/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

Alphabet (GOOGL) shares reached a fresh 52-week high of $256 on Sept. 19, pushing the company's market capitalization higher. Google had hit the $3 trillion mark for the first time last week, fueled by easing regulatory headwinds, particularly a recent antitrust ruling that spared Google from divesting flagship assets such as Chrome and Android. Meanwhile, growth in its cloud business and the increasing traction of its artificial intelligence (AI) products, including the Gemini suite, are providing fresh tailwinds.

Google has now become only the fourth publicly listed firm to achieve that market value, joining Apple (AAPL), Microsoft (MSFT), and Nvidia (NVDA). The milestone reflects growing investor conviction that the company is undergoing a long-term shift from being primarily a search leader to establishing itself as a comprehensive AI powerhouse.

So, is this the right entry point in GOOGL stock?

About Alphabet Stock

Headquartered in Mountain View, California, Alphabet has transformed the tech landscape through its wide-ranging businesses, including Google Services, Google Cloud, and forward-looking initiatives like Waymo and Verily. Its strategic focus on artificial intelligence and cloud computing continues to be a major growth engine, reinforcing its strong competitive positioning. With a market capitalization of more than $3 trillion, Alphabet remains a dominant force in global technology and a key member of the Magnificent Seven.

On a year-to-date (YTD) basis, GOOGL stock has advanced about 34%, with an impressive 56% gain over the past 52 weeks. Investor enthusiasm picked up in the recent trading sessions owing to a favorable Chrome ruling on Sept. 2, driving the stock to notch a new 52-week high on Sept. 19.

In the recent antitrust ruling, federal Judge Amit Mehta delivered a landmark antitrust ruling requiring Google to abandon certain exclusive contracts and share search-related data, while allowing it to keep its core assets like Chrome and Android.

At 25 times forward earnings, GOOGL stock currently trades at a premium compared to the sector median and its own historical average.

Alphabet's Steady Q2 Results

Alphabet released its second-quarter 2025 earnings on July 23, delivering a strong quarter that highlighted both the durability of its core businesses and momentum in AI innovation. Revenue came in at $96.4 billion, up 14% year-over-year (YOY), with broad-based gains across Google Search, YouTube ads, subscriptions, devices, and Google Cloud.

Net income rose 19% YOY to $28.2 billion, while EPS jumped 22% to $2.31, topping Wall Street expectations. Google Services generated $82.5 billion in revenue, a 12% YOY increase driven by strength across all subcategories. Google Cloud was a standout, climbing 32% to $13.6 billion, pushing its annual revenue run rate past $50 billion and reinforcing the company's growing strategic role.

CEO Sundar Pichai pointed to AI products like AI Overviews and AI Mode as increasingly central to monetization, with adoption levels nearing those of Search. To meet soaring demand for AI infrastructure and cloud services, the company raised its 2025 capital expenditure outlook to about $85 billion — earmarked for servers, data centers, and AI capacity.

Analysts remain optimistic, forecasting EPS of roughly $9.97 for fiscal 2025, a 24% YOY jump, followed by a further 7% rise to $10.63 forecast for fiscal 2026.

What Do Analysts Expect for Alphabet Stock?

TD Cowen recently raised its price target on Alphabet to $270 from $240 while keeping a “Buy” rating. The upgrade was driven by the firm’s 2025 GenAI Public Cloud Survey, which ranked Google Cloud Platform as the second choice for companies evaluating new providers.

On Sept. 8, Evercore ISI boosted its price target on Alphabet from $240 to $300 while maintaining an “Outperform” rating. The firm emphasized Google’s enduring strength in commercial-intent search, noting that advances in generative AI are making the platform increasingly valuable for both users and advertisers. Key growth catalysts cited include accelerating YouTube revenue, consistent momentum in Google Cloud, and the continued rollout of Waymo’s robotaxi business.

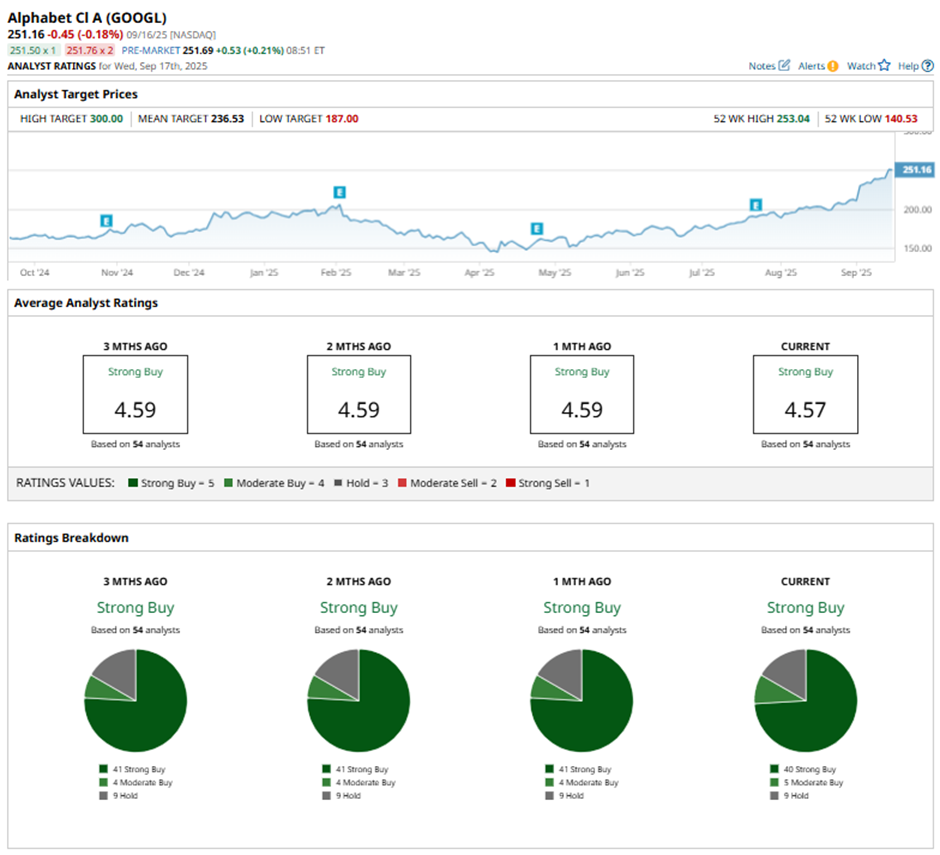

Wall Street is majorly bullish on GOOGL stock. Overall, GOOGL has a consensus “Strong Buy” rating. Of the 54 analysts covering the stock, 40 advise a “Strong Buy,” five suggest a “Moderate Buy,” and the remaining nine analysts are on the sidelines with a “Hold” rating.

GOOGL stock has already surged past the average analyst price target of $239.18. Meanwhile, the Street-high target price of $300 suggests that shares could rally as much as 19% from here.