/LKQ%20Corp%20laptop%20and%20phone%20by-%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $7.7 billion, LKQ Corporation (LKQ) is a prominent distributor of automotive replacement, recycled, remanufactured, and specialty parts, serving collision and mechanical repair shops as well as individual consumers. Headquartered in Antioch, Tennessee, the company leverages a broad distribution network and diverse product portfolio that includes recycled parts, performance accessories, and its self-service salvage business.

Companies valued between $2 billion and $10 billion or more are generally classified as “mid-cap” stocks, and LKQ fits this criterion perfectly. Its market leadership stems from its extensive global distribution and logistics network, which ensures high parts availability and fast delivery to repair shops, along with a diverse product portfolio spanning aftermarket, recycled, remanufactured, and specialty parts.

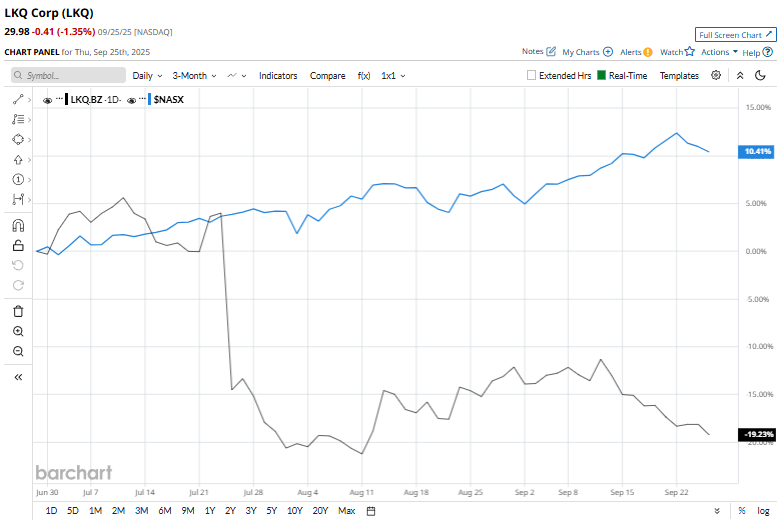

Shares of the company have retreated 33.1% from its 52-week high of $44.82. LKQ’s shares have plunged 18.8% over the past three months, underperforming the broader Nasdaq Composite’s ($NASX) 12.1% rise over the same time frame.

LKQ stock is down 18.4% on a YTD basis, lagging behind the Nasdaq Composite’s 15.9% rise. Moreover, shares of the auto parts distributor have decreased 23.3% over the past 52 weeks, compared to NASX’s 23.8% rise over the same time frame.

The stock has been trading below its 50-day moving average since mid-April. It has remained below its 200-day moving average since early June, indicating a downtrend.

On Jul.24, LKQ Corporation announced Q2 2025 earnings, and its shares dropped 17.8% as the company lowered its 2025 guidance, citing weaker repairable claims in North America and challenging European market conditions, now expecting adjusted EPS of $3.00–$3.30 and a 1.5–3.5% decline in organic parts and services revenue. It posted revenue of $3.6 billion, down 1.9% year-over-year, with organic parts and services revenue falling 3.4%. Adjusted EPS also declined 11.2% to $0.87.

In comparison, rival AutoZone, Inc. (AZO) has outpaced LKQ stock. AZO stock has gained 29.2% on a YTD basis and returned 33% over the past 52 weeks.

Despite the stock’s underperformance, analysts remain reasonably bullish on LKQ. The stock has a consensus rating of “Moderate Buy” from the seven analysts covering the stock, and the mean price target of $43.42 implies an upswing potential of 44.8% from the current market prices.

.jpg?w=600)