/Cooper%20Companies%2C%20Inc_%20phone%20and%20site-by%20T_Schneider%20via%20Shutterstock.jpg)

San Ramon, California-based The Cooper Companies, Inc. (COO) is a specialty medical device company. It operates through CooperVision and CooperSurgical segments. CooperVision manufactures and sells a wide range of contact lenses, and CooperSurgical sells a variety of medical devices and surgical instruments. With a market cap of $12.8 billion, Cooper’s operations span the Americas, Indo-Pacific, Europe, and internationally.

Companies worth $10 billion or more are generally described as "large-cap stocks." COO fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size and influence in the medical instruments & supplies industry.

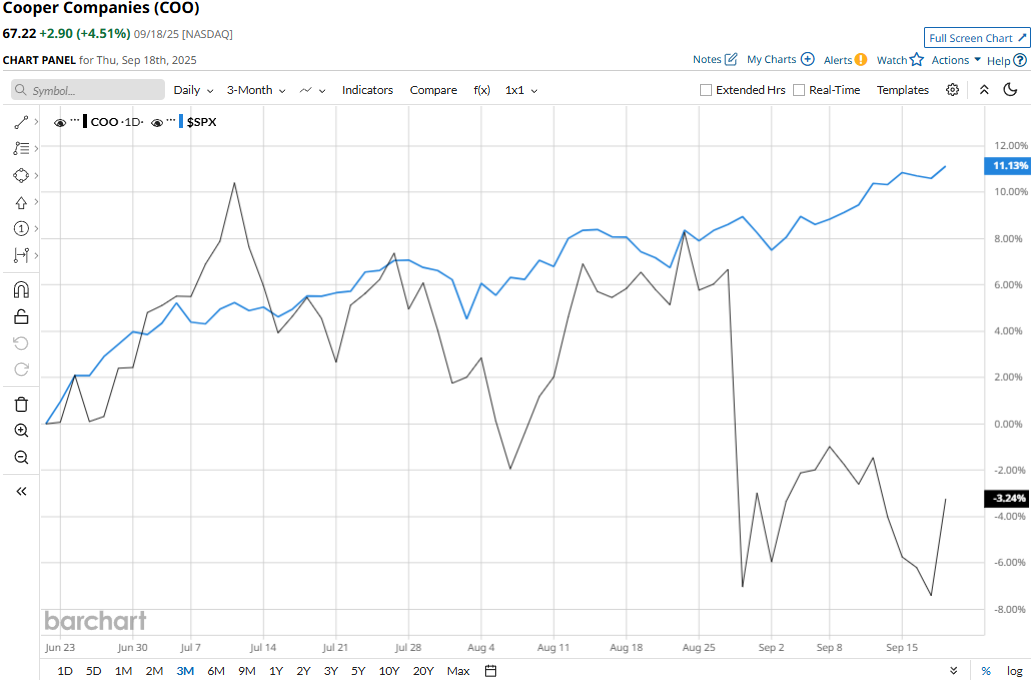

The stock touched its 52-week high of $112.29 on Sep. 19, 2024, and is currently trading 40.1% below that peak. Meanwhile, COO stock has dipped 3.7% over the past three months, underperforming the S&P 500 Index’s ($SPX) 10.9% gains during the same time frame.

Over the longer term, Cooper’s performance looks even more grim. The stock plummeted 26.9% on a YTD basis and 39.2% over the past 52 weeks, lagging behind SPX’s 12.8% surge in 2025 and 18% returns over the past year.

Further, the stock has traded mostly below its 200-day moving average since mid-December 2024 and below its 50-day moving average since early November 2024, with some fluctuations.

Cooper Companies’ stock prices tanked 12.9% in a trading session following the release of its mixed Q3 results on Aug. 27. The company’s organic revenues grew by 2% compared to the year-ago quarter, which missed the Street’s expectations. Further, its overall sales came in at $1.1 billion, up 5.7% year-over-year and falling 50 bps short of expectations. Moreover, the company expects its Q4 results to remain soft, which unsettled investor confidence and led to the sell-off in stock prices.

On the positive note, Cooper’s adjusted EPS increased 14.6% year-over-year to $1.10, surpassing the consensus estimates by 2.8%.

When compared to its peer, COO has notably underperformed Hologic, Inc.’s (HOLX) 5.3% decline on a YTD basis and 16.5% plunge over the past 52 weeks.

Among the 15 analysts covering the COO stock, the consensus rating is a “Moderate Buy.” Its mean price target of $83.28 suggests a 23.9% upside potential from current price levels.