/GE%20HealthCare%20Technologies%20Inc%20info%20on%20phone-by%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $34.9 billion, GE HealthCare Technologies Inc. (GEHC) is a global medical technology and diagnostics company that provides a broad range of products, services, and digital solutions, supporting patient care across multiple areas of healthcare. Headquartered in Chicago, Illinois, it operates through Imaging, Advanced Visualization Solutions (AVS), Patient Care Solutions (PCS), and Pharmaceutical Diagnostics (PDx) segments.

Companies worth $10 billion or more are generally described as "large-cap stocks", and GE HealthCare fits this description perfectly. It serves hospitals, clinics, and research institutions worldwide, with a strong focus on integrating AI, digital platforms, and data analytics to improve efficiency and clinical outcomes. The company emphasizes precision care, enabling providers to deliver more personalized diagnosis and treatment.

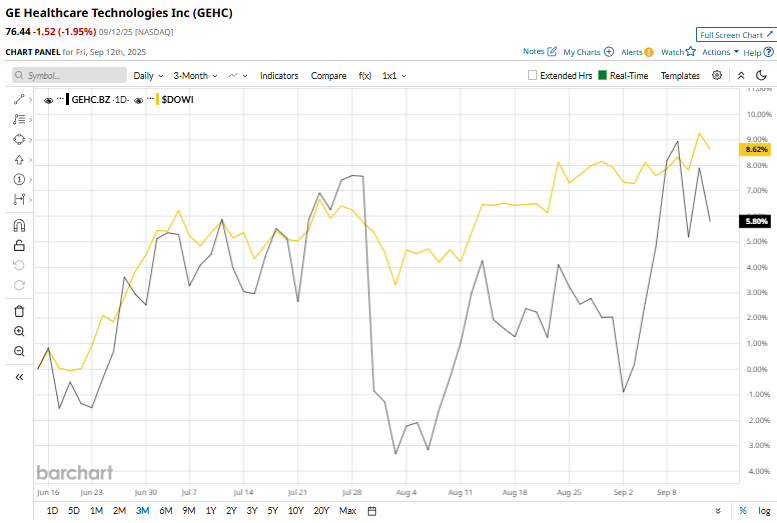

GE HealthCare currently trades 19.4% below its 52-week high of $94.80 recorded on February 13. GEHC's stock has climbed 4.6% over the past three months, significantly outpacing the broader Dow Jones Industrial Average’s ($DOWI) 6.7% rise during the same time frame.

GE HealthCare stock has dropped 2.2% on a YTD basis, whereas Dow Jones has increased 7.7%. Additionally, shares of GEHC dipped 12.6% over the past 52 weeks, notably underperforming $DOWI’s 11.5% returns over the same period.

GEHC stock has been trading over its 50-day and 200-day moving averages recently.

On Sept. 10, GE HealthCare announced plans to acquire icometrix, a specialist in AI-powered brain imaging analysis for neurological disorders such as Alzheimer’s disease. The deal will integrate icometrix’s icobrain platform, including the FDA-cleared icobrain aria for detecting side effects of amyloid therapies, into GEHC’s MRI systems to streamline workflow and support personalized treatment planning.

The acquisition reinforces GE HealthCare’s precision care strategy by broadening its neuro solutions portfolio and enhancing clinical decision support in neurological care, which helped lift its shares 2.6% in the following trading session.

Compared to its rival, Veeva Systems Inc. (VEEV) has notably outpaced the GEHC stock. VEEV stock has soared 31.5% on a YTD basis and climbed 25.7% over the past 52 weeks.

Among the 20 analysts covering the GEHC stock, the consensus rating is a “Strong Buy.” Its mean price target of $87.79 suggests a 14.8% upside potential from current price levels.