/Emerson%20Electric%20Co_%20sign%20on%20building-by%20SNEHIT%20PHOTO%20via%20Shutterstock.jpg)

Saint Louis, Missouri-based Emerson Electric Co. (EMR) is a global technology and engineering company providing innovative solutions for customers in industrial, commercial, and residential markets. With a market cap of $72.9 billion, Emerson operates through Final Control, Measurement & Analytical, Discrete Automation, Safety & Productivity, Control Systems & Software, and Test & Measurement segments.

Companies worth $10 billion or more are generally described as “large-cap stocks.” EMR fits this bill perfectly. Given the company’s extensive operations and dominance in the industrial sector, its valuation above this mark is unsurprising.

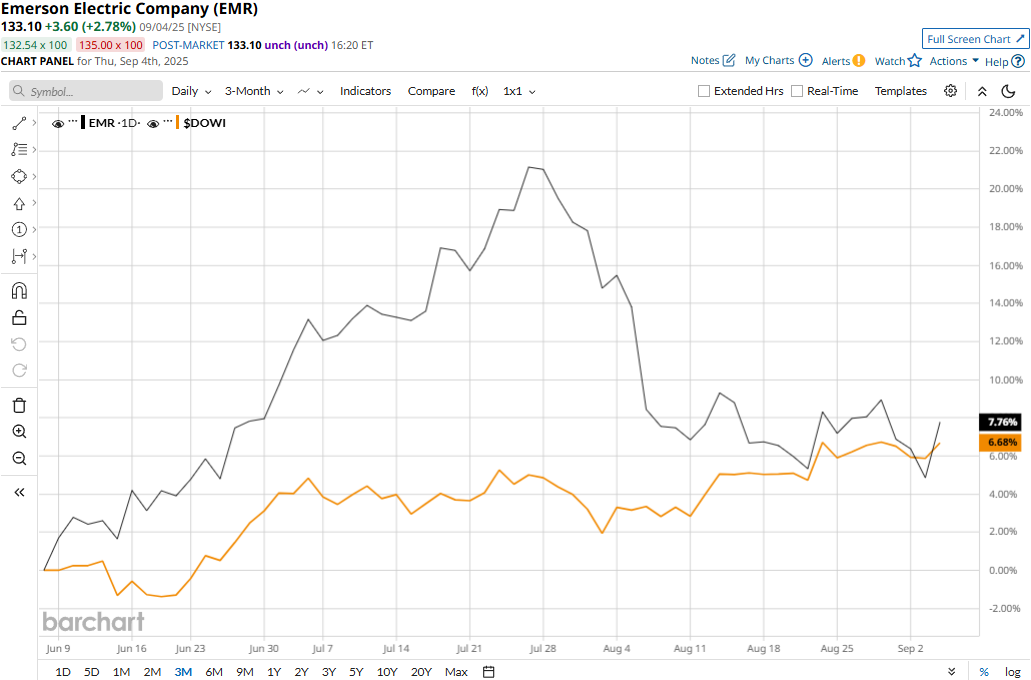

Emerson touched its all-time high of $150.27 on Jul. 29 and is currently trading 11.4% below that peak. Meanwhile, over the past three months, Emerson’s stock prices have soared 9.5%, outpacing the Dow Jones Industrial Average’s ($DOWI) 7.5% gains during the same time frame.

Over the longer term, Emerson’s performance looks even more impressive. EMR stock has gained 7.4% on a YTD basis and surged 32% over the past 52 weeks, outpacing the Dow’s 7.2% uptick in 2025 and 11.3% gains over the past year.

To confirm the uptrend and recent downturn, EMR has traded consistently above its 200-day moving average since early May and dropped below its 50-day moving average in early August.

Emerson Electric’s stock prices dropped 4.7% following the release of its mixed Q3 results on Aug. 6. The drop can primarily be attributed to Emerson’s net sales of $4.6 billion missing the Street’s expectations by 60 bps. However, the sales figure was up almost 4% year-over-year, and the company’s overall performance remained resilient. The quarter was marked with strong profitability and cash flows despite the chaotic macro environment. Emerson’s adjusted EPS increased 6.3% year-over-year to $1.52, surpassing the consensus estimates by 66 bps. Further, the company generated solid free cash flows of $970 million during the quarter.

Meanwhile, Emerson has slightly underperformed its peer, Rockwell Automation, Inc.’s (ROK) 33.2% surge over the past 52 weeks and 19.6% gains in 2025.

Among the 25 analysts covering the EMR stock, the consensus rating is a “Moderate Buy.” Its mean price target of $150.46 suggests a 13% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.