With a market cap of $31.2 billion, Extra Space Storage Inc. (EXR) is a leading self-storage real estate investment trust (REIT). As of June 30, 2025, the company owned and/or operated 4,179 stores across 43 states and Washington, D.C., comprising approximately 2.9 million units and 321.5 million square feet of rentable space.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and Extra Space Storage fits this criterion perfectly. Recognized as the largest operator of self-storage properties in the United States, Extra Space offers secure and convenient storage solutions, including options for boats, RVs, and businesses.

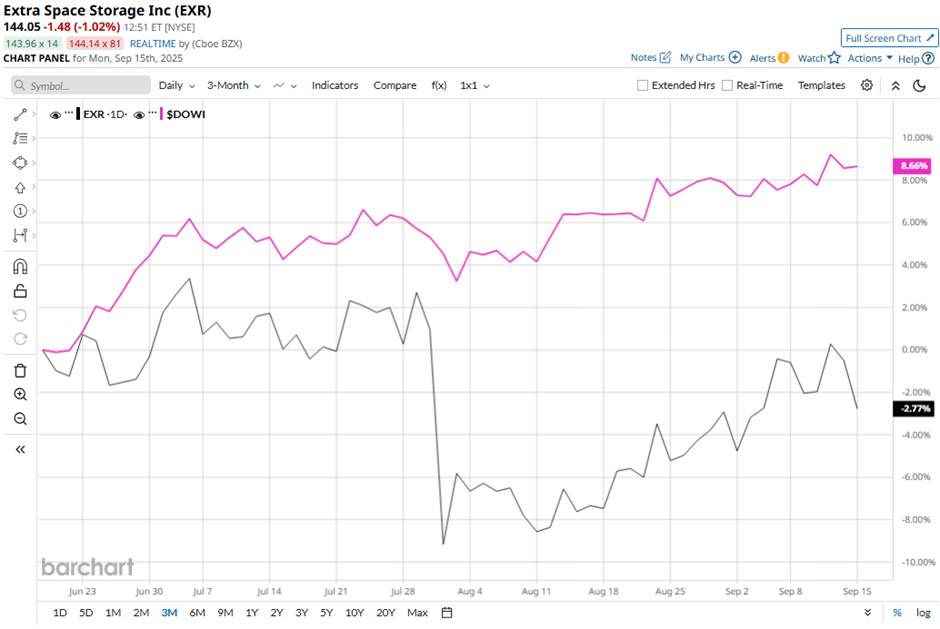

Shares of the Salt Lake City, Utah-based company have declined 22.1% from its 52-week high of $184.87. Over the past three months, its shares have decreased 3.8%, underperforming the broader Dow Jones Industrials Average's ($DOWI) 8.6% rise during the same period.

Longer term, EXR stock is down 3.8% on a YTD basis, lagging behind DOWI's 7.7% gain. Moreover, shares of the company have dipped 19.1% over the past 52 weeks, compared to DOWI’s 10.7% increase over the same time frame.

The stock has been in a bearish trend, consistently trading below its 200-day moving average since mid-December last year.

Shares of Extra Space Storage tumbled over 10% after Q2 2025 results on Jul. 30 as core FFO per share came in at $2.05, missing the consensus estimate. Same-store NOI dropped 3.1% to $474.2 million as expenses surged 8.6% to $191.4 million, while interest expenses climbed 6.6% to $146.1 million, pressuring margins despite a 60-basis-point occupancy gain to 94.6%. Adding to investor concerns, management revised 2025 guidance to a narrower FFO of $8.05 per share - $8.25 per share range with expectations of flat-to-negative same-store revenue growth and NOI decline.

However, rival Lineage, Inc. (LINE) has performed weaker than EXR stock. LINE stock has dipped 27.9% YTD and 49.2% over the past 52 weeks.

Despite the stock’s underperformance, analysts remain moderately optimistic about its prospects. The stock has a consensus rating of “Moderate Buy” from 22 analysts in coverage, and the mean price target of $157.63 is a premium of 9.4% to current levels.