/Fedex%20Corp%20cargo%20planes-by%20Teka77%20via%20iStock.jpg)

With a market cap of $65 billion, FedEx Corporation (FDX) is a global provider of transportation, e-commerce, and business services operating through its Federal Express and FedEx Freight segments. The company offers a wide range of shipping, logistics, printing, and digital solutions to support businesses and consumers worldwide.

Companies valued at $10 billion or more are generally considered "large-cap" stocks, and FedEx fits this criterion. FedEx has grown into a leading player in express delivery and supply chain management.

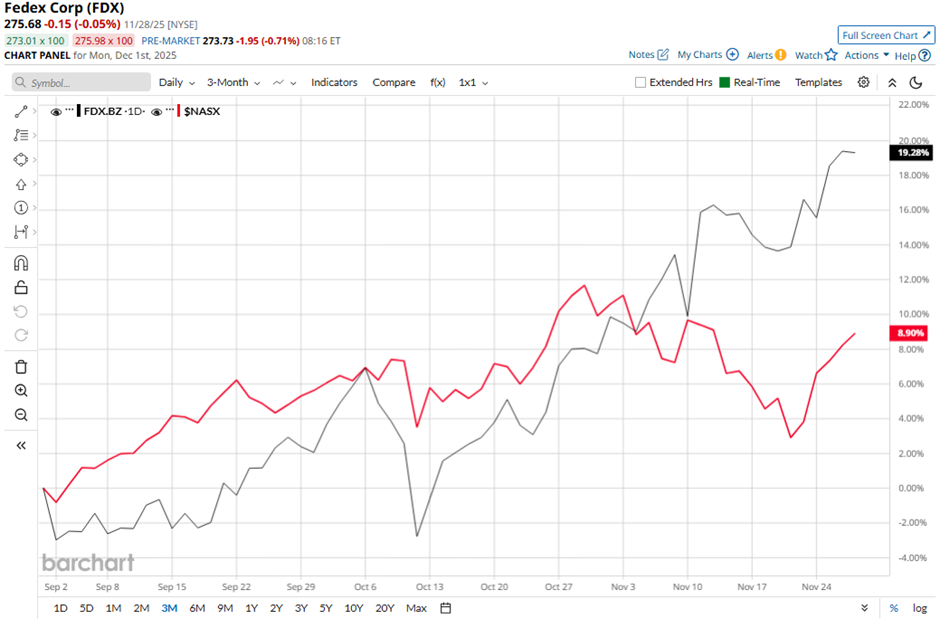

Shares of the Memphis, Tennessee-based company have declined 9.4% from its 52-week high of $302.02. FDX stock has soared 18.5% over the past three months, outperforming the Nasdaq Composite’s ($NASX) 7.7% gain over the same time frame.

In the longer term, FDX stock is down 2.7% on a YTD basis, lagging behind NASX’s 21% gain. Moreover, shares of the company have decreased 9.6% over the past 52 weeks, compared to NASX’s 22.6% return over the same time frame.

Despite a few fluctuations, the stock has been trading above its 50-day moving average since June.

Shares of FDX rose 2.3% following its Q1 2026 results on Sep. 18 because the company posted solid year-over-year earnings growth, with adjusted operating income increasing to $1.30 billion and adjusted EPS rising to $3.83, driven by strong U.S. domestic package revenue and structural cost reductions. Investors were also encouraged by FedEx’s fiscal 2026 outlook, including 4% - 6% revenue growth and $17.20 - $19 adjusted EPS after excluding optimization, spin-off, and fiscal-year-change costs.

Additionally, confidence improved due to FedEx completing $500 million in share repurchases during the quarter and advancing toward the planned June 2026 spin-off of FedEx Freight.

In contrast, rival United Parcel Service, Inc. (UPS) has lagged behind FDX stock. Shares of United Parcel Service have dipped 24.3% on a YTD basis and 29.6% over the past 52 weeks.

Despite the stock’s underperformance over the past year, analysts remain moderately optimistic on FedEx. The stock has a consensus rating of “Moderate Buy” from 30 analysts in coverage, and as of writing, it is trading above the mean price target of $268.52.