/Chubb%20Limited%20office%20sign-by%20Poetra_%20RH%20via%20Shutterstock.jpg)

With a market cap of $110.4 billion, Chubb Limited (CB) is the world’s largest publicly traded property and casualty insurance company. With operations across six business segments, the company offers a broad range of commercial and personal insurance, reinsurance, accident and health, and life insurance products worldwide.

Companies valued at $10 billion or more are generally considered "large-cap" stocks, and Chubb Limited fits this criterion perfectly. Known for its strong underwriting discipline, financial strength, and global reach, Chubb serves diverse clients with extensive risk management solutions and responsive claims service.

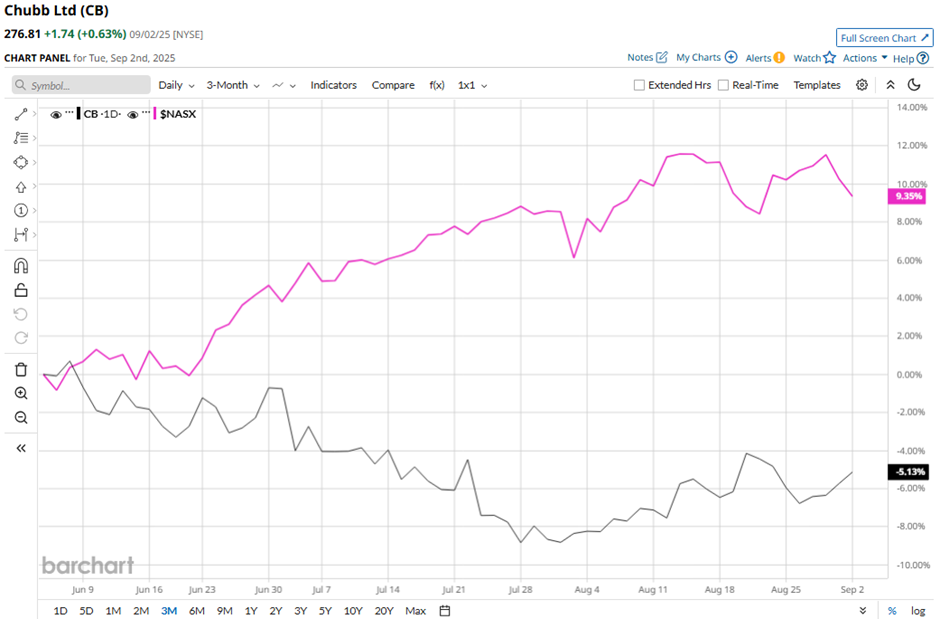

Despite this, shares of the Zurich, Switzerland-based company have declined 9.8% from its 52-week high of $306.91. Chubb’s shares have dipped 7.7% over the past three months, underperforming the Nasdaq Composite’s ($NASX) 10.6% increase over the same time frame.

In the longer term, CB stock is up marginally on a YTD basis, lagging behind NASX’s 10.2% gain. Moreover, shares of the insurer have decreased 2.6% over the past 52 weeks, compared to NASX’s 20.1% return over the same time frame.

CB stock has been trading below its 50-day moving average since early June and its 200-day moving average since July.

Shares of Chubb fell 3.1% following its Q2 2025 results on Jul. 22 as revenues of $14.8 billion missed estimates despite rising 6.9% year-over-year, while net investment income of $1.5 billion came in below both the consensus estimate and internal expectations. Additionally, the company incurred $630 million in pre-tax catastrophe losses, wider than last year, which weighed on investor sentiment despite strong underwriting income and premium growth.

In contrast, rival The Travelers Companies, Inc. (TRV) has outpaced CB stock. TRV stock has gained 13.5% on a YTD basis and 19.9% over the past 52 weeks.

Despite the stock’s underperformance, analysts remain moderately optimistic on Chubb Limited. CB stock has a consensus rating of “Moderate Buy” from 24 analysts in coverage, and the mean price target of $303.18 is a premium of 9.5% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.