/Hologic%2C%20Inc_%20logo%20on%20phone-by%20rafapress%20via%20Shuttestock.jpg)

Marlborough, Massachusetts-based Hologic, Inc. (HOLX) develops, manufactures, and supplies diagnostic products, imaging systems, and surgical products for women's health through early detection and treatment worldwide. With a market cap of $16.7 billion, Hologic operates through Diagnostics, Breast Health, GYN Surgical, and Skeletal Health segments.

Companies worth $10 billion or more are generally described as “large-cap stocks.” Hologic fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size and influence in the medical instruments & supplies industry.

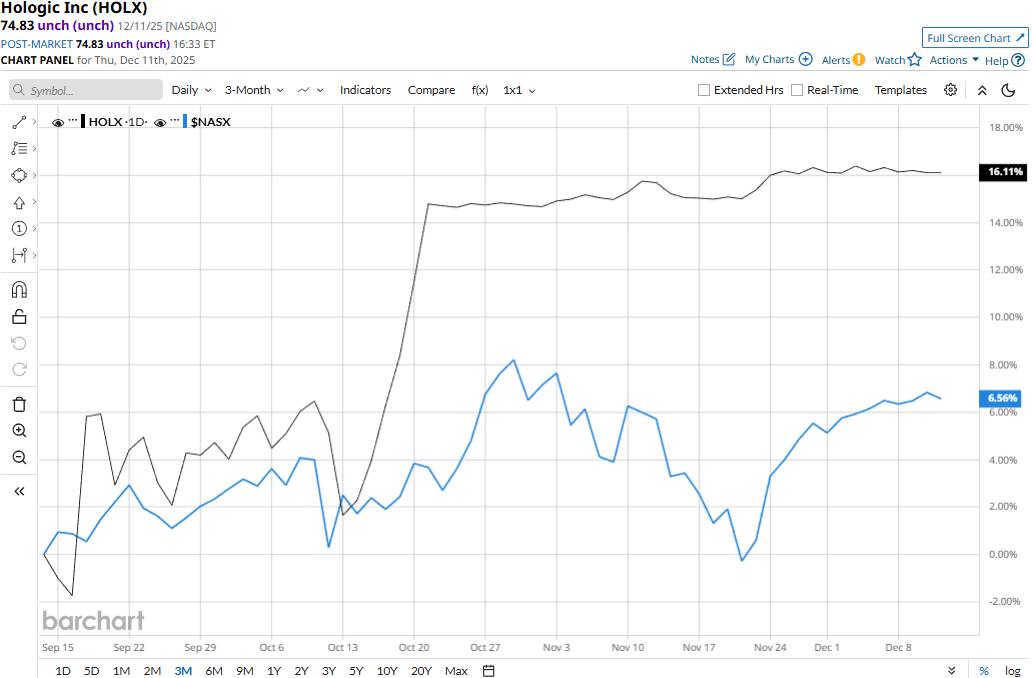

Hologic stock touched its 52-week high of $76.29 on Dec. 12, 2024, and is currently trading 1.9% below that peak. Meanwhile, HOLX stock soared 12.7% over the past three months, outpacing the Nasdaq Composite’s ($NASX) 7% gains during the same time frame.

Hologic’s performance has remained grim over the longer term. HOLX stock prices have gained 3.8% on a YTD basis and dipped 93 bps over the past 52 weeks, lagging behind the Nasdaq’s 22.2% surge in 2025 and 17.8% returns over the past year.

Hologic has traded mostly above its 50-day moving average since late May and above its 200-day moving average since early August, with some fluctuations, underscoring its bullish trend.

Hologic’s stock prices observed a marginal uptick in the trading session following the release of its better-than-expected Q3 results on Nov. 3. Driven by a 5.2% increase in US revenues and a 9.4% surge in international revenues, the company’s overall topline for the quarter grew 6.2% year-over-year to $1.1 billion, beating the Street’s expectations by 1.5%.

The company’s gross margins were negatively impacted due to product mix and an increase in tariff expenses. Nonetheless, driven by the impact of leverage from revenue growth, the company’s non-GAAP operating margins increased 120 bps year-over-year to 31.2%. Meanwhile, the company’s non-GAAP EPS soared 11.9% year-over-year to $1.13, beating the consensus estimates by 2.7%.

Further, Hologic has also outperformed its peer, Align Technology, Inc.’s (ALGN) 21.4% decline on a YTD basis and 31.6% plunge over the past 52 weeks.

Among the 18 analysts covering the HOLX stock, the consensus rating is a “Hold.” As of writing, its mean price target of $76.92 suggests a modest 2.8% upside potential from current price levels.