/Enphase%20Energy%20Inc%20-%20solar%20panels-by%20anatoliy_gleb%20via%20Shutterstock.jpg)

Fremont, California-based Enphase Energy, Inc. (ENPH) designs, develops, manufactures, and sells solar energy equipment for the global solar photovoltaic industry. Valued at $5.1 billion by market cap, the company offers home and commercial solar and storage solutions.

Companies worth $2 billion or more are generally described as “mid-cap stocks,” and ENPH perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the solar industry. Enphase's technological prowess drives its market leadership, with industry-leading microinverter technology and integrated solar-plus-storage solutions.

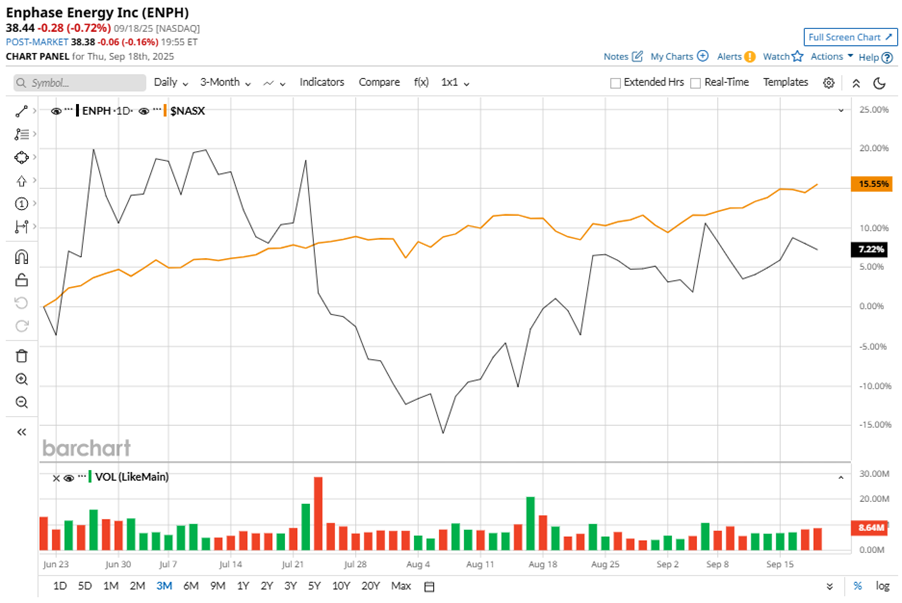

Despite its notable strength, ENPH shares slipped 69.1% from their 52-week high of $124.40, achieved on Sep. 19, 2024. Over the past three months, ENPH stock has gained 5.7%, underperforming the Nasdaq Composite’s ($NASX) 15% gains during the same time frame.

In the longer term, shares of ENPH dipped 44% on a YTD basis and plunged 67.9% over the past 52 weeks, significantly underperforming NASX’s YTD gains of 16.4% and 27.9% returns over the last year.

To confirm the bearish trend, ENPH has been trading below its 200-day moving average over the past year, with a minor fluctuation. However, the stock is trading above its 50-day moving average since early September, despite the negative price momentum.

Enphase Energy's underperformance is driven by exposure to global trade policies, with rising tariffs potentially increasing costs and pressuring margins. Stricter domestic content rules may impose additional compliance burdens and restrict access to tax incentives. Additionally, the company faces a slowdown in Europe due to lower utility rates and unfavorable government policies, which could weigh on near-term revenues and slow growth.

On Jul. 22, ENPH shares closed up more than 7% after reporting its Q2 results. Its adjusted EPS of $0.69 beat Wall Street expectations of $0.62. The company’s revenue was $363.2 million, beating Wall Street forecasts of $356.3 million. For Q3, ENPH expects revenue in the range of $330 million to $370 million.

In the competitive arena of solar, SolarEdge Technologies, Inc. (SEDG) has massively taken the lead over the stock, with 155.2% gains on a YTD basis and a 60% uptick over the past 52 weeks.

Wall Street analysts are cautious on ENPH’s prospects. The stock has a consensus “Hold” rating from the 30 analysts covering it, and the mean price target of $41.85 suggests a potential upside of 8.9% from current price levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.