Valued at a market cap of around $36 billion, Charter Communications, Inc. (CHTR) is a leading broadband connectivity and cable operator based in Stamford, Connecticut. It provides high-speed internet, video, mobile, and voice services to residential and commercial customers across more than 40 states.

Companies valued at $10 billion or more are typically classified as “large-cap stocks,” and CHTR fits the label perfectly. With a strong focus on broadband expansion, advanced network infrastructure, and bundled offerings, the company plays a key role in meeting the growing demand for reliable connectivity and digital services.

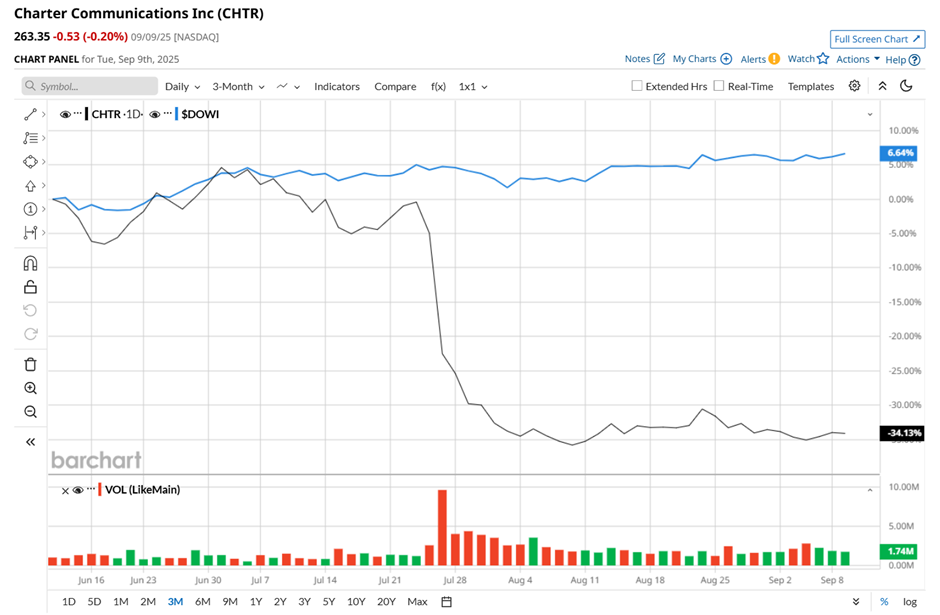

Despite its notable strength, shares of the broadband connectivity provider have slipped 39.7% from its 52-week high of $437.06, reached on May 16. Moreover, shares of CHTR have declined 33.3% over the past three months, significantly underperforming the Dow Jones Industrial Average’s ($DOWI) 6.9% rise during the same time frame.

In the longer term, CHTR stock has fallen 18.9% over the past 52 weeks, lagging behind DOