/Johnson%20Controls%20International%20plc%20logo%20on%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Johnson Controls International plc (JCI) is an Ireland-based multinational conglomerate specializing in smart, healthy, and sustainable building solutions. Valued at a market cap of $70.1 billion, the company engineers, manufactures, and services high-performance systems such as HVAC (heating, ventilation, and air‑conditioning), industrial refrigeration, integrated fire detection and suppression, security systems, and building management platforms.

Companies worth $10 billion or more are typically classified as “large-cap stocks,” and JCI fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the building products & equipment industry. With a highly diversified customer base across healthcare, education, data centers, airports, and government facilities, JCI’s scale, technological expertise, and global reach underscore its influence and leadership in the sector.

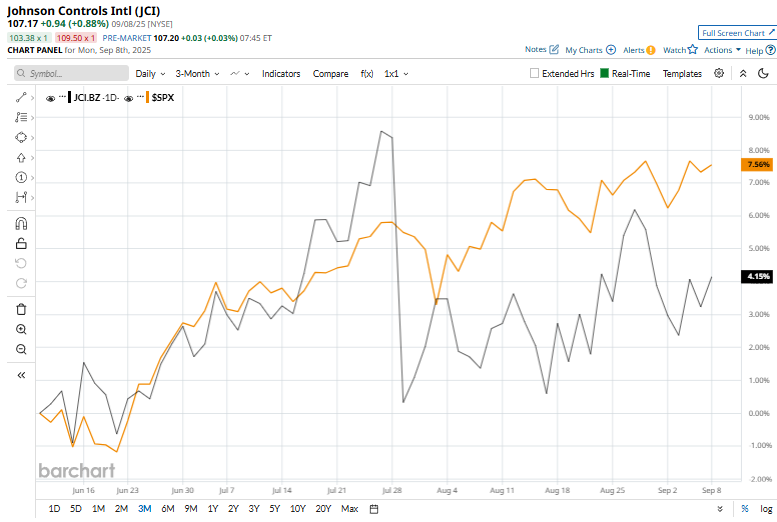

This building products manufacturer touched its 52-week high of $112.63 on June 28 and is currently trading 4.9% below the peak. Moreover, JCI has rallied 3.3% over the past three months, underperforming the S&P 500 Index ($SPX), which has returned 8.3% over the same time frame.

JCI has surged 58% over the past 52 weeks, significantly outperforming the S&P 500’s 20.1% gain over the same time frame. Moreover, on a YTD basis, shares of JCI are up 35.8%, compared to $SPX’s 10.4% rally.

Despite recent volatility, JCI has been trading mostly above its 200-day moving average over the past year and has remained above its 50-day moving average since late April, reinforcing an uptrend.

On Jul. 29, Johnson Controls reported Q3 2025 earnings, and its shares tumbled 7.4%. The company’s adjusted EPS of $1.05 and total revenue of $6.1 billion surpassed the consensus estimates. Its backlog climbed to $14.6 billion on healthy demand. Regional strength in EMEA and APAC helped offset softer performance in the Americas, and free cash flow reached $693 million. Despite raising full-year EPS guidance to $3.65–$3.68, shares slid as investors focused on margin pressures and near-term growth uncertainties.

JCI has outperformed its top rival, Carrier Global Corporation (CARR), which dipped 5.6% over the past 52 weeks and 3.9% on a YTD basis.

The stock has a consensus rating of "Moderate Buy” from the 21 analysts covering it, and its mean price target of $113.95 implies a premium of 6.3% from the current market prices.