Formula One Group (NASDAQ:FWONK), as the name suggests, is the company responsible for the Formula One Championship.

The company’s Growth score in the Edge rankings spiked 47.71 points within a week, resulting in an impressive new score of 99.49. This can primarily be attributed to the company’s robust second-quarter performance, with revenues surging 41% year-over-year and earnings by 126%.

In addition to several new commercial deals during the quarter, the company closed the acquisitions of MotoGP, adding another marquee motor racing franchise under its umbrella.

The stock scores high on Momentum and Growth, with a favorable price trend in the medium and long terms. Click here to learn more about the company, its finances, and the stock.

Photo courtesy: Shutterstock