Raleigh, North Carolina-based Martin Marietta Materials, Inc. (MLM) is a natural resource-based building materials company that supplies aggregates and heavy-side building materials to the construction industry. With a market cap of $37.2 billion, the company also manufactures and markets magnesia-based products, including heat-resistant refractory products for the steel industry, chemical products for industrial and environmental uses, and dolomitic lime.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and MLM perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the building materials industry. MLM solidifies its leadership in the aggregates industry through a robust presence in strategic markets. Its diversified portfolio, featuring cement and magnesia specialties, buffers against market fluctuations.

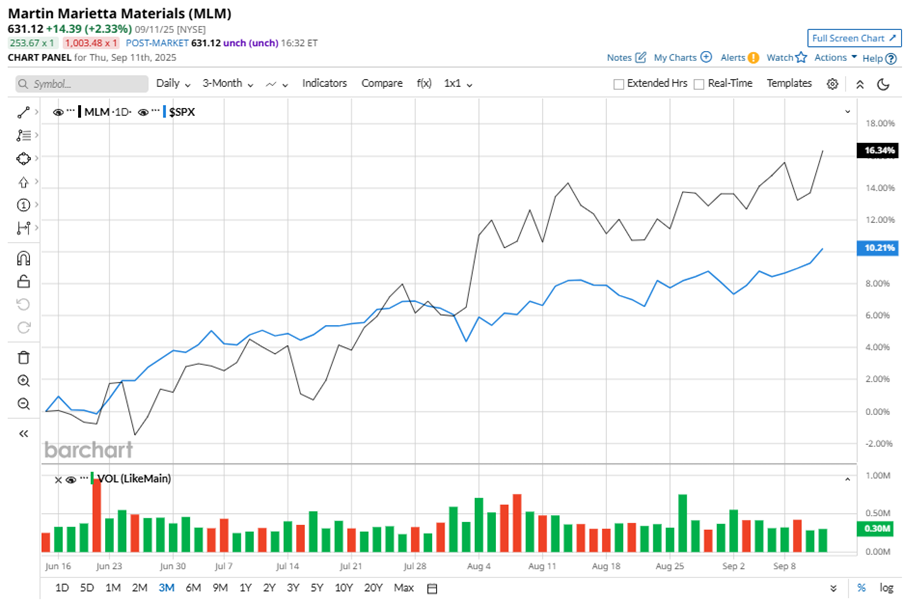

Despite its notable strength, MLM slipped marginally from its 52-week high of $633.23, achieved on Nov. 6, 2024. Over the past three months, MLM stock has gained 15.6%, outperforming the S&P 500 Index’s ($SPX) 9.4% gains during the same time frame.

In the longer term, shares of MLM rose 22.2% on a YTD basis and climbed 24.3% over the past 52 weeks, outperforming SPX’s YTD gains of 12% and solid 18.6% returns over the last year.

To confirm the bullish trend, MLM has been trading above its 50-day moving average since mid-April, with slight fluctuations. The stock is trading above its 200-day moving average since early May, with a minor fluctuation.

Martin Marietta's strong performance is driven by its aggregates strength, favorable pricing, and exposure to large-scale infrastructure and industrial projects, such as public highway spending and tech-driven projects like data centers and semiconductor manufacturing. The company's strict commercial discipline has also led to margin expansion, while its strategic shift to an aggregates-led portfolio is creating a more resilient business model.

On Aug. 7, MLM shares closed up marginally after reporting its Q2 results. Its EPS of $5.43 exceeded Wall Street expectations of $5.32. The company’s revenue stood at $1.8 billion, up 2.7% year-over-year. MLM expects full-year revenue in the range of $6.8 billion to $7.1 billion.

In the competitive arena of building materials, Vulcan Materials Company (VMC) has taken the lead over MLM, showing resilience with a 29.5% uptick over the past 52 weeks, but lagged behind the stock with 17.3% gains on a YTD basis.

Wall Street analysts are reasonably bullish on MLM’s prospects. The stock has a consensus “Moderate Buy” rating from the 21 analysts covering it, and the mean price target of $643.98 suggests a potential upside of 2% from current price levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.