Arlington, Virginia-based CoStar Group, Inc. (CSGP) operates as an information services provider to the commercial real estate industry. With a market cap of $36.6 billion, the company offers information, analytics, and online marketplace services in the Americas, Europe, and the Indo-Pacific.

Companies worth $10 billion or more are generally described as "large-cap stocks." CoStar Group fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size, influence, and dominance in the real estate services industry.

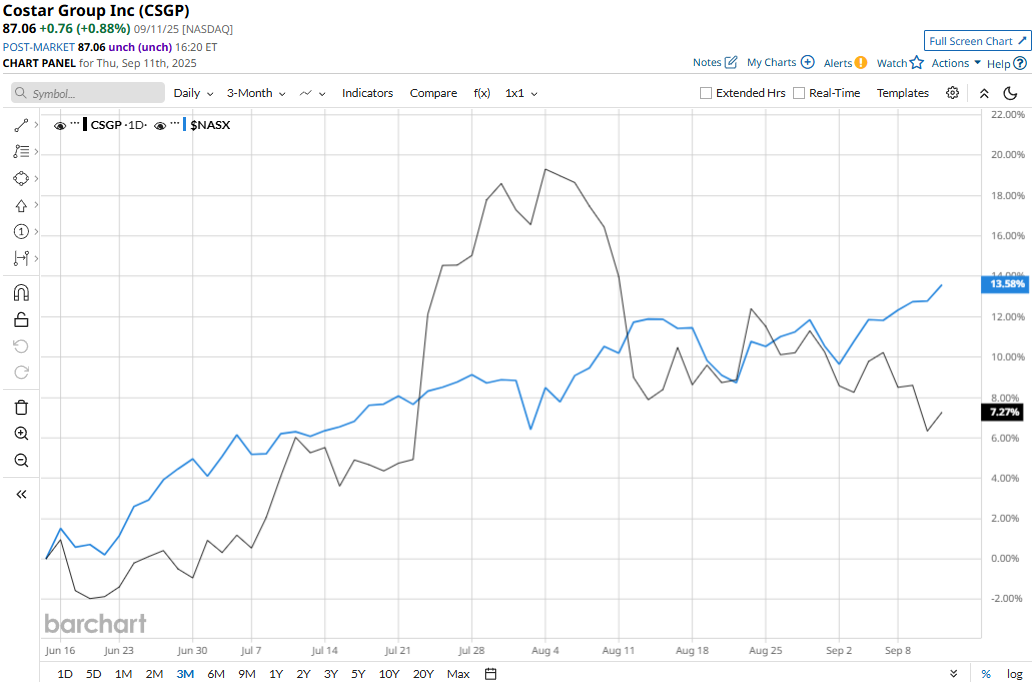

CoStar touched its 52-week high of $97.43 on Aug. 5 and is currently trading 10.6% below that peak. Meanwhile, the stock has gained 6.4% over the past three months, lagging behind the Nasdaq Composite’s ($NASX) 12.4% surge during the same time frame.

Over the longer term, CSGP stock has soared 21.6% on a YTD basis and 9.4% over the past 52 weeks, outperforming NASX’s 14.2% gains in 2025, but lagging behind its 26.7% surge over the past year.

CSGP stock surged above its 50-day and 200-day moving averages in early June, underscoring its upturn in recent months.

CoStar Group’s stock prices surged 6.9% in the trading session following the release of its impressive Q2 results on Jul. 22 and maintained a positive momentum for the next five trading sessions. Driven by its continued business momentum, Q2 2025 marked the 57th consecutive quarter of double-digit topline growth. CoStar’s revenues for the quarter surged 15.2% year-over-year to $781 million, surpassing the Street expectations by 1.3%. Further, the company’s adjusted EBITDA skyrocketed 107.3% year-over-year to $85 million.

Meanwhile, its adjusted EPS increased 13.3% year-over-year to $0.17, exceeding the consensus estimates.

However, CoStar has lagged behind its peer, Jones Lang LaSalle Incorporated’s (JLL) 24.2% surge in 2025 and 23.9% gains over the past 52 weeks.

Among the 16 analysts covering the CSGP stock, the consensus rating is a “Moderate Buy.” Its mean price target of $97 suggests an 11.4% upside potential from current price levels.