With a market cap of $131.2 billion, KKR & Co. Inc. (KKR) is a global investment firm that specializes in private equity, real estate, credit, and infrastructure investments. The firm focuses on a wide range of strategies including leveraged buyouts, growth equity, distressed situations, and impact investing across diverse sectors and geographies.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and KKR fits this criterion perfectly. KKR actively seeks controlling or strategic minority positions in companies worldwide, typically holding investments for five to seven years before exiting through IPOs, secondary offerings, or strategic sales.

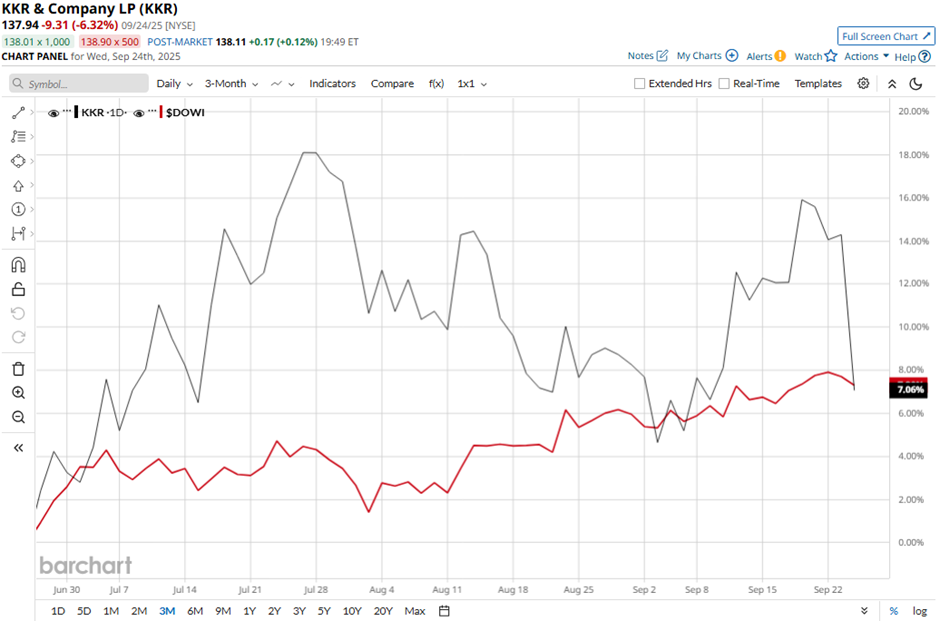

Shares of the New York-based company have declined 19.1% from its 52-week high of $170.40. Over the past three months, its shares have returned nearly 8%, slightly outpacing the broader Dow Jones Industrials Average's ($DOWI) over 7% rise during the same period.

Longer term, KKR stock is down 6.7% on a YTD basis, lagging behind DOWI's 8.4% gain. Moreover, shares of the company have risen 4.2% over the past 52 weeks, compared to DOWI’s 9.3% increase over the same time frame.

Despite a few fluctuations, KKR stock has been trading above its 50-day moving average since May. Also, it has moved above its 200-day moving average since July.

Despite Q2 2025 adjusted EPS of $1.18 topping the consensus estimate, KKR shares fell 2.6% on Jul. 31, as net income on a GAAP basis dropped sharply to $472.4 million from $667.9 million a year earlier. Investors were also cautious about rising expenses, which climbed 12.8% to $396.9 million, partially offsetting strong revenue growth.

In comparison, rival BlackRock, Inc. (BLK) has performed better than KKR stock. BLK stock has soared over 10% YTD and 19.8% over the past 52 weeks.

Despite the stock’s underperformance over the past year, analysts remain bullish about its prospects. KKR stock has a consensus rating of “Strong Buy” from 20 analysts in coverage, and the mean price target of $164.79 is a premium of 19.5% to current levels.