I last wrote about the dollar index on Barchart on July 22, 2025, when I asked if the index had found a bottom. I concluded that article with the following:

If the dollar index is heading for a challenge of the next technical support level, the UDN ETF will appreciate from the bearish ride. With lower U.S. interest rates on the horizon and a rising debt level, the dollar index’s path of least resistance remains lower in mid-July 2025, and the index has not yet found a bottom.

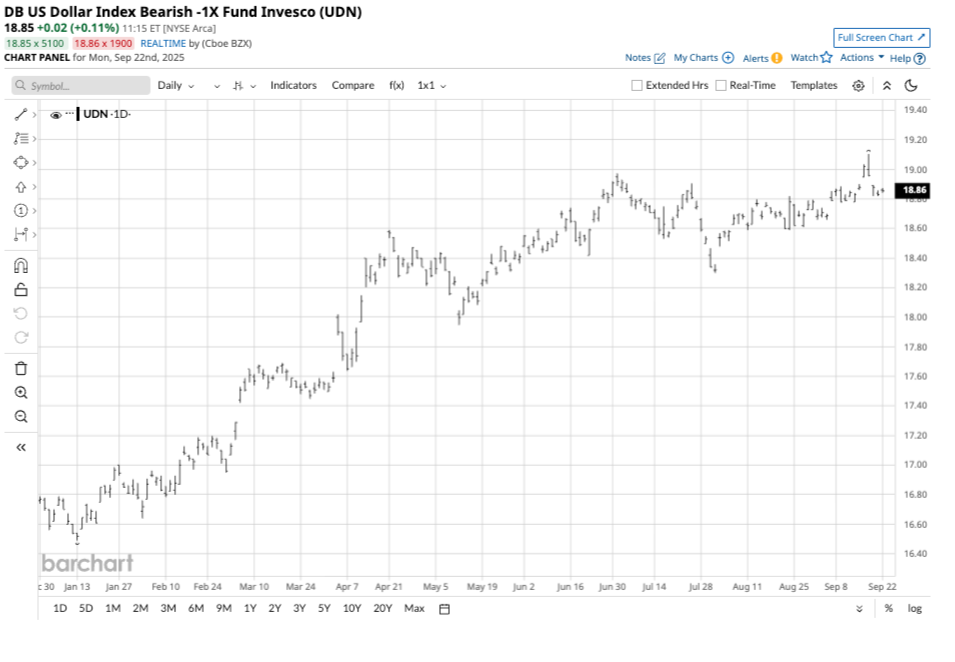

The dollar index was trading at the 97.77 level on July 21, with the Invesco DB U.S. Dollar Bearish -1X Fund (UDN) at $18.75 per share. The index and UDN have not moved much over the past two months, but falling U.S. rates could mean that lower lows are on the horizon.

The dollar index has traded in a narrow range

The dollar index declined 12.5% from the January 13, 2025, high of 110.17 to the July 1, 2025, low of 96.37.

The daily year-to-date chart shows that since July 24, the index has consolidated in a 96.22 to 100.26 range. At around 97.50 in late September, the index is not far above the low end of the trading range and within striking distance of critical technical support at the September 17 low of 96.22.

The Fed is cutting interest rates

One of the most significant factors for the path of least resistance of the dollar index is the interest rate differential between the U.S. dollar and the euro. The euro comprises 57.6% of the dollar index. Short-term European rates are at just below the 2% level. While the Fed cut the short-term U.S. Fed Funds Rate by 25 basis points at the September 18 FOMC meeting, the rate is at a midpoint of 4.125%.

The Fed is likely to continue to reduce the Fed Funds Rate due to rising U.S. unemployment and inflation below the 3% level. The central bank’s mandate is to achieve full employment and stable prices, with an inflation target at 2%. Moreover, President Trump and his Treasury Secretary, Scott Bessent, have not been shy about their opinion that the Fed has waited too long to reduce short-term rates.

Lower rates on the horizon in 2026 for one key reason

In early 2026, President Trump will appoint the Fed’s next Chairman, and the current Chair, Jerome Powell, is not a candidate for reappointment. Meanwhile, the President is prepared to appoint new members to the central bank’s voting ranks. Any appointments will likely support the administration’s call for lower short-term rates.

With European short-term rates over 2% below the Fed Funds Rate and the prospects for falling U.S. rates in 2026, the bottom line is that the U.S. dollar index could be on a path toward a new low for 2025, and a challenge of longer-term downside technical targets.

The dollar index’s technical targets

The monthly chart highlights the dollar index’s next downside target.

The monthly seven-year chart illustrates that while technical resistance is at the January 2025 110.17 high and the September 2022 peak of 114.78, support is over 8.5% below the current level at the January 2021 low of 89.20.

Aside from falling U.S. short-term interest rates, the growing U.S. debt at over $37.50 trillion, Moody’s 2025 downgrade of U.S. sovereign debt, trade tariffs and sanctions on global trading partners, and the dollar index’s trend since early 2025 support lower levels.

UDN will rise as the dollar index falls

The Invesco DB U.S. Dollar Bearish -1X Fund (UDN) is an unleveraged ETF product that appreciates when the dollar index declines. At $18.85 per share, UDN had over $153.46 million in assets under management. UDN trades an average of over 173,800 shares daily and charges a 0.77% management fee. The dollar index declined 12.66% from its 2025 high to its low.

The daily year-to-date chart shows the UDN ETF’s 15.9% rise from $16.49 to $19.11 per share. The bearish UDN ETF outperformed the decline of the dollar index from its January 13 high to the September 17 low.

If the dollar index is heading lower toward a challenge of the 90 level or lower, UDN is likely to continue to appreciate. The odds favor lower lows in the dollar index when the current consolidation near the lows comes to an end.