/LKQ%20Corp%20laptop%20and%20phone%20by-%20T_Schneider%20via%20Shutterstock.jpg)

Antioch, Tennessee-based LKQ Corporation (LKQ) is a leading provider of alternative and specialty parts to repair and accessorize vehicles. With a market cap of $7.9 billion, LKQ operates through Wholesale-North America, Europe, Specialty, and Self-Service segments.

Companies worth between $2 billion and $10 billion are generally described as "mid-cap stocks." LKQ fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size and influence in the auto parts industry. It offers a wide range of replacement systems, components, and equipment for automobiles, trucks, and recreational vehicles.

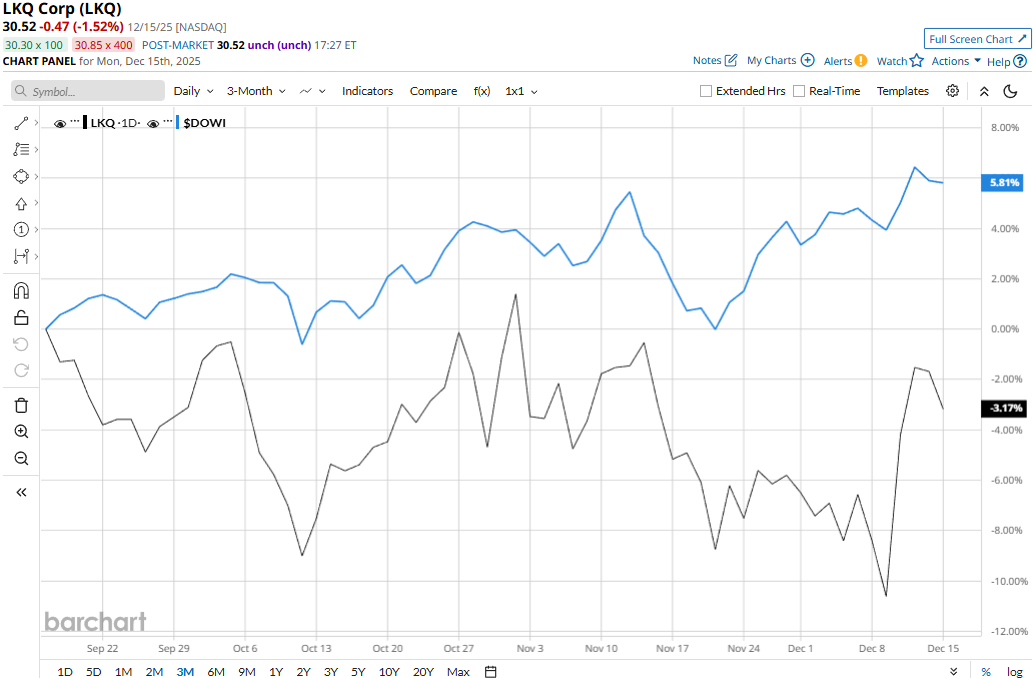

Despite its notable strengths, LKQ stock has dropped 31.9% from its 52-week high of $44.82 touched on Mar. 10. Meanwhile, LKQ stock prices have dipped 3.3% over the past three months, underperforming the Dow Jones Industrial Average’s ($DOWI) 5.5% uptick during the same time frame.

LKQ’s performance has remained grim over the longer term as well. LKQ stock prices have plunged 17% on a YTD basis and 19.6% over the past 52 weeks, compared to the Dow’s 13.8% gains in 2025 and 10.5% returns over the past year.

LKQ stock has traded mostly below its 50-day moving average since late April, with some fluctuations, and consistently below its 200-day moving average since mid-June, underscoring its bearish trend.

LKQ’s stock prices gained 3.7% in the trading session following the release of its mixed Q3 results on Oct. 30. The company observed a 1.2% decrease in parts and services organic revenues and a 30 bps net negative impact of acquisitions and divestitures. However, due to a positive impact of forex translation, the company’s overall topline increased 1.3% year-over-year to $3.5 billion, which fell 84 bps below Street’s expectations.

Meanwhile, due to a slight contraction in net margins, the company’s adjusted EPS decreased 2.3% year-over-year to $0.84, but surpassed the consensus estimates by a notable 13.5%.

When compared to its peer, LKQ has significantly outperformed Mobileye Global Inc.’s (MBLY) 47.1% decline on a YTD basis and 39.8% plunge over the past 52 weeks.

Among the 10 analysts covering the LKQ stock, the consensus rating is a “Moderate Buy.” As of writing, its mean price target of $41.19 suggests an approximate 35% upside potential from current price levels.