/Dell%20Technologies%20by%20Gustianto%20via%20Shutterstock.jpg)

Valued at $90.3 billion by market cap, Dell Technologies Inc. (DELL) operates as one of the largest laptop and PC companies in the world. The Round Rock, Texas-based PC designer operates through Infrastructure Solutions Group (ISG) and Client Solutions Group (CSG) segments. Its operations span numerous countries across the Americas, Indo-Pacific, and EMEA.

Companies worth $10 billion or more are generally described as "large-cap stocks." Dell fits right into that category, reflecting its significant presence and influence in the computer hardware industry.

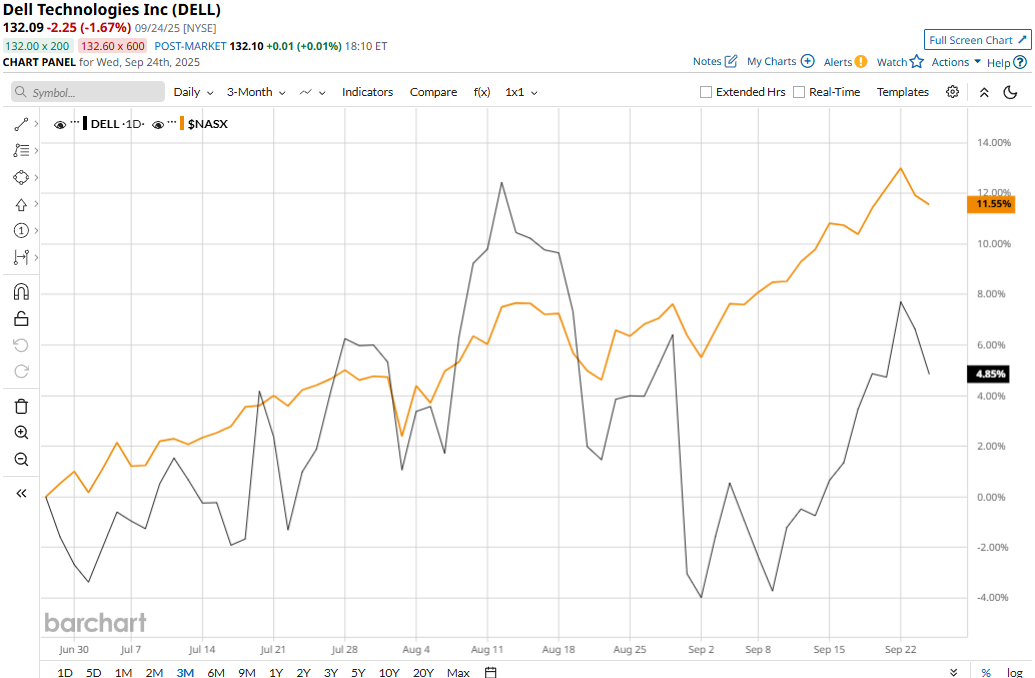

Dell touched its 52-week high of $147.66 on Nov. 25, 2024, and is currently trading 10.5% below that peak. Meanwhile, the stock has gained 9.5% over the past three months, slightly underperforming the Nasdaq Composite’s ($NASX) 13% surge during the same time frame.

Dell has lagged behind the Nasdaq over the longer term as well. The stock has gained 14.6% in 2025 and 12.6% over the past 52 weeks, compared to NASX’s 16.5% surge in 2025 and 24.5% returns over the past year.

Meanwhile, the stock has traded mostly above its 50-day moving average since early May and above its 200-day moving average since mid-May, with some fluctuations, highlighting its bullish trend.

Despite delivering better-than-expected results, Dell Technologies’ stock prices declined 8.9% in a single trading session following the release of its Q2 results on Aug. 28. The company has continued to observe a massive surge in the infrastructure solutions group’s revenues. Its ISG revenues reached a record $16.8 billion during the quarter, marking a 44% year-over-year growth. Overall, the company’s topline for the quarter grew 19% year-over-year to a record $29.8 billion, beating the consensus estimates by 1.6%. Meanwhile, the company’s non-GAAP EPS soared 19% year-over-year to $2.32, surpassing Street’s expectations.

However, for Q3, Dell expected to report a topline of $27 billion plus or minus $500 million, marking an 11% year-over-year growth, which didn’t impress investors and led to the sell-off.

Nonetheless, Dell has significantly outperformed its peer, HP Inc.’s (HPQ) 15.7% decline on a YTD basis and 23.3% plunge over the past 52 weeks.

Among the 20 analysts covering the Dell stock, the consensus rating is a “Moderate Buy.” Its mean price target of $150.61 suggests a 14% upside potential from current price levels.