Healthpeak Properties, Inc. (DOC) is a Denver-based real estate investment trust (REIT) specializing in healthcare real estate. Valued at a market cap of $12.8 billion, the company owns, operates, and develops high-quality real estate at the intersection of healthcare discovery and delivery. Its portfolio primarily focuses on three private-pay healthcare asset classes: life science, outpatient medical, and senior housing

Companies worth $10 billion or more are typically classified as “large-cap stocks,” and DOC fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the healthcare REIT industry. Healthpeak Properties’ prime U.S. locations in innovation hubs provide access to top healthcare and biotech players, ensuring strong demand and stable tenants.

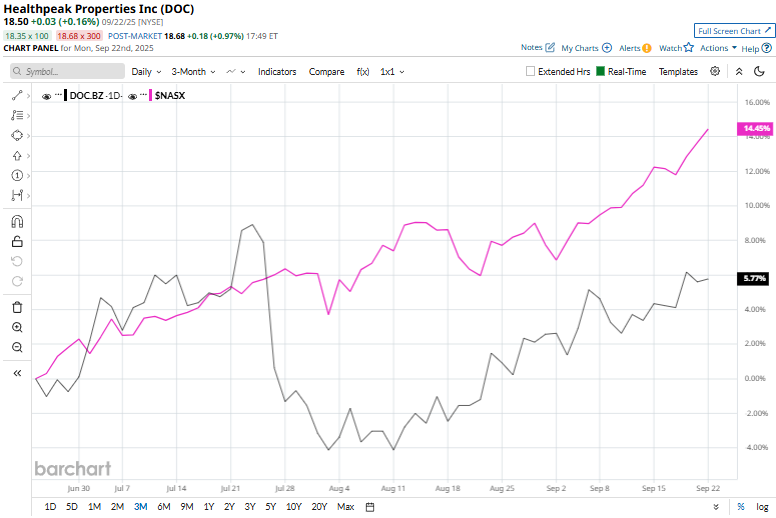

This healthcare facilities REIT has slipped 20.5% from its 52-week high of $23.26, reached on Oct. 24, 2024. Shares of DOC have surged 8.2% over the past three months, underperforming the broader Nasdaq Composite’s ($NASX) 17.2% rise over the same time frame.

In the longer term, DOC has fallen 16% over the past 52 weeks, underperforming $NASX’s 27% rise over the same time frame. Moreover, on a YTD basis, shares of DOC are down 8.7%, compared to $NASX’s 18% uptick.

DOC has been trading below its 200-day moving average since mid-December 2024, with slight fluctuations, but has remained above its 50-day moving average since late August.

On Jul. 24, DOC released its Q2 results, and its shares tumbled 6.7% on the following trading session. Revenue edged down marginally year-over-year to $694.3 million, narrowly missing consensus expectations, which may have dampened investor sentiment. Meanwhile, AFFO per share rose 2.2% to $0.46, in line with analyst forecasts, and total merger-combined same-store cash adjusted NOI increased 3.5% compared with the prior year.

Healthpeak Properties’ underperformance looks pronounced when compared to its rival, Omega Healthcare Investors, Inc.’s (OHI) 1.6% rise over the past 52 weeks and is up 8.5% on a YTD basis.

Despite DOC’s recent underperformance, analysts remain moderately optimistic about its prospects. The stock has a consensus rating of "Moderate Buy” from the 19 analysts covering it, and the mean price target of $21 suggests a 13.5% premium to its current price levels.