/Expeditors%20International%20Of%20Washington%2C%20Inc_%20logo%20magnified-by%20Casimiro%20PT%20via%20Shutterstock.jpg)

Seattle, Washington-based Expeditors International of Washington, Inc. (EXPD) is a leading third-party logistics provider. With a market cap of $20.3 billion, Expeditors offers global logistics management, including international freight forwarding and consolidation, for both air and ocean freight.

Companies worth $10 billion or more are generally described as “large-cap stocks.” Expeditors fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size and influence in the logistics industry.

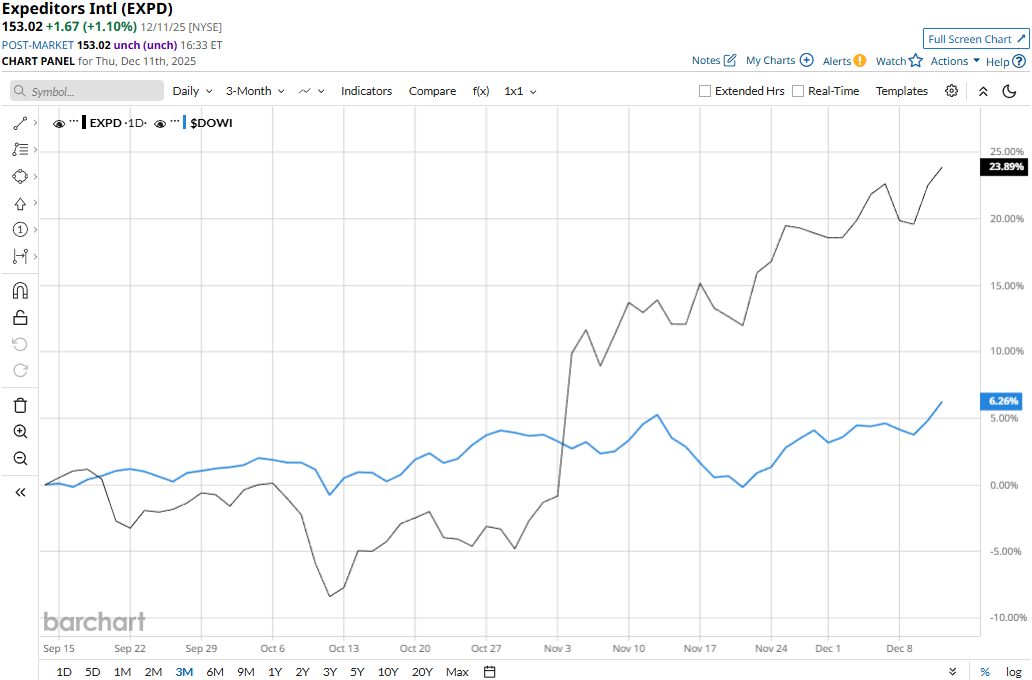

EXPD stock touched its all-time high of $153.84 in yesterday’s trading session before slightly pulling back. Meanwhile, its stock prices have soared 24.1% over the past three months, significantly outperforming the Dow Jones Industrial Average’s ($DOWI) 5.6% uptick during the same time frame.

Expeditors’ performance has been impressive over the longer term as well. EXPD stock prices have soared 38.1% on a YTD basis and 27.1% over the past 52 weeks, underperforming the Dow’s 14.5% gains in 2025 and 10.3% returns over the past year.

EXPD stock has traded mostly above its 200-day moving average since early August and its 50-day moving average since mid-May, with some fluctuations, underscoring its bullish trend.

Expeditors International’s stock prices soared 10.8% in a single trading session following the release of its better-than-expected Q3 results on Nov. 4. Due to the ongoing macro challenges and shift in demand and supply patterns, the company’s revenues for the quarter declined 3.5% year-over-year to $2.9 billion, but surpassed the Street’s expectations by a significant 7.8%. Meanwhile, its EPS inched up 61 bps year-over-year to $1.64, beating the consensus estimates by a staggering 17.1%.

Further, Expeditors has notably outperformed its peer J.B. Hunt Transport Services, Inc.’s (JBHT) 16.9% gains in 2025 and 9.6% returns over the past year.

Among the 15 analysts covering the EXPD stock, the consensus rating is a “Hold.” As of writing, the stock is trading notably above its mean price target of $128.77.