/Hewlett%20Packard%20Enterprise%20Co%20San%20Jose%20campus-by%20Michael%20Vi%20via%20Shutterstock.jpg)

With a market cap of $32.2 billion, Hewlett Packard Enterprise Company (HPE) is a global edge-to-cloud company that delivers solutions across Cloud Services, Compute, High Performance Computing & AI, Intelligent Edge, Software, and Storage. Its portfolio includes industry-leading servers, composable infrastructure, networking products through HPE Aruba, and consumption-based services via HPE GreenLake.

Companies valued at $10 billion or more are generally considered “large-cap” stocks, and Hewlett Packard Enterprise fits this criterion perfectly. HPE serves enterprises and public sector organizations worldwide through a vast ecosystem of partners and advanced research from Hewlett Packard Labs.

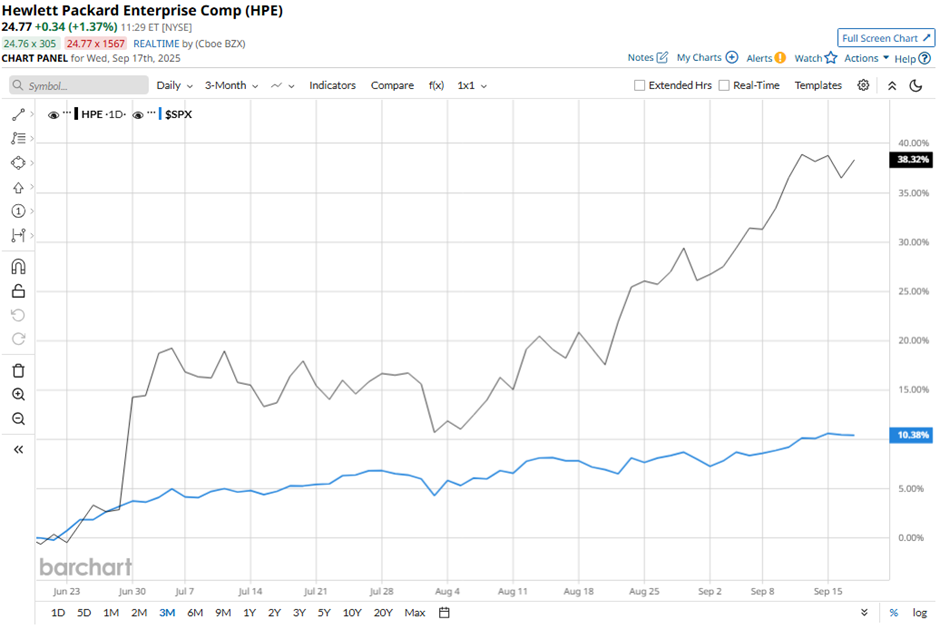

Shares of the Spring, Texas-based company have fallen 1.2% from its 52-week high of $25.10. Hewlett Packard’s shares have surged 38.6% over the past three months, outperforming the broader S&P 500 Index’s ($SPX) 10.4% gain over the same time frame.

In the longer term, HPE stock is up 16.2% on a YTD basis, outpacing SPX’s 12.2% rise. Moreover, shares of the information technology products and services provider have climbed 36.3% over the past 52 weeks, compared to the 17.2% return of the SPX over the same time frame.

The stock has been trading above its 50-day moving average since May. Also, it has remained above its 200-day moving average since late June.

Shares of Hewlett Packard Enterprise rose 1.5% after it reported Q3 2025 results that exceeded Wall Street expectations, with adjusted EPS of $0.44 and revenue of $9.14 billion. Growth was fueled by a 16% year-over-year jump in server revenue, driven by surging demand for AI-optimized servers with Nvidia GPUs, and a 54% surge in networking revenue, boosted further by the $14 billion Juniper acquisition.

HPE also raised its full-year 2025 revenue growth forecast to 14% - 16% and projected Q4 revenue of $9.7 billion - $10.1 billion, ahead of analyst expectations.

However, rival Ciena Corporation (CIEN) has outpaced HPE stock. CIEN stock has jumped 61.1% on a YTD basis and 142.1% over the past 52 weeks.

Despite the stock’s outperformance relative to the SPX, analysts remain cautiously optimistic on HPE. It has a consensus rating of “Moderate Buy” from the 19 analysts in coverage, and the mean price target of $25.13 is a premium of 1.5% to current levels.