I asked if cotton can ever rally in an October 10, 2025, Barchart article. I concluded with the following:

Cotton is in the buy zone as commodity cyclicality and seasonality for Q1 and Q2 2026 favor a price recovery. I rate cotton a buy at a price below 70 cents per pound, but will leave plenty of room to buy on a scale-down basis over the coming weeks and months.

Don’t Miss a Day: From crude oil to coffee, sign up free for Barchart’s best-in-class commodity analysis.

Nearby ICE cotton futures were trading at 64.15 cents per pound on October 10, and were only marginally lower on the active month March futures contract in December 2025.

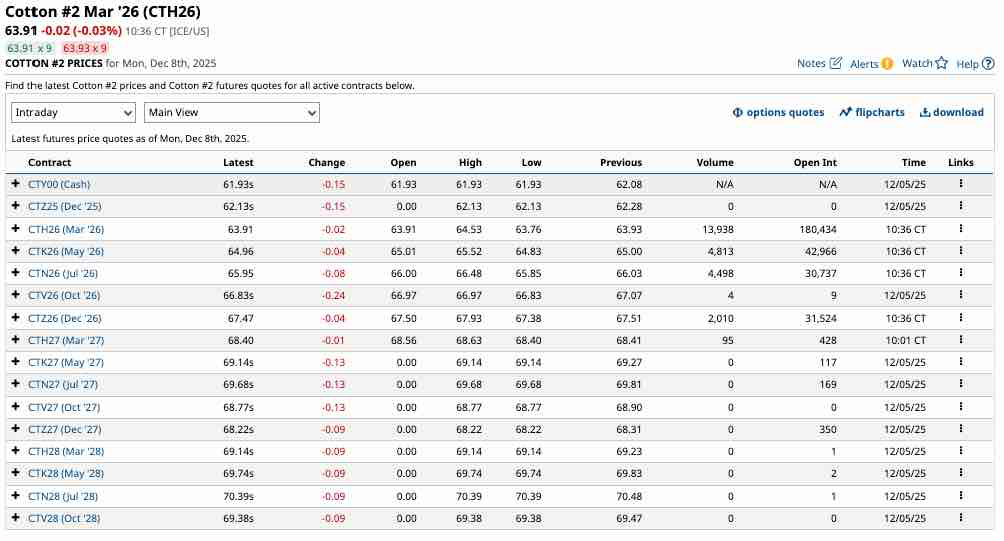

The latest WASDE report remained bearish for cotton

The USDA released its November World Agricultural Supply and Demand Estimates Report on November 14, 2025. The fundamentals for the cotton market included:

The November WASDE report validated the current sideways-to-bearish price action in cotton, as U.S. production and stocks, as well as global stockpiles, increased.

The price action suggests a limited downside risk

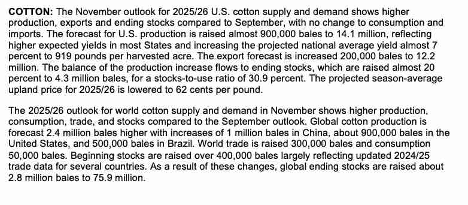

At below 65 cents per pound in December 2025, ICE cotton futures remain in a long-term bearish trend.

The monthly chart highlights the 61% decline from the May 2022 high of $1.5595 to the April 2025 low of 60.80 cents per pound. In 2025, nearby cotton futures have traded in a narrow 60.80 to 69.75 range. At nearly 63.90 cents in December, cotton futures were directionless, in the middle of this year’s trading range.

