With a market cap of $12.9 billion, Erie Indemnity Company (ERIE) serves as the managing attorney-in-fact for the subscribers of the Erie Insurance Exchange. The company provides a wide range of services, including policy issuance and renewal, sales and advertising support, and agent compensation.

Companies valued at more than $10 billion are generally considered “large-cap” stocks, and Erie Indemnity fits this criterion perfectly. It also delivers underwriting, customer service, administrative support, and information technology services.

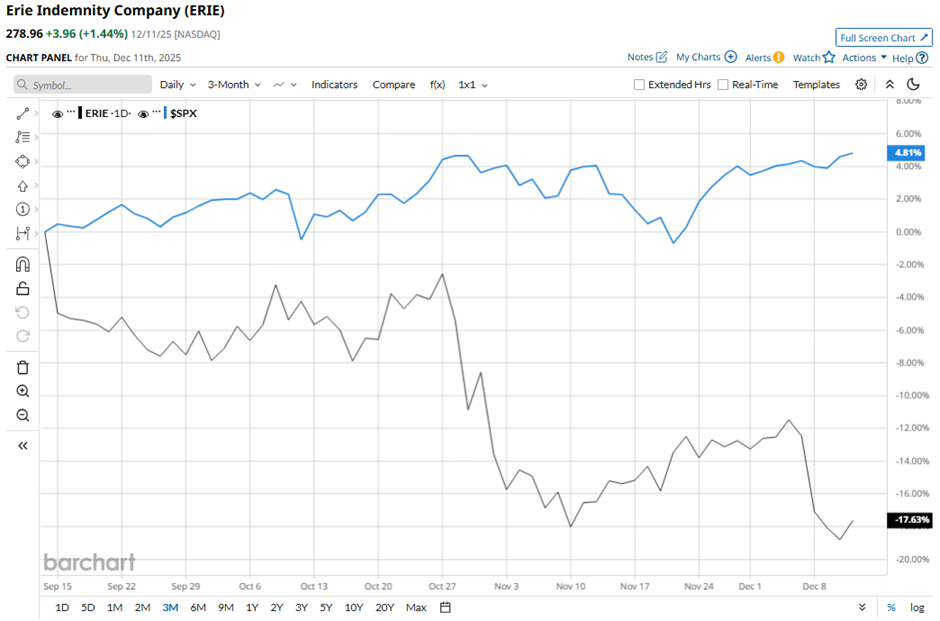

Shares of the Erie, Pennsylvania-based company have fallen nearly 39% from its 52-week high of $456.93. Erie Indemnity’s shares have decreased 17.5% over the past three months, lagging behind the broader S&P 500 Index’s ($SPX) 4.8% gain over the same time frame.

In the longer term, ERIE stock is down 32.3% on a YTD basis, underperforming SPX’s 17.3% rise. Moreover, shares of the insurance company have dropped 31.5% over the past 52 weeks, compared to the 13.4% return of the SPX over the same time frame.

The stock has been trading below its 50-day and 200-day moving averages since last year.

Despite beating Q3 2025 EPS expectations with $3.50 on Oct. 30, Erie Indemnity’s shares fell 5.5% the next day as revenue of $1.07 billion missed estimates. Investors were also cautious about rising commission costs, which increased $41 million year-over-year, outpacing the 7.3% growth in management fee revenue.

In comparison, rival Aon plc (AON) has shown a less pronounced decline than ERIE stock. AON stock has dipped 3.3% on a YTD basis and 4.2% over the past 52 weeks.

Despite the stock’s weak performance over the past year, analysts remain moderately optimistic on ERIE. It has a consensus rating of “Moderate Buy” from the three analysts in coverage, and as of writing, the stock is trading above the mean price target of $73.