Burlington, Massachusetts-based Keurig Dr Pepper Inc. (KDP) is a non-alcoholic beverage company. It owns, manufactures, and distributes beverages and single-serve brewing systems in the U.S. and internationally. With a market cap of $38.9 billion, KDP operates through the U.S. Refreshment Beverages, U.S. Coffee, and International segments.

Companies worth $10 billion or more are generally described as "large-cap stocks." KDP fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size, influence, and dominance in the non-alcoholic beverages industry. It is known for its carbonated soft drinks, ready-to-drink teas and juices, and specialty coffees.

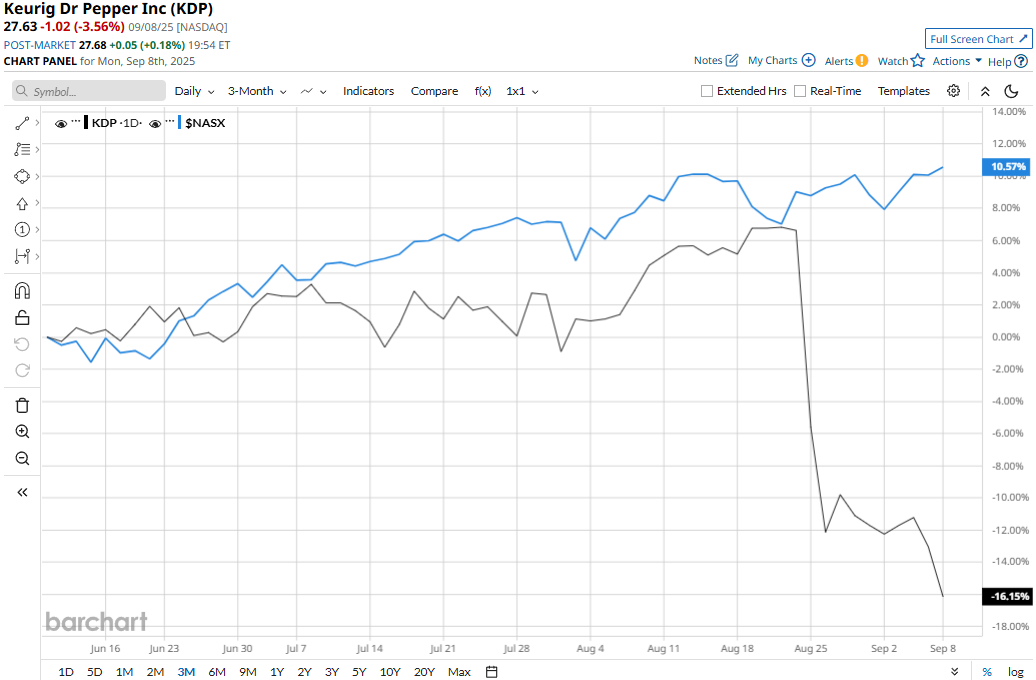

Keurig Dr Pepper touched its two-year high of $38.28 on Sept. 24, 2024, and is currently trading 27.8% below that peak. Meanwhile, KDP stock has dropped 15.7% over the past three months, notably underperforming the Nasdaq Composite’s ($NASX) 11.6% surge during the same time frame.

Over the longer term, KDP’s performance looks even grimmer. The stock has dropped nearly 14% on a YTD basis and 25% over the past 52 weeks, underperforming Nasdaq’s 12.9% surge in 2025 and 30.6% returns over the past year.

To confirm the bearish trend, KDP has remained mostly below its 50-day and 200-day moving averages since early May with some fluctuations.

Keurig Dr Pepper’s stock prices plummeted 11.5% on Aug. 25 and 6.9% in the subsequent trading session. This was followed by the company’s announcement to acquire JDE Peet (EURONEXT: JDEP), a Dutch-listed coffee company, for approximately €15.7 billion (or $18.4 billion), paying a 33% premium on the target’s share prices.

Following the acquisition, KDP plans to split itself into two separate companies, one for soft drinks and another for the coffee business. Although the management observes this step as strategically beneficial for stakeholders, investor sentiment was severely damaged due to the 33% premium KDP agreed to pay for the acquisition.

Meanwhile, KDP has also underperformed its peer, Monster Beverage Corporation’s (MNST) 19.9% gains on a YTD basis and 29.5% surge over the past 52 weeks.

Among the 17 analysts covering the KDP stock, the consensus rating is a “Moderate Buy.” As of writing, its mean price target of $37.76 suggests a 36.7% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.