/Ford%20Motor%20Co_%20mustang%20by-%20Sue%20Thatcher%20via%20iStock.jpg)

Valued at a market cap of $46.7 billion, Ford Motor Company (F) is a global automaker headquartered in Dearborn, Michigan. The company designs, manufactures, markets, and services a wide range of vehicles, including trucks, SUVs, cars, and electric vehicles, and is known for its iconic Ford and Lincoln brands.

Companies valued at $10 billion or more are typically classified as “large-cap stocks,” and Ford Motor fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the auto manufacturers industry. The company is expanding into mobility solutions, autonomous driving technologies, and connected services, while maintaining a strong position in pickup trucks and commercial vehicles.

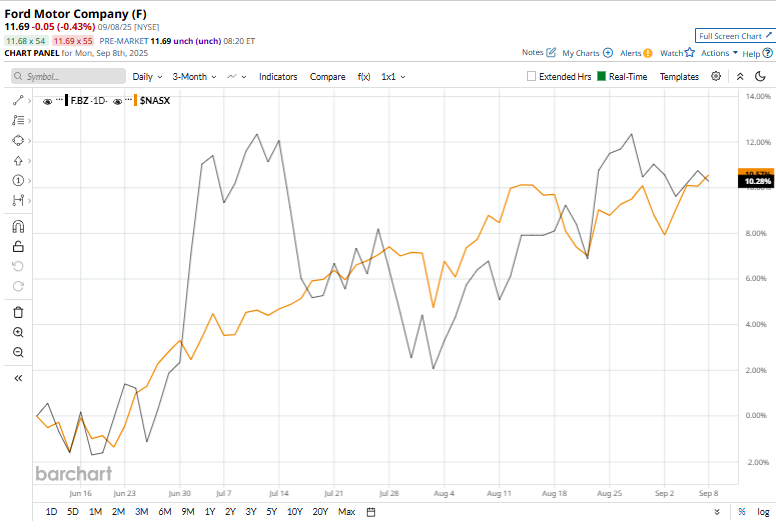

This auto titan is currently trading 2.5% below its 52-week high of $11.99, reached recently on Aug. 28. Ford Motor has soared 13.9% over the past three months, outpacing the broader Nasdaq Composite’s ($NASX) 11.6% rise over the same time frame.

Moreover, on a YTD basis, shares of F are up 18.1%, outperforming $NASX’s 12.9% rise. However, F has surged 10.5% over the past 52 weeks, lagging behind NASX’s 30.6% uptick over the same time frame.

To confirm its recent bullish trend, F has been trading above its 50-day moving average since early June and has mostly remained above its 200-day moving average since mid-April.

On Jul. 30, F shares dipped 1.9% after reporting its Q2 results. The company’s revenue totalled $50.2 billion, representing a 5% year-over-year increase, supported by strength in trucks, SUVs, and its commercial vehicle segment. However, profitability came under pressure, and adjusted EPS declined 21.3% year over year to $0.37.

Ford Motor has lagged behind its rival, General Motors Company’s (GM) 23.5% gain over the past 52 weeks.

The stock has a consensus rating of "Hold” from the 25 analysts covering it. On the bright side, the stock is trading above its mean price target of $10.41.