With a market cap of $27 billion, Fox Corporation (FOXA) is a leading U.S.-based media company that delivers news, sports, and entertainment content through its well-known brands, including FOX News, FOX Sports, the FOX Network, and Tubi. Operating across four segments: Cable Network Programming, Television, Credible, and FOX Studio Lot, the company reaches audiences through broadcast, cable, digital platforms, and production services.

Companies valued over $10 billion are generally described as “large-cap” stocks, and Fox Corporation fits right into that category. Fox Corporation combines traditional media with digital innovation to serve diverse viewers and advertisers.

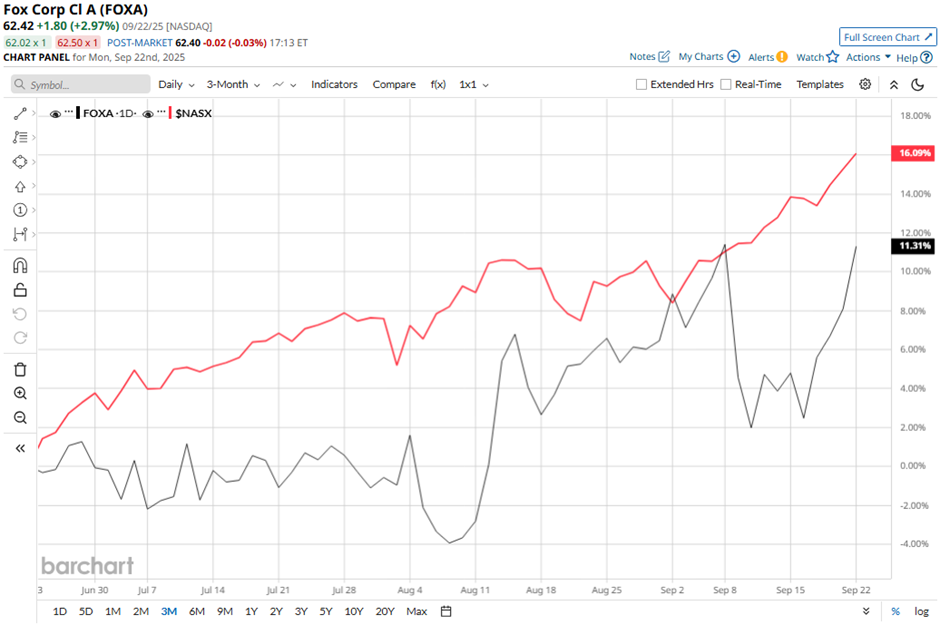

Despite this, shares of the New York-based company have declined marginally from its 52-week high of $62.69. FOXA stock has increased nearly 13% over the past three months, underperforming the Nasdaq Composite’s ($NASX) 17.2% return over the same time frame.

In the longer term, FOXA stock is up 28.5% on a YTD basis, surpassing NASX’s over 18% gain. Moreover, shares of the TV broadcasting company have climbed 55.2% over the past 52 weeks, compared to NASX’s over 28% surge over the same time frame.

Despite a few fluctuations, the stock has been trading above its 50-day and 200-day moving averages since last year.

Despite reporting better-than-expected Q4 2025 adjusted EPS of $1.27 and revenue of $3.29 billion, shares of FOXA fell 3.7% on Aug. 5 due to investor concerns over rising SG&A expenses, which climbed 9.5% year-over-year and pressured margins. Advertising growth was viewed as less durable, given tough year-over-year comparisons tied to the absence of UEFA and Copa América broadcasts.

In contrast, rival Live Nation Entertainment, Inc. (LYV) has slightly lagged behind FOXA stock on a YTD basis, rising 27.5%. However, LYV stock has returned 59.4% over the past 52 weeks, outpacing FOXA stock.

Despite the stock’s outperformance relative to the Nasdaq over the past year, analysts remain cautiously optimistic on FOXA. It has a consensus rating of “Moderate Buy” from the 20 analysts in coverage, and as of writing, the stock is trading above the mean price target of $60.29.