/Illinois%20Tool%20Works%2C%20Inc_%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

Glenview, Illinois-based Illinois Tool Works Inc. (ITW) is a diversified industrial manufacturer that produces engineered fasteners, components, equipment, and consumable systems. Valued at a market cap of $77.6 billion, the company serves a broad range of industries, including automotive, food equipment, construction, specialty products, welding, polymers, and fluids markets.

Companies worth $10 billion or more are typically classified as “large-cap stocks,” and ITW fits the label perfectly. Its specialty is developing innovative, customer-focused engineered products and solutions, supported by its unique decentralized operating structure that empowers individual business units to respond quickly to market needs.

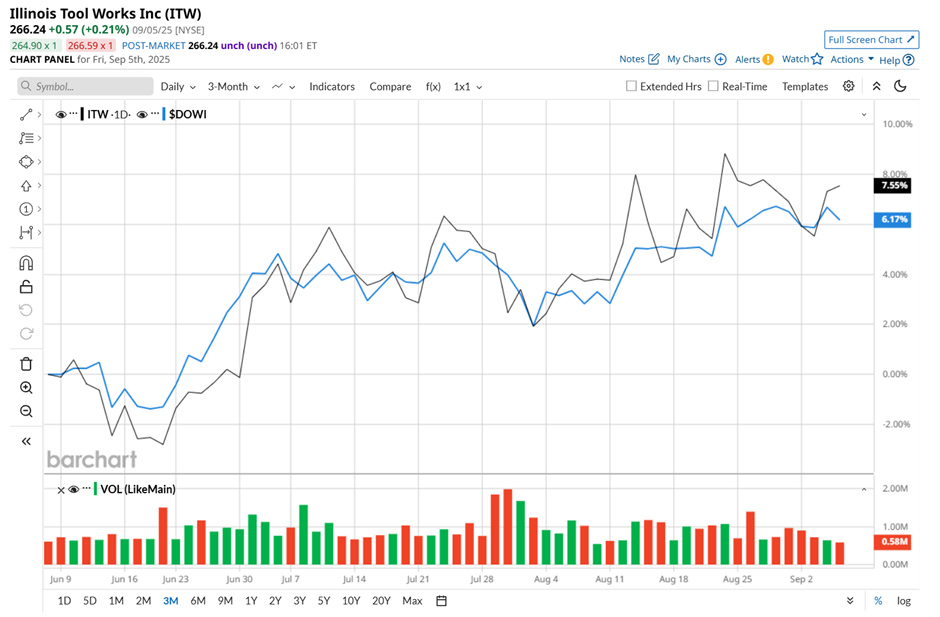

Shares of this diversified industrial manufacturer have declined 4.6% from its 52-week high of $279.13. Shares of ITW have increased 8.2% over the past three months, slightly outperforming the Dow Jones Industrial Average’s ($DOWI) 7.3% gain during the same time frame.

In the longer term, ITW stock has gained 9.5% over the past 52 weeks, lagging behind DOWI's 11.4% uptick over the same time period. Moreover, on a YTD basis, shares of the company are up 5%, compared to DOWI’s 6.7% surge.

Yet, ITW stock has been trading above its 200-day moving average since July and has remained above its 50-day moving average since early May.

On Jul. 30, ITW delivered better-than-expected Q2 2025 earnings results. The company’s revenue grew marginally year-over-year to $4.1 billion, surpassing the consensus. Moreover, its EPS reached $2.58, up 1.6% from the year-ago quarter and slightly above Wall Street’s estimates. Additionally, the company raised its fiscal 2025 EPS guidance, now expecting it to be between $10.35 and $10.55. Yet, its shares fell 2.3% after the earnings release, possibly due to investor concerns about the slow pace of revenue growth despite the beat.

Moreover, ITW stock has lagged behind its rival, 3M Company (MMM), which rallied 18.2% over the past 52 weeks and 20.3% on a YTD basis.

Due to ITW’s underperformance, analysts remain cautious about its prospects. The stock has a consensus rating of "Hold” from the 19 analysts covering it. As of writing, the stock is trading above its mean price target of $261.69.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.