/Fiserv%2C%20Inc_%20logo%20and%20chart%20on%20phone-by%20IgorGolovniov%20via%20Shutterstock.jpg)

With a market cap of $37.5 billion, Fiserv, Inc. (FISV) is a global provider of payments and financial services technology solutions. The company operates through two segments: Merchant Solutions and Financial Solutions, offering services such as merchant acquiring, digital commerce, mobile payments, fraud protection, card processing, and digital banking solutions.

Companies valued at $10 billion or more are generally considered "large-cap" stocks, and Fiserv fits this criterion perfectly. Fiserv serves a wide range of clients including businesses, banks, credit unions, fintechs, public sector entities, and software providers.

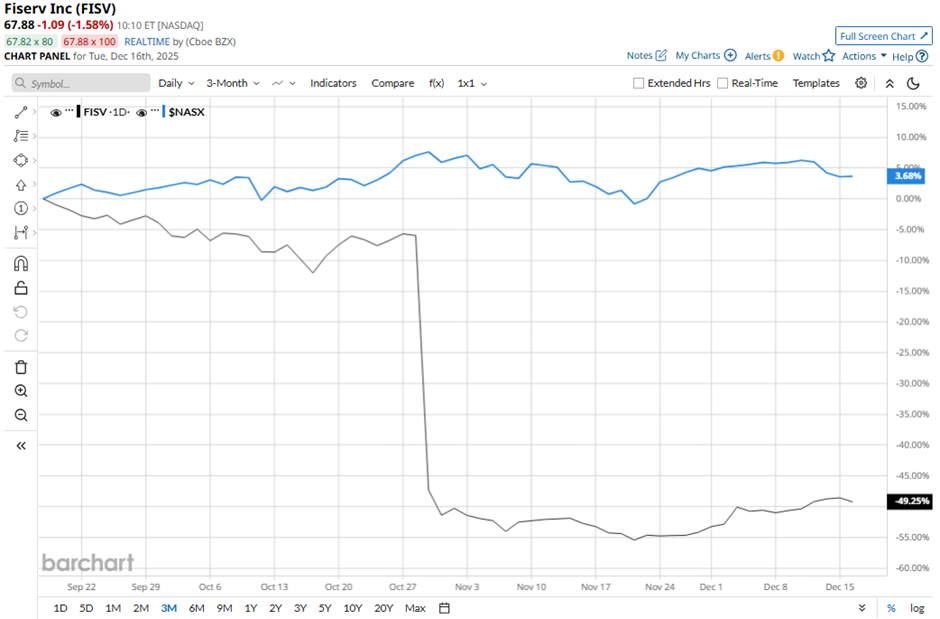

Despite this, shares of the Milwaukee, Wisconsin-based company have declined 71.3% from its 52-week high of $238.59. FISV stock has dropped 48.5% over the past three months, underperforming the Nasdaq Composite’s ($NASX) 3.3% rise over the same time frame.

In the longer term, FISV stock is down 66.7% on a YTD basis, lagging behind NASX’s 19.5% gain. Moreover, shares of the company have decreased 66.4% over the past 52 weeks, compared to NASX’s 14.4% return over the same time frame.

The stock has been trading below its 50-day moving average since early March. Also, it has fallen below its 200-day moving average since late April.

Fiserv shares tumbled over 44% on Oct. 29 after the company reported weaker-than-expected Q3 2025, with adjusted EPS of $2.04 and revenue of $4.92 billion. The selloff deepened after Fiserv sharply cut its full-year outlook for a second straight quarter, slashing revenue growth expectations to 3.5% - 4% from 10% and lowering adjusted EPS guidance to $8.50 - $8.60.

In contrast, rival Accenture plc (ACN) has shown a less pronounced decline than FISV stock. ACN stock has dropped 22.6% on a YTD basis and 23.7% over the past 52 weeks.

Due to the stock’s weak performance, analysts remain cautious on Fiserv. FISV stock has a consensus rating of “Hold” from 34 analysts in coverage, and the mean price target of $82.10 is a premium of 21% to current levels.