/Chubb%20Limited%20office%20sign-by%20Poetra_%20RH%20via%20Shutterstock.jpg)

Zurich, Switzerland-based Chubb Limited (CB) provides insurance and reinsurance products. With a market cap of $117.2 billion, the company offers commercial and personal property, casualty, and personal accident and supplemental health insurance, reinsurance, and life insurance to a diverse group of clients.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and CB perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the insurance - property & casualty industry. Chubb's financial stability and diverse portfolio have solidified its competitive advantage in the insurance market. The company's strong brand reputation, commitment to intellectual property protection, and global workforce of 40,000 employees across 54 countries further enhance its market position.

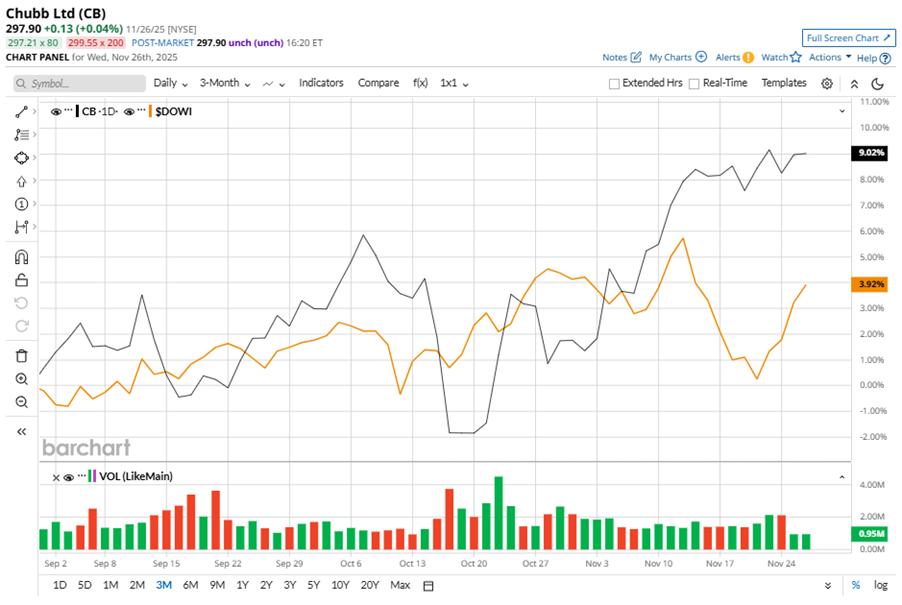

Despite its notable strength, CB slipped 2.9% from its 52-week high of $306.91, achieved on Apr. 3. Over the past three months, CB stock gained 9.5%, outperforming the Dow Jones Industrials Average’s ($DOWI) 4.4% gains during the same time frame.

In the longer term, shares of CB rose 7.8% on a YTD basis and climbed 3.3% over the past 52 weeks, underperforming DOWI’s YTD gains of 11.5% and 5.7% returns over the last year.

To confirm the bullish trend, CB has been trading above its 200-day moving average since late September, with slight fluctuations. The stock has been trading above its 50-day moving average since late August, with minor fluctuations.

On Oct. 21, CB reported its Q3 results, and its shares closed up by 2.7% in the following trading session. Its net premiums written stood at $14.9 billion, up 7.5% year over year. The company’s core operating income increased 30.9% from the year-ago quarter to $7.49 per share.

In the competitive arena of insurance - property & casualty, The Progressive Corporation (PGR) has lagged behind CB, showing resilience with a 4.4% loss on a YTD basis and a 14.5% downtick over the past 52 weeks.

Wall Street analysts are reasonably bullish on CB’s prospects. The stock has a consensus “Moderate Buy” rating from the 25 analysts covering it, and the mean price target of $310.09 suggests a potential upside of 4.1% from current price levels.