/F5%20Inc%20HQ%20logo-by%20Sundry%20Photography%20via%20Shutterstock.jpg)

F5, Inc. (FFIV), based in Seattle, Washington, is a key player in multi-cloud application security and delivery. The company’s portfolio is wide yet sharply aligned with today’s digital needs. From NGINX and BIG-IP to consulting, training, and technical support, its offerings are positioned as critical infrastructure for enterprises, governments, and service providers that depend on uninterrupted and secure application delivery.

With a market capitalization of approximately $18.7 billion, F5 sits comfortably in the “large-cap” category, well above the $10 billion threshold. The valuation reflects the company’s operational stability and influence earned over the years of execution.

Turning to performance, FFIV stock has slipped by a mere 3.8% from its 52-week high of $337.39 this September. Over the past three months, however, it rose by 9.7%, ahead of the S&P 500 Index’s ($SPX) 9% gain. The edge, though small, signals that FFIV stock continues to outperform the broader market in the near term.

The longer horizon underscores the same momentum. Over the past 52 weeks, FFIV stock surged 45.1%. In 2025 alone, it has already climbed 29%. By comparison, the S&P 500 rose 15.8% over the past 52 weeks and 12.9% on a year-to-date (YTD) basis. The contrast highlights consistent outperformance against a major benchmark.

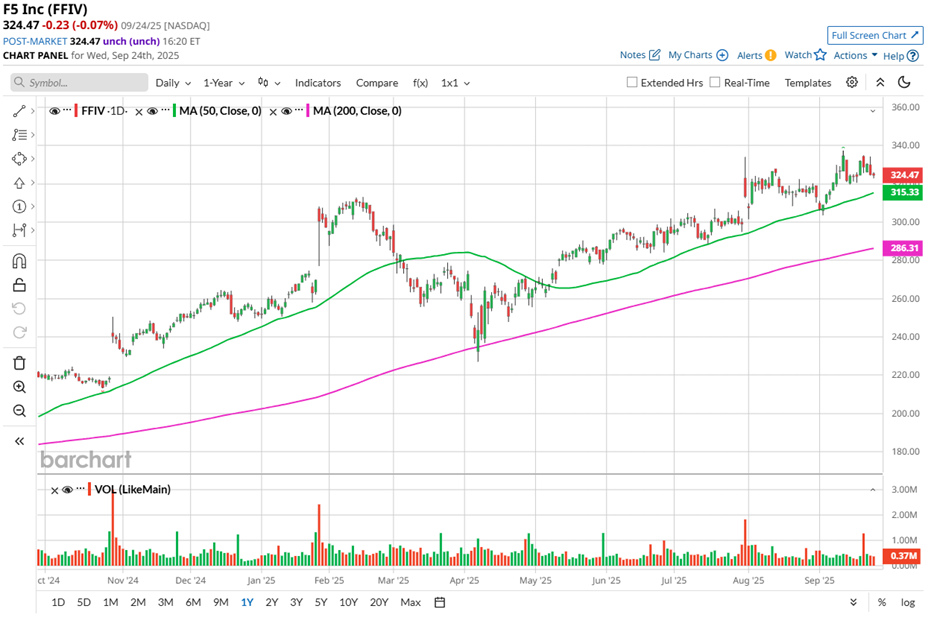

Technical levels confirm the strength. Since mid-May, FFIV stock has traded above its 50-day and 200-day moving averages. Except for a brief dip below the 50-day MA earlier this month, it has held above the levels firmly, reinforcing a bullish market stance.

That said, the path has not been without volatility. On Sept. 12, FFIV stock dropped nearly 3.9%, closing at $321.67 after touching an all-time high of $337.39 the prior day. The pullback followed news of F5’s $180 million cash acquisition of CalypsoAI, a startup focused on artificial intelligence (AI) security.

The deal, expected to close by the end of September, is designed to strengthen F5’s AI threat protection capabilities. While strategically sound, investors weighed near-term cash outflow and integration risk, leading to a short-term selloff despite the longer-term upside.

Context becomes sharper when compared to the firm’s rival, Fortinet, Inc. (FTNT), which gained only 7.9% over the past 52 weeks and is down 11.5% YTD. Against this backdrop, FFIV’s advances stand out clearly.

Wall Street remains cautious on the stock. The tempered outlook reflects concerns over the CalypsoAI acquisition, integration risks, and its financial impact despite F5’s strong recent stock run. FFIV has a consensus rating of “Hold” overall from the 13 analysts in coverage. The mean price target of $326.40 represents a marginal premium to current levels.