Fox Corporation (FOX) is a major U.S. mass media company specializing in broadcast television, news, and sports. Headquartered in New York City, it was formed in 2019 as a spin-off from 21st Century Fox, retaining assets such as Fox News, Fox Sports, Fox Television Stations, and the broadcast network FOX. Fox Corporation’s market capitalization stands at $25 billion, reflecting its position as a major player in the media landscape.

Companies with a market cap of $10 billion or more are typically bucketed as “large-cap stocks,” a designation that signals financial heft, resilient performance, and wide market influence. Fox Corporation clearly qualifies, underpinning its stability and capacity for investment, innovation, and competitive positioning, confirming its prominence amongst its media peers.

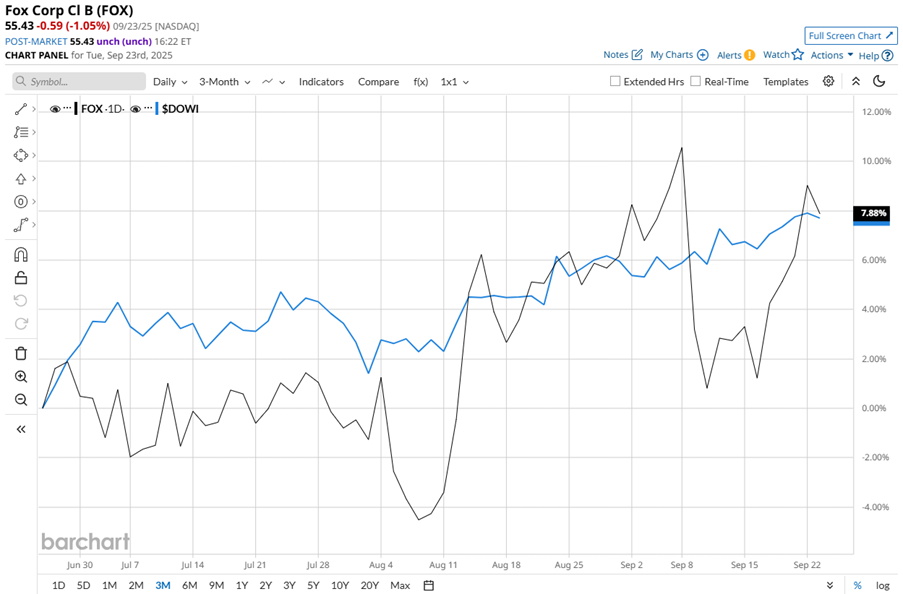

FOX hit its 52-week high of $57.02 on Sept. 8 and is currently trading just 2.8% below it. Over the past three months, FOX stock has gained 7.8%, slightly underperforming the Dow Jones Industrials Average’s ($DOWI) 8.7% gains during the same time frame.

The stock demonstrated strength in the longer term. FOX has delivered 21.2% returns on a year-to-date (YTD) basis, outpacing the DOWI’s 8.8% gains. Plus, the stock has surged 46.6% over the past 52 weeks, compared to Dow Jones’ 9.9% climb over the same period.

FOX has been riding steady bullish momentum, holding above its 200-day moving average over the past year. The stock also stayed largely above its 50-day line, slipping only during brief pullbacks. That resilience, paired with fresh upticks, paints a picture of strength – FOX keeping its trend intact while flashing solid upside signals.

Fox Corporation’s shares have been rising recently due to a combination of strong financial results, strategic moves, and investor confidence. On Aug. 5, Fox Corporation announced fourth-quarter revenues of $3.3 billion, up about 6% year-over-year (YoY). Adjusted net income attributable to Fox Corporation came in at $581 million or $1.27 per share, compared to $423 million or $0.90 per share in the year-ago quarter.

Adding to momentum is the launch of a new streaming service called “Fox One” targeting younger, cord-cutting viewers, which gives Fox a new growth avenue as traditional cable/video models face challenges.

Its rival, News Corporation (NWSA), has surged 11.9% this year and 17% over the past year, underperforming FOX stock.

The stock has a consensus rating of “Moderate Buy” from the 13 analysts covering the stock, and the mean price target of $60.27 suggests an upside potential of 8.7% from the last closing.