With a market cap of $66.4 billion, EOG Resources, Inc. (EOG) is a leading independent U.S. oil and gas exploration and production company. Headquartered in Houston, Texas, it focuses on shale plays such as the Permian, Eagle Ford, and Bakken, while also operating internationally in places like Trinidad & Tobago.

Companies worth $10 billion or more are generally described as "large-cap stocks." EOG fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size and influence in the Oil & Gas E&P industry. Formed in 1999 following its separation from Enron, it has grown into one of the country’s most efficient and profitable producers, with major operations across prolific shale basins.

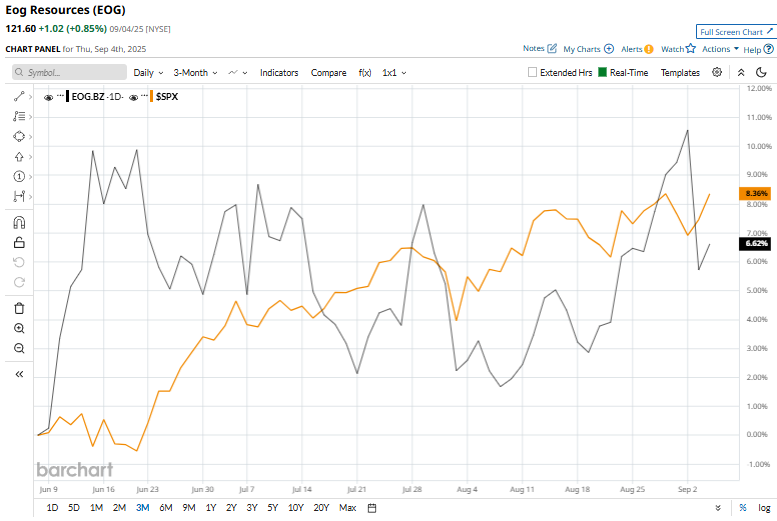

Nevertheless, the energy giant's stock has retreated 12% from its 52-week high of $138.18 achieved on Jan. 16. EOG’s stock has increased 9.8% in the past three months, outperforming the S&P 500 Index ($SPX), which has returned 8.9% over the same time frame.

However, EOG has declined marginally on a YTD basis and over the past year, trailing behind $SPX’s 10.6% rally in 2025 and 17.8% rise over the past year.

EOG has been observing volatility recently, and is trading above its 50-day moving average but below its 200-day moving average recently.

On Aug. 7, EOG Resources announced its fiscal 2025 second-quarter earnings, and its shares dipped marginally. The company posted an adjusted EPS of $2.32, beating forecasts despite a nearly 20% drop in Brent crude prices. Higher output of 1.13 million boepd drove performance, generating about $973 million in free cash flow. The company returned $1.1 billion to shareholders through dividends and buybacks while keeping its balance sheet solid.

Following its $5.6 billion Encino acquisition, EOG raised its full-year production outlook to 1.2 million boepd and lifted capex guidance, underscoring its disciplined growth and resilience in a softer price environment.

Its top rival, ConocoPhillips (COP), has lagged behind the stock, with its shares declining 3.4% in 2025 and 11.8% over the past year.

Among the 32 analysts covering the EOG stock, the consensus rating is a “Moderate Buy.” Its mean price target of $140.83 suggests a 15.8% upside potential from current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.