Fastly Inc. (FSLY) in San Francisco, is a cloud computing company that offers delivery, security, streaming media, e-commerce, and a private real-time content delivery network (CDN).

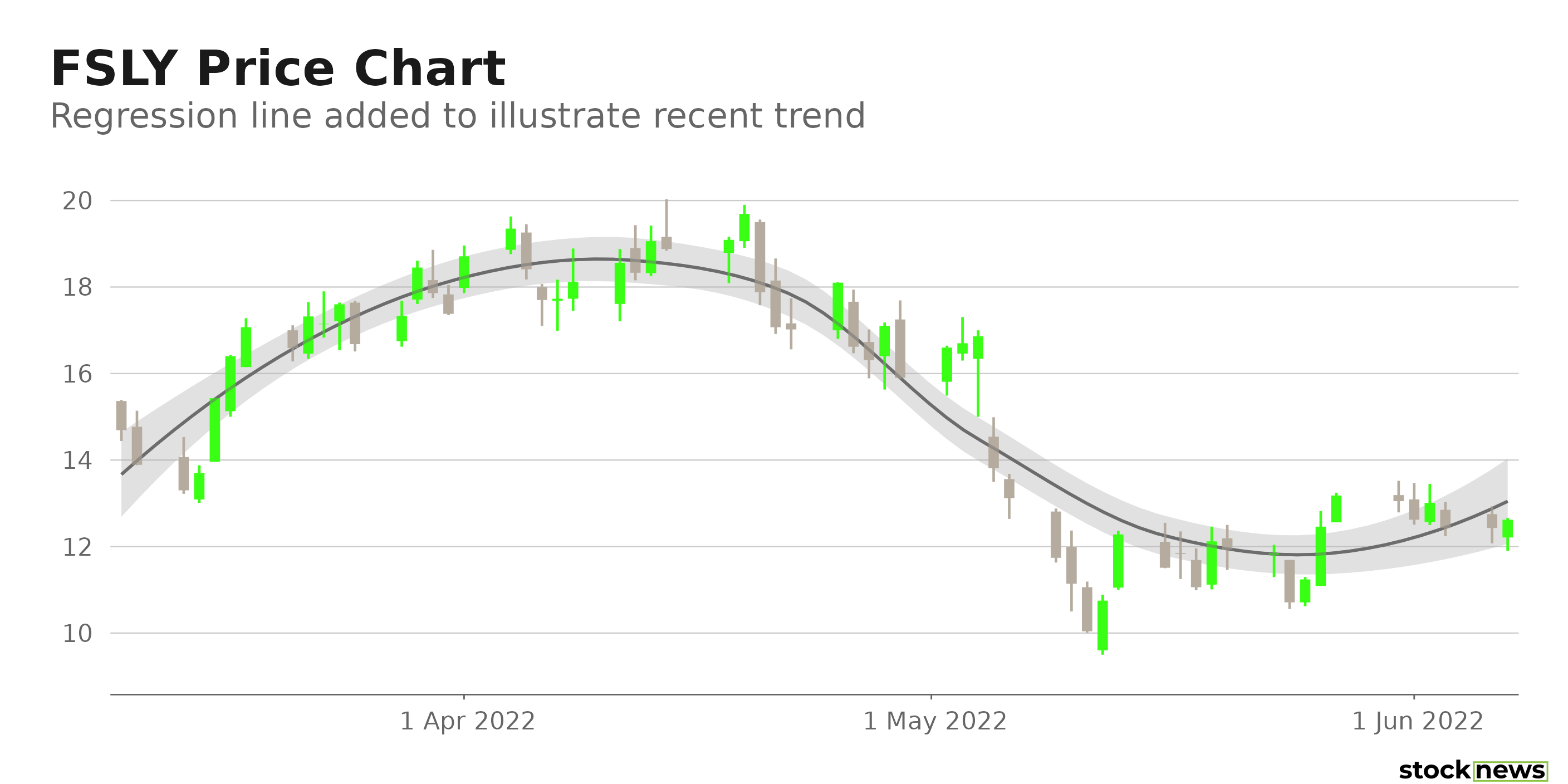

The company's shares are down 75.1% in price over the past year and 64.4% year-to-date to close yesterday's trading session at $12.62.

Although Fastly managed to outperform Wall Street's average revenue forecast for the quarter, with revenues of $102.4 million versus estimates of $99 million, investors were disappointed by FSLY inability to hit analysts' bottom-line consensus expectations and by the company’s need to hunt for a replacement for current CEO Joshua Bixby. This led the stock to slump nearly 17% last month.

Here is what could shape FSLY's performance in the near term:

Click here to check out our Cloud Computing Industry Report for 2022

Lackluster Financials

FSLY's revenue increased 20.7% year-over-year to $102.38 million for the first quarter, ended March 31, 2022. Its non-GAAP operating loss grew 34.5% from its year-ago value to $17.74 million. The company's non-GAAP net loss surged 32.4% from the prior-year quarter to $18.04 million. Its non-GAAP loss per share amounted to $0.15. In addition, its net cash used in operating activities grew 21.4% for the three months ended March 31, 2022, to $13.19 million.

Poor Profitability

FSLY's 0.17% trailing-12-month asset turnover ratio is 72.8% lower than the 0.64% industry average. Also, its trailing-12-month ROA, ROC, and net income margin are negative 11.1%, 6.9%, and 63.5%, respectively.

POWR Ratings Reflect Bleak Outlook

FSLY has an overall D rating, which equates to Sell in our proprietary POWR Ratings system. The POWR ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. FSLY has a D for Stability and Quality. The stock’s 1.49 beta is in sync with its Stability grade. In addition, the company's poor profitability is consistent with the Quality grade.

Among the 156 stocks in the F-rated Software – Application industry, FSLY is ranked #141.

Beyond what I have stated above, you can view FSLY ratings for Growth, Value, Momentum, and Sentiment here.

Click here to check out our Software Industry Report for 2022

Bottom Line

FSLY failed to meet analysts' earnings estimates which led its stock to plummet in price. In addition, analysts expect its EPS to decline 13.3% in the current quarter (ending June 3o, 2022) and 27.3% next quarter (ending Sept. 30, 2022). Furthermore, the stock is currently trading below its 50-day and 200-day moving averages of $15.17 and $30.70, respectively, indicating bearish sentiment. So, we think this, along with negative profit margins, makes the stock best avoided now.

How Does Fastly Inc. (FSLY) Stack Up Against its Peers?

While FSLY has an overall D rating, one might want to consider its industry peers, Commvault Systems Inc. (CVLT), Rimini Street Inc. (RMNI), and Progress Software Corporation (PRGS), which have an overall A (Strong Buy) rating.

FSLY shares were unchanged in premarket trading Wednesday. Year-to-date, FSLY has declined -64.40%, versus a -12.20% rise in the benchmark S&P 500 index during the same period.

About the Author: Pragya Pandey

Pragya is an equity research analyst and financial journalist with a passion for investing. In college she majored in finance and is currently pursuing the CFA program and is a Level II candidate.

Is Fastly Stock a Buy or a Sell? StockNews.com