Findlay, Ohio-based Marathon Petroleum Corporation (MPC) is an integrated downstream energy company with a market cap of $54.4 billion. It refines, markets, and transports petroleum products, including gasoline, diesel, jet fuel, and asphalt.

Companies valued at $10 billion or more are typically classified as “large-cap stocks,” and MPC fits the label perfectly. With its scale, efficiency, and strong distribution network, the company plays a central role in meeting the country’s energy demand. It operates one of the nation’s largest refining systems and an extensive network of pipelines, terminals, and retail locations under the Speedway and other fuel brands.

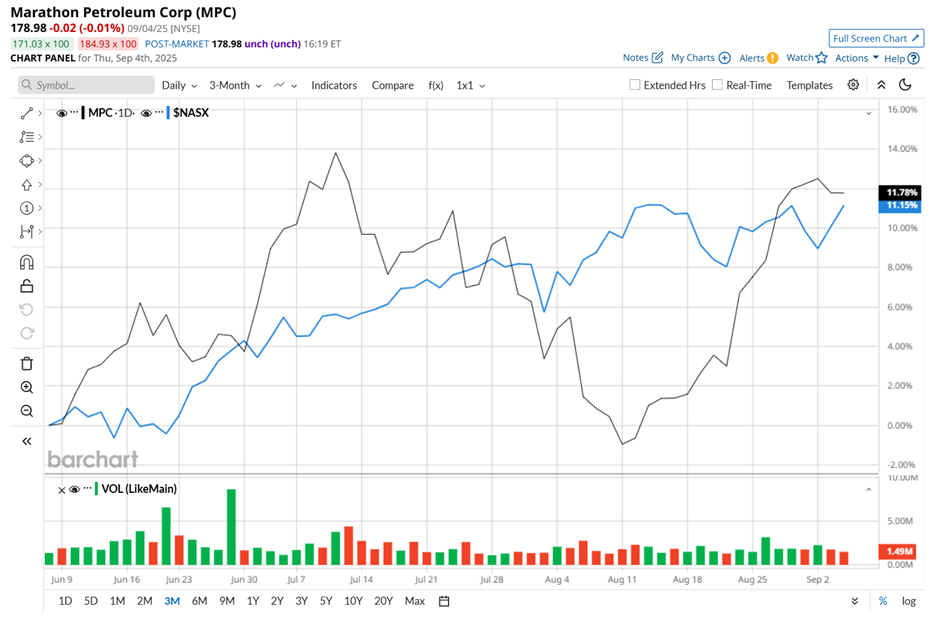

The energy company stock has declined 2.5% below its 52-week high of $183.50, reached recently on Sep. 3. Shares of MPC have soared 14% over the past three months, outperforming the Nasdaq Composite’s ($NASX) 11.6% return during the same time frame.

Moreover, shares of MPC are up 28.3% on a YTD basis, outpacing NASX’s 12.4% rise. However, MPC stock has gained 4.2% over the past 52 weeks, lagging behind NASX's 27.1% uptick over the same time period.

Yet, MPC stock has been trading above its 200-day and 50-day moving averages since early May, with minor fluctuations.

On Aug. 5, MPC reported its Q2 2025 results, and its shares plunged 3.8% in the following trading session. Due to lower sales and other operating revenues, the company’s top-line decreased 11.1% year-over-year to $34.1 billion. Additionally, on the earnings front, its adjusted EBITDA declined 3.8% from the year-ago quarter to $3.3 billion, while its EPS of $3.96 dropped 8.5% annually, but exceeded Wall Street’s expectations by a notable margin of 23%.

Additionally, MPC stock has lagged behind its rival, Valero Energy Corporation’s (VLO) 11.3% rise over the past 52 weeks. Nevertheless, it has outpaced VLO’s 26.8% return on a YTD basis.

Despite MPC’s outperformance on a YTD basis, analysts remain cautiously optimistic about its prospects. The stock has a consensus rating of "Moderate Buy” from the 20 analysts covering it, and the mean price target of $184.72 suggests a 3.2% premium to its current price levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.