Seasonality is critical- Purchases during winter could lead to profits in spring

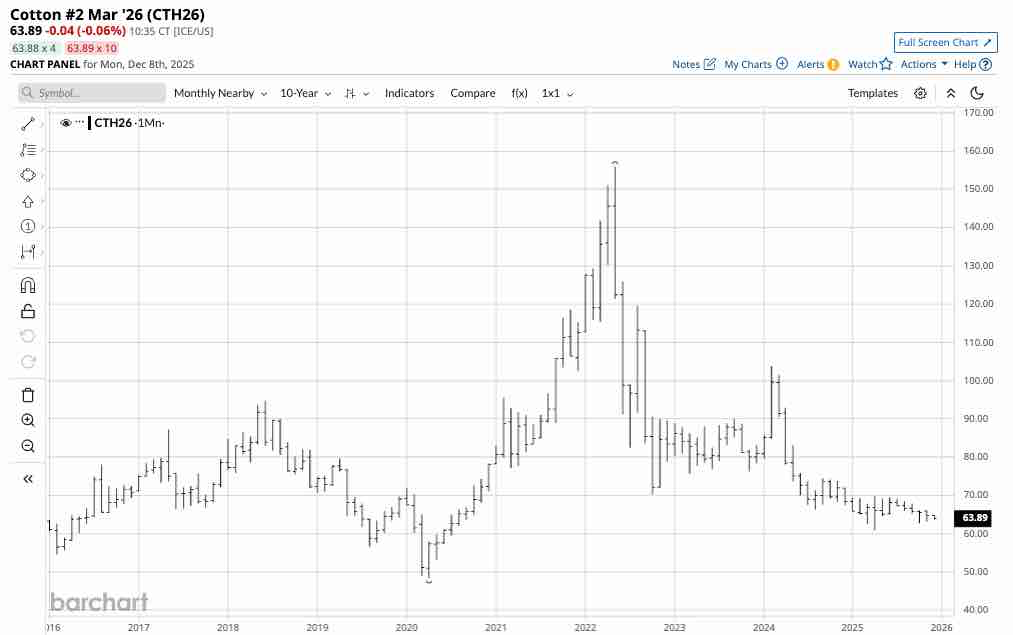

The long-term twenty-year monthly chart highlights cotton’s price seasonality.

Over the past two decades, cotton reached annual highs from March through July in 2008, 2010, 2011, 2013, 2014, 2015, 2017, 2018, 2022, and 2024. At the current price level, the odds favor a recovery rally in spring or early summer 2026.

Commodity cyclicality also favors a recovery, as cotton prices have declined to a level where production will likely slow, U.S. and global inventories will decrease, and consumer purchases will increase, creating the perfect environment for price bottoms. The 65 cents per pound level limits the downside risk, while the potential for a recovery to higher prices has increased.

The forward curve remains attractive at current levels

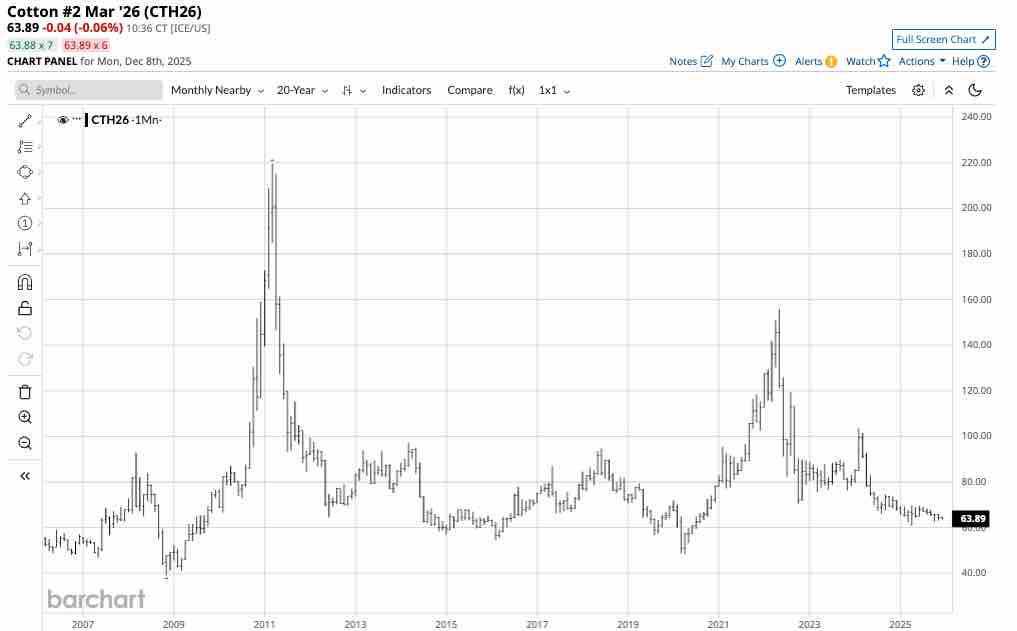

Cotton’s forward curve in the ICE futures market shows that prices remain depressed across the board out to October 2028 delivery.

The forward curve shows that cotton remains below 70 cents per pound through 2026 and until July 2028, where it is only marginally above the 70 cents level. May through July 2026 futures prices are under 66 cents in December 2025, which could be inexpensive, given commodity cyclicality and seasonality for the coming year.

The only route for a risk position is the ICE futures

There are no ETFs or ETNs that track cotton prices on the Intercontinental Exchange. Therefore, the only route for a risk position is the ICE futures or futures options. The options have limited liquidity as open interest, the total number of open long and short positions in ICE cotton put and call options, is low.

With May cotton futures at 64.95 cents per pound, and each contract containing 50,000 pounds, the contract value is $32,475. ICE’s original margin requirement for cotton is $1,430 per contract. A market participant can control one ICE cotton contract on the long or short side with a 4.40% down payment. If equity drops below $1,300, the exchange requires maintenance margin payments. Futures are leveraged instruments, that require careful attention to risk-reward dynamics.

I remain bullish on cotton prices going into 2026, as prices are low, commodity cyclicality could limit downside risk, and seasonality favors a recovery in the coming year. I would be a buyer of cotton futures at the current price level, leaving plenty of room to add on further price declines.