/Las%20Vegas%20Sands%20Corp%20phone%20by-%20Piotr%20Swat%20via%20Shutterstock.jpg)

With a market cap of $37.6 billion, Las Vegas Sands Corp. (LVS) is a global leader in the development and operation of world-class integrated resorts. The company’s portfolio includes premier properties in Macao, China such as The Venetian Macao, The Londoner Macao, The Parisian Macao, The Plaza Macao and Four Seasons Hotel Macao, and The Sands Macao as well as the iconic Marina Bay Sands in Singapore.

Companies valued more than $10 billion are generally considered “large-cap” stocks, and Las Vegas Sands fits this criterion perfectly. The destinations combine luxury accommodations, gaming, retail, dining, entertainment, and convention facilities, making Las Vegas Sands a major player in international hospitality and leisure.

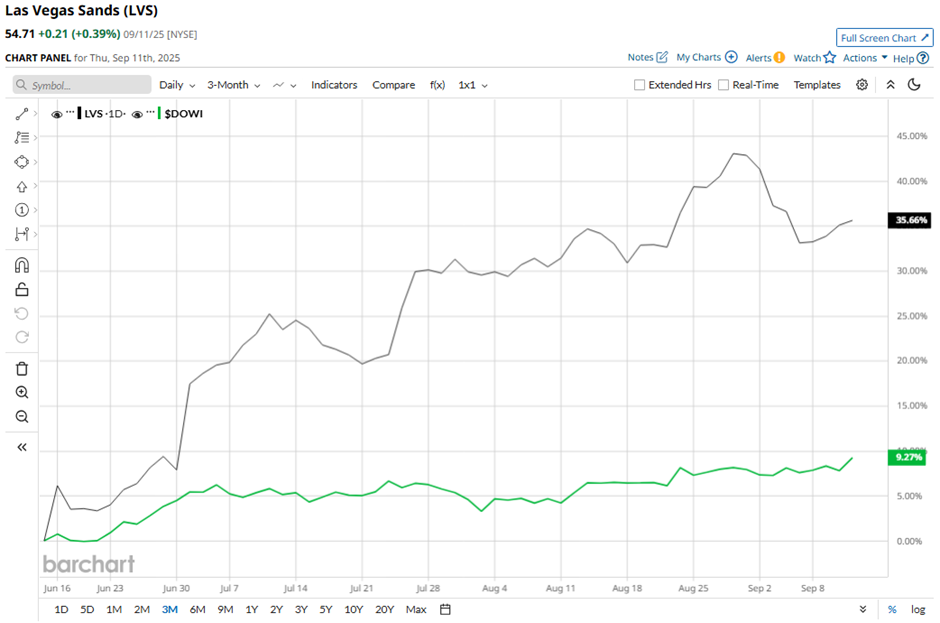

Shares of the Las Vegas, Nevada-based company have declined 5.8% from its 52-week high of $58.05. Over the past three months, its shares have surged 30.8%, outperforming the broader Dow Jones Industrials Average's ($DOWI) 7.6% gain during the same period.

Longer term, shares of the casino operator have climbed 39% over the past 52 weeks, exceeding DOWI’s 12.8% return over the same time frame. However, LVS stock has risen 6.5% on a YTD basis, lagging behind DOWI's 8.4% increase.

Yet, the stock has been in a bullish trend, consistently trading above its 50-day moving average since early May. Also, it has remained above its 200-day moving average since July.

Shares of Las Vegas Sands soared 4.3% following its Q2 2025 results on July 23. The company reported adjusted earnings of $0.79 per share and quarterly revenue of $3.1 billion, topping forecasts. Growth was fueled by a 36% revenue jump to $1.4 billion in Singapore and a 2.5% increase to $1.8 billion in Macau, highlighting strong performance in both key markets.

Nevertheless, LVS stock has lagged behind its rival, Wynn Resorts, Limited (WYNN). WYNN stock has returned 43.8% YTD and 63.5% over the past 52 weeks.

Despite the stock’s outperformance relative to the Dow over the past year, analysts remain cautiously optimistic about its prospects. LVS stock has a consensus rating of “Moderate Buy” from 17 analysts in coverage, and the mean price target of $59.65 represents a premium of over 9% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.