Headquartered in Dallas, Texas, Invitation Homes Inc. (INVH) is the largest single-family home leasing and management company in the U.S., operating as a real estate investment trust (REIT).

The company acquires, renovates, leases, and manages homes in desirable neighborhoods across multiple major markets. Its operations emphasize technology-driven property management and high resident retention. The company has a market capitalization of $18.10 billion. Hence, it is considered a “Large cap” stock.

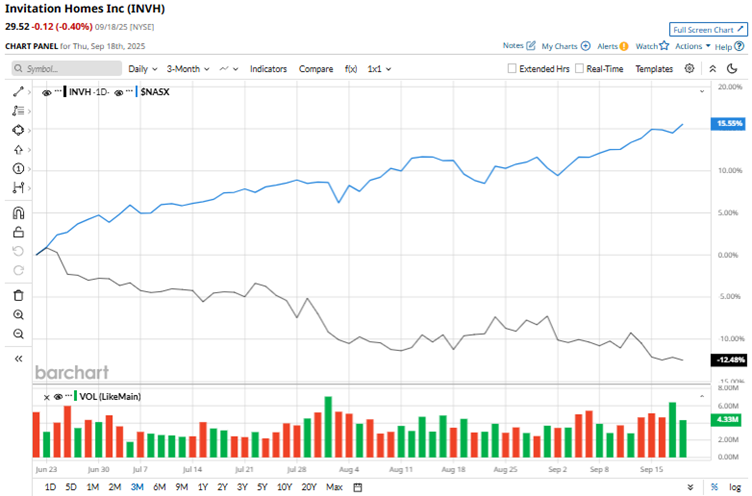

Invitation Homes’ stock reached a 52-week low of $29.37 on April 9, 2025, and is currently up only marginally from this low. In contrast, it had reached a 52-week high of $36.75 in September 2024 and is now down 19.7% from this high. Over the past three months, the stock has declined by 12.5%. In contrast, the broader Nasdaq Composite ($NASX) index gained 15% over the same period.

Invitation Homes’ stock is facing pressure from the sector’s downturn and cautious market sentiments. Over the past 52 weeks, the stock has declined 17.7%, while it is down 7.7% year-to-date (YTD). On the other hand, the Nasdaq Composite has gained 27.9% and 16.4% over the same periods.

Invitation Homes’ stock has shown a downturn, trading lower than its 50-day and 200-day moving averages since late June.

On July 30, Invitation Homes reported robust second-quarter results for fiscal 2025. However, investors might have been expecting more, as the stock declined 1.9% intraday on July 30 and 2.3% on July 31. The REIT’s same-store average occupancy was 97.2%. This represents an expected annual decline of 40 basis points.

On the other hand, the company’s total revenue increased 4.3% year-over-year (YOY) to $681.40 million, surpassing the $676.90 million that Wall Street analysts had expected. Its net income per common share was $0.23, representing a 91.7% increase from the prior year’s period. Its core FFO per share increased modestly YOY to $0.48, which was higher than the $0.47 figure that Wall Street analysts were expecting.

Despite the stock’s recent selloff, Wall Street analysts are bullish about Invitation Homes. The stock has a consensus rating of “Moderate Buy” from the 24 analysts covering it. The mean price target of $36.21 shows a 22.7% upside compared to current levels. However, the Street-high price target of $41 indicates a 38.9% upside.