/JPMorgan%20Chase%20%26%20Co_%20operations%20center-by%20jetcityimages%20via%20iStock.jpg)

Valued at a market cap of $827.9 billion, JPMorgan Chase & Co. (JPM) is one of the world’s largest financial services firms. The New York-based company operates globally through Consumer & Community Banking, Commercial & Investment Bank, and Asset & Wealth Management segments, offering a full suite of banking, payments, lending, and investment solutions.

Companies worth more than $200 billion are generally labeled as “mega-cap” stocks and JPMorgan Chase fits this criterion perfectly. Its diversified businesses serve consumers, small businesses, corporations, institutions, governments, and high-net-worth clients.

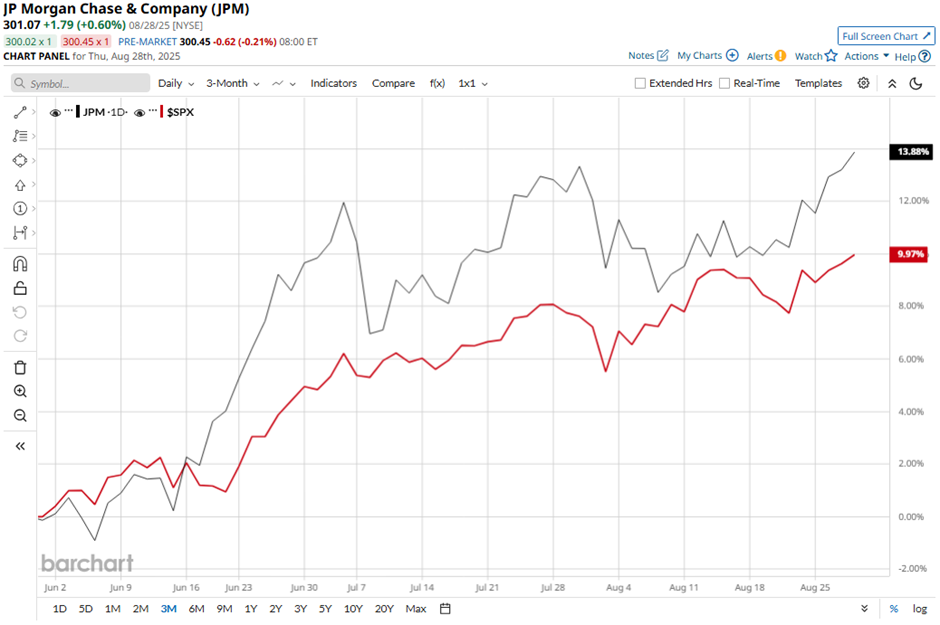

JPM stock has decreased marginally from its 52-week high of $301.29. However, shares of the company have increased 14.3% over the past three months, outperforming the broader S&P 500 Index’s ($SPX) 10.4% gain over the same time frame.

In the longer term, JPM stock is up 25.6% on a YTD basis, exceeding SPX’s 10.6% rise. Moreover, shares of JPMorgan Chase have surged 36.1% over the past 52 weeks, compared to the 16.3% return of the SPX over the same time frame.

Despite a few fluctuations, the stock has been trading mostly above its 50-day and 200-day moving averages since last year.

Despite beating expectations with Q2 2025 EPS of $4.96 and revenue of $44.9 billion, JPMorgan’s stock fell marginally on Jul. 15 due to concerns over its 10% year-over-year revenue decline. Investors were also cautious about the bank’s rising expenses of $23.8 billion, up 5% year-over-year.

Nevertheless, JPM stock has surpassed its rival, Bank of America Corporation (BAC). BAC stock saw a 14.9% rise on a YTD basis and a 26.4% gain over the past 52 weeks.

Despite JPMorgan Chase’s outperformance relative to its industry peers, analysts remain cautiously optimistic about its prospects. The stock has a consensus rating of “Moderate Buy” from 27 analysts' coverage, and the mean price target of $302.24 is a marginal premium to current levels.