Electric vehicle (EV) maker Tesla (TSLA) is shifting gears in Japan, a market where EV penetration is still relatively low. The Elon Musk-led automaker plans to double its retail presence in the country by the end of 2026, signaling a major push to capture market share in one of the world’s top automotive hubs.

Having relied mostly on online-only sales in Japan until now, Tesla is steering toward a more visible presence with plans to open more physical stores in high-traffic shopping and business centers, each of which will be directly operated by Tesla itself. The company aims to grow its store count from 23 to 30 by the end of this year, and add another 20 in 2026, with an eye on eventually hitting 100 locations nationwide.

That’s not all. Tesla also plans to expand its fast-charging network, making EV ownership even more convenient for Japanese consumers. As Japan starts to embrace electrification, can Tesla’s bold expansion plans in the region be a key catalyst for the company’s overall growth?

About Tesla Stock

While Tesla remains a prominent name in the EV world, 2025 has been anything but smooth for the brand. CEO Elon Musk’s political entanglements, marked by growing ties and then a sudden fallout with President Donald Trump, have created distractions that many believe have dented Tesla’s growth and weighed on its stock. Still, the tide may be turning. Recently, Musk posted on X that he’s “back to working 7 days” on Tesla, declaring “now it’s game on” for the company’s artificial intelligence (AI) ambitions.

That statement marks a clear pivot toward high-margin, scalable areas like autonomous driving, robotics, and software, core pillars of Tesla’s long-term vision. At the same time, the company is pressing ahead with its global expansion. Beyond its aggressive push in Japan, Tesla also made headlines this month by confirming plans to open its first showroom in India, on July 15.

To start, Tesla will import vehicles from its factories in Shanghai and Berlin, minimizing upfront costs while gauging India’s local demand. With sales losing steam in mature markets like the U.S. and Europe, Tesla’s push into countries like India and Japan looks like a calculated effort to unlock fresh growth and broaden its global footprint. The company presently commands a hefty market capitalization of about $1.1 trillion.

While shares of the EV giant are still down 18.7% year-to-date (YTD), trailing the broader S&P 500 Index ($SPX), which is up around 7.1% in 2025, there’s been a noticeable shift in sentiment lately. The stock has recently roared back to life, climbing an impressive 38% over the past three months as Elon Musk’s renewed focus on Tesla and its AI ambitions begins to reignite investor enthusiasm.

Tesla’s Q1 Earnings Miss and Q2 in Spotlight

Tesla started fiscal 2025 on a shaky note, with its fiscal 2025 first-quarter earnings report on April 22 falling short across the board. Revenue slipped 9% year-over-year (YOY) to $19.3 billion, missing analysts’ expectations of $21 billion. But the bigger shock came from adjusted earnings, which plunged 40% to just $0.27 per share, roughly 63% below what Wall Street was looking for.

The company’s core automotive business was the main drag, with revenue dropping 20% from $17.4 billion to about $14 billion. Tesla pointed to factory upgrades tied to the Model Y refresh as a factor, but deeper issues loomed. Heavy discounts and declining average selling prices chipped away at profitability, putting pressure on both revenue and margins.

Despite the weak quarter, there were a few bright spots. Tesla’s energy generation segment jumped 67% to $2.7 billion, while its services business rose 15% to $2.6 billion. Even so, Tesla struck a cautious tone, choosing not to offer updated forecasts and instead saying it would “revisit our 2025 guidance in our Q2 update.”

That next update is just around the corner. Tesla is scheduled to report its Q2 earnings on July 23 after market hours, and all eyes will be on whether the company can show signs of a rebound. Tesla is under pressure as competition ramps up, especially from Chinese EV makers rolling out sleek, budget-friendly models as well as CEO Elon Musk’s political controversies this year have hurt the company’s brand image.

The impact was clear in the company’s Q2 delivery update. Earlier this month, Tesla reported 384,122 vehicle deliveries for the second quarter, marking a sharp 13.5% drop from the same period last year and its second straight quarterly decline. Production also edged down slightly to 410,244 vehicles, compared to 410,831 a year ago, signaling ongoing challenges in maintaining momentum.

What Do Analysts Expect for Tesla Stock?

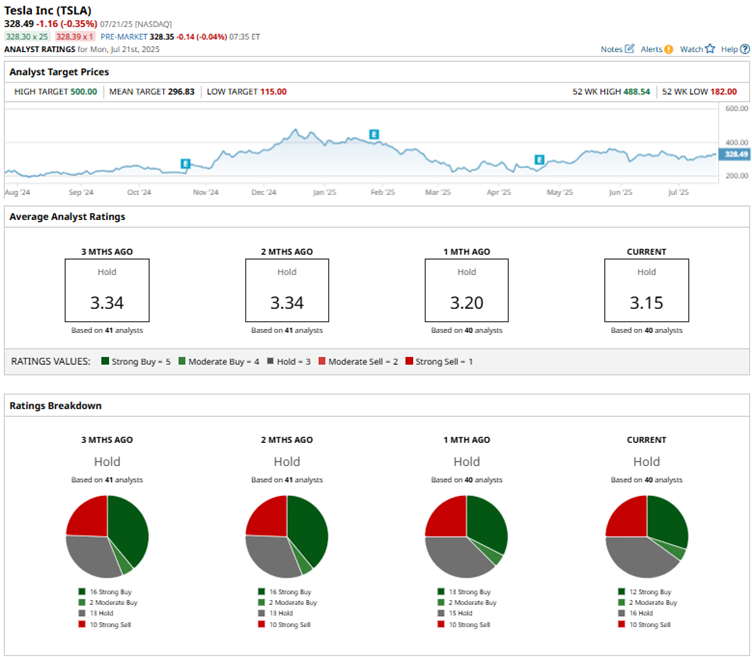

Overall, Wall Street is playing it safe with Tesla, sticking to a consensus “Hold” rating as the company navigates through a tough stretch. Of the 40 analysts offering recommendations, 12 advocate for a “Strong Buy” rating, two give a “Moderate Buy,” 16 suggest a “Hold,” and the remaining 10 maintain a “Strong Sell” rating.

While the stock trades premium to its average analyst price target of $296.83, the Street-high target of $500 suggests that TSLA can still rally as much as 52.2% from current levels.

Key Takeaways

All in all, while Tesla’s bold push into markets like Japan offers long-term promise, especially given the country’s low EV penetration and growing government support, it won’t be without hurdles. An aging population, loyalty to domestic automakers, limited charging infrastructure, and broader macro pressures could continue to weigh on near-term performance.

Combine that with the company’s recent delivery declines and ongoing margin compression, and it's clear the stock faces a tough road ahead. Japan might just be Tesla’s next big test. Success here would show Tesla’s ability to win in more established, competitive regions.