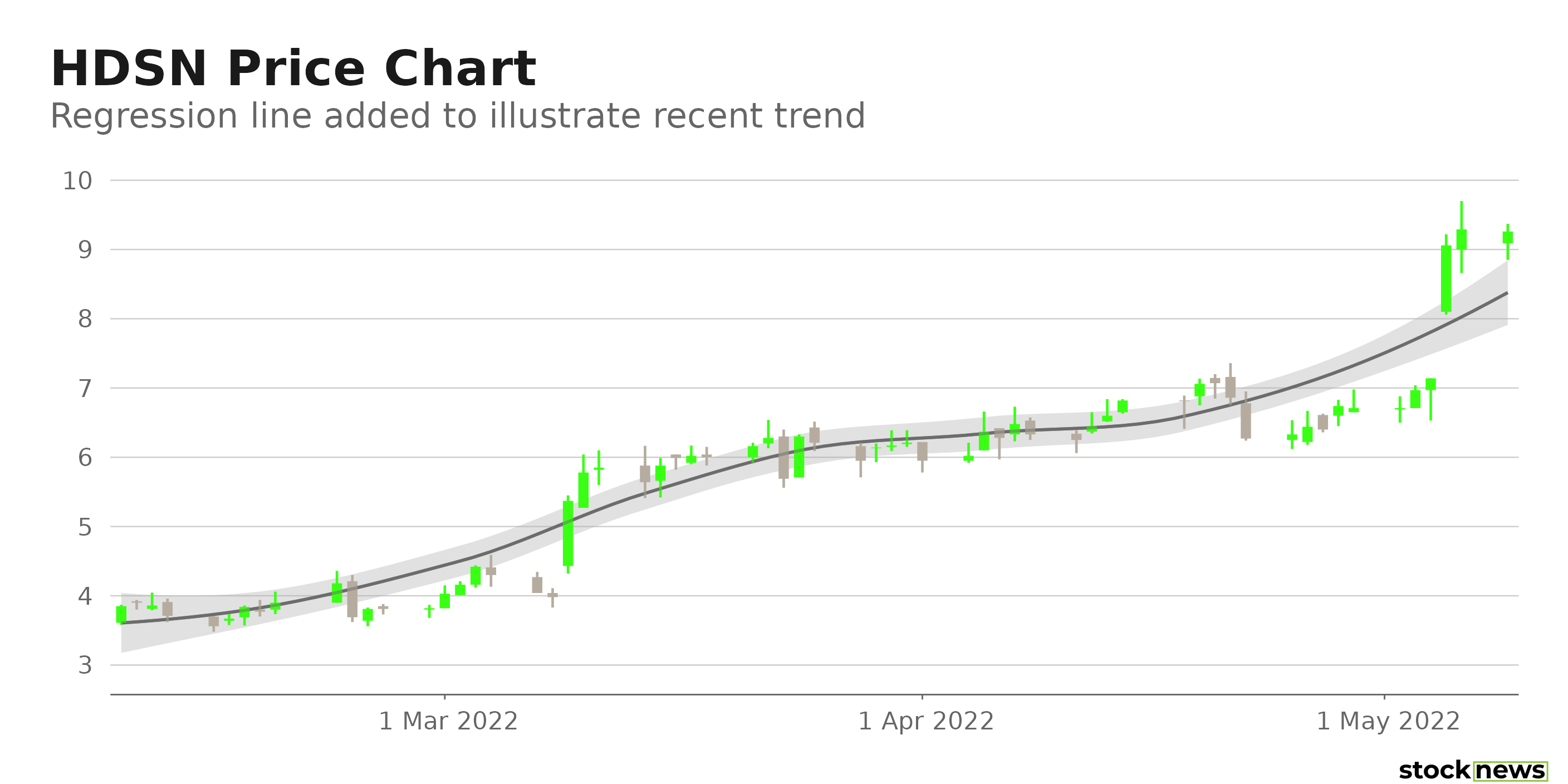

Pearl River, N.Y.-based Hudson Technologies Inc. (HDSN) is a prominent producer of innovative and sustainable refrigerant products and services to the HVACR sector and one of the nation's largest refrigerant reclaimers. Its shares have gained 316.6% in price over the past year and 109.2% year-to-date. In addition, the stock has risen close to 40% since it beat the consensus earnings estimate for its last reported quarter.

HDSN recently acquired Freight App, Inc., and expects its revenue to increase by more than 86% year over year by 2022. Furthermore, Fr8PrivateFleet, its recently announced technological solution, has already acquired new and existing customers, including one of Mexico's top food producers.

Also, TCW Asset Management Company and HDSN have signed a new $85 million term loan arrangement. In addition, Hudson has revised its current revolving credit facility, raising it to $90 million, with TCW extending a $15 million FILO loan and Wells Fargo continuing to manage the facility and awarding up to an additional $75 million in borrowing capacity.

Here is what could shape HDSN's performance in the near term:

Mixed Profitability

HDSN's 25.9% trailing-12-months net income margin is 281.8% higher than the 6.8% industry average. Its 1.2% trailing-12-months asset turnover ratio is 46.3% higher than the 0.80% industry average. However, its trailing-12-months cash from operation stood at negative $1.23 million compared to the $186.97 million industry average. Also, its trailing-12-months levered FCF margin was negative at 6.9%.

Discounted Valuation

In terms of forward non-GAAP P/E, the stock is currently trading at 7.09x, which is 57.3% lower than the 16.62x industry average. Also, its 0.26x forward non-GAAP PEG is 81% lower than the 1.36x industry average. Furthermore, HDSN's 6.01x forward EV/EBIT is 59.8% lower than the 14.95x industry average.

Consensus Price Target Indicates Potential Downside

The 12-month median price target of $7.25 indicates a 21.9% potential downside. The price targets range from a low of $6.50 to a high of $8.00.

POWR Ratings Reflect Uncertainty

HDSN has an overall C rating, which equates to a Neutral in our proprietary POWR Ratings system. The POWR ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. HDSN has a D grade for Stability and a C for Quality. The 1.35 stock beta is in sync with the Stability grade. The company's mixed profitability is consistent with the Quality grade.

Among the 77 stocks in the B-rated Industrial – Machinery industry, HDSN is ranked #43.

Beyond what I have stated above, you can view HDSN ratings for Growth, Momentum, Value, and Sentiment here.

Click here to check out our Industrial Sector Report for 2022

Bottom Line

HDSN has exhibited robust momentum over the past year and successfully beat analysts' expectations in its last reported quarter. However, analysts expect its EPS to decline 20.6% the current quarter, and 28.2% next year. So, we think investors should wait before scooping up its shares.

How Does Hudson Technologies Inc. (HDSN) Stack Up Against its Peers?

While HDSN has an overall C rating, one might want to consider its industry peers, THK CO. LTD. (THKLY), Amada Co. Ltd. (AMDLY), and Donaldson Company Inc. (DCI), which have an overall A (Strong Buy) rating.

Want More Great Investing Ideas?

HDSN shares were trading at $9.26 per share on Monday morning, down $0.03 (-0.32%). Year-to-date, HDSN has gained 108.56%, versus a -14.44% rise in the benchmark S&P 500 index during the same period.

About the Author: Pragya Pandey

Pragya is an equity research analyst and financial journalist with a passion for investing. In college she majored in finance and is currently pursuing the CFA program and is a Level II candidate.

Is Hudson Technologies a Buy After Beating Q1 Earnings Estimates? StockNews.com