With a market cap of $9.4 billion, The Interpublic Group of Companies, Inc. (IPG) is a leading global advertising and marketing services firm headquartered in New York City. Established in 1930 as McCann-Erickson and rebranded as IPG in 1961, the company has grown to employ approximately 51,000 people across over 100 countries.

Companies worth between $2 billion and $10 billion are generally described as “mid-cap stocks,” and IPG perfectly fits that description. IPG’s market leadership stems from strong global presence, a diverse service portfolio through top networks, long-standing client relationships, a focus on innovation and technology, and efficient operations, all of which help it maintain an edge in the advertising industry.

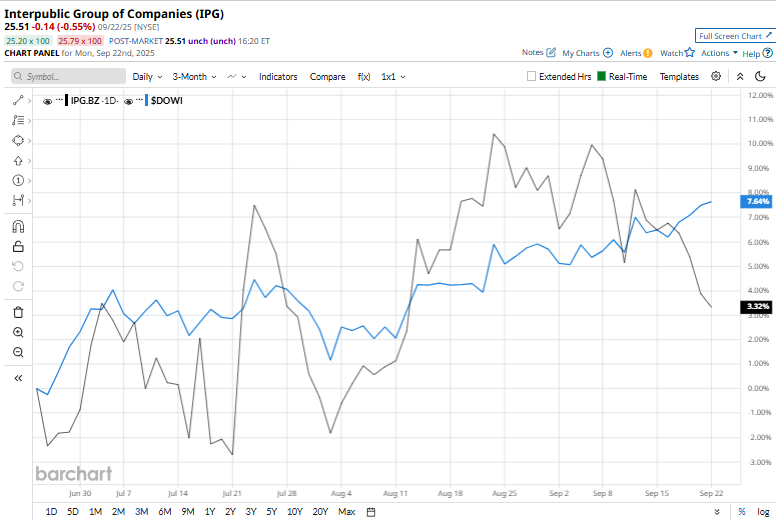

IPG shares have faced challenges and are currently trading 22.8% below their 52-week high of $33.05, touched on Dec. 9, 2024. The stock has surged 8.9% over the past three months, lagging behind the broader Dow Jones Industrial Average’s ($DOWI) 9.9% rise during the same time frame.

IPG has declined 9% on a YTD basis, underperforming $DOWI’s 9% rise. Moreover, over the past 52 weeks, IPG's 18% decline has been outperformed by $DOWI's 10.3% increase.

IPG has remained chiefly below its 200-day and 50-day moving averages since the end of October, indicating a downtrend.

On Jul. 22, Interpublic Group released its Q2 2025 results, and shares surged nearly 7%. It posted an adjusted revenue of $2.2 billion, in line with expectations and adjusted EPS of $0.75, exceeding forecasts. The strong performance was fuelled by robust spending in its media and healthcare-focused segments, along with growth in sports marketing and public relations.

IPG’s rival, Omnicom Group Inc. (OMC), has fallen behind IPG, with a fall of 13.4% on a YTD basis and a 27.2% drop over the past 52 weeks.

Among the nine analysts covering the IPG stock, the consensus rating is a “Moderate Buy.” The mean price target of $30.51 suggests a 19.6% upside potential from current price levels.