Eastman Chemical Company (EMN) is a global specialty materials firm headquartered in Kingsport, Tennessee. With a market cap of $7.4 billion, Eastman specializes in producing a wide range of products, including chemicals, fibers, and plastics, for various industries such as automotive, electronics, and consumer goods.

Companies with a market capitalization between $2 billion and $10 billion are generally classified as 'mid-cap stocks,” and EMN perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the specialty chemicals industry. Eastman Chemical leverages strong customer relationships and integrated operations to drive efficiency and reliability. Its focus on sustainable solutions and circular economy initiatives positions it favorably in the growing market for eco-friendly materials.

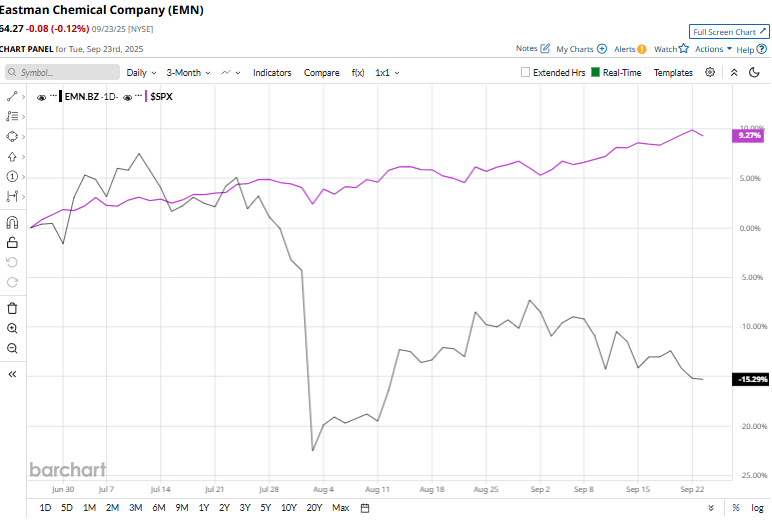

Despite the notable strengths, the stock touched its 52-week high of $114.50 on Sep. 27 last year and is now trading 43.9% below that peak. It has fallen 14.3% over the past three months, underperforming the S&P 500 Index ($SPX), which has returned 10.5% over the same time frame.

EMN shares have fallen 29.6% year-to-date and 40.5% over the past 52 weeks, sharply underperforming the S&P 500, which gained 13.2% in 2025 and 16.4% over the past year.

Reflecting a bearish trend, EMN has been trading below its 200-day moving average since late February and beneath its 50-day moving average since mid-March.

On July 31, Eastman Chemical reported its Q2 results, triggering a 19% drop in its shares the next trading session. Revenue came in at $2.3 billion, down 3.2% year-over-year but in line with consensus estimates. Adjusted EPS declined 25.6% to $1.60, falling 7% short of analyst expectations, while adjusted EBIT dropped 22.1% to $275 million, fuelling investor concerns over the company’s profitability.

Its key rival, The Sherwin-Williams Company (SHW), has shown a 1.3% rise on a YTD basis and has dropped 9.8% over the past 52 weeks, outperforming EMN.

Nevertheless, the stock has a consensus “Moderate Buy” rating from the 15 analysts covering it, and the mean price target of $75.53 suggests a potential upside of 17.5% from current price levels.