Valued at a market cap of $8.6 billion, Federal Realty Investment Trust (FRT) is a prominent real estate investment trust (REIT) specializing in the ownership, operation, and redevelopment of high-quality retail and mixed-use properties. Founded in 1962 and headquartered in Rockville, Maryland, Federal Realty focuses on densely populated, affluent communities along the U.S. East Coast, as well as in California and South Florida.

Companies valued between $2 billion and $10 billion are generally classified as “mid-cap stocks," and Federal Realty Investment Trust fits this criterion perfectly. It stands out in the real estate investment trust (REIT) sector due to its strategic focus on high-quality, retail-based properties located in affluent, densely populated urban markets. Another cornerstone of Federal Realty's appeal is its impressive 58-year streak of consecutive annual dividend increases, earning it the title of a "Dividend King" in the REIT industry.

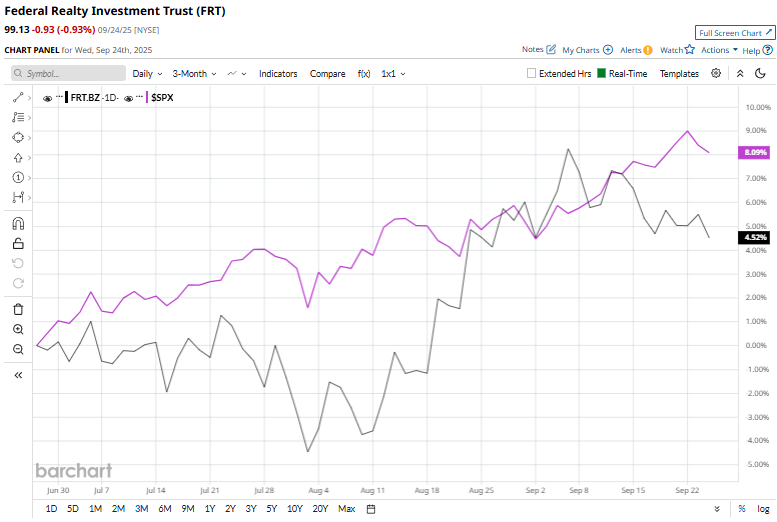

Despite the feat, shares of FRT have retreated 16.1% from its 52-week high of $118.09 recorded on Nov. 29. FRT stock has surged 3% over the past three months, underperforming the S&P 500 Index ($SPX), which has returned 9% over the same time frame.

In the longer term, shares of FRT have slumped 11.5% on a YTD basis, underperforming the S&P 500 Index’s 12.9% gains over the same time frame. Moreover, Federal Realty’s stock has fallen 13.8% over the past 52 weeks, compared to $SPX’s 15.8% gain.

Despite fluctuations, the stock has remained below its 200-day moving average since mid-February. However, the stock has been trading above its 50-day moving average since mid-August.

On August 6, Federal Realty announced Q2 results that exceeded Wall Street expectations, with funds from operations of $1.91 per share, surpassing the consensus estimate of $1.73. The company reported net income of $153.9 million or $1.78 per share and revenue of $311.5 million, slightly above the projected $310.7 million. For the full year, Federal Realty expects funds from operations between $7.16 and $7.26 per share. Despite the strong results, shares of the REIT experienced a marginal decline following the announcement.

In comparison, rival NNN REIT, Inc. (NNN), has outperformed FRT stock. Shares of NNN have increased 2.8% on a YTD basis and dipped 12.6% over the past 52 weeks.

The stock has a consensus rating of “Moderate Buy” from the 19 analysts covering the stock. Its mean price target of $108.69 indicates an upswing potential of 9.6% from the current price levels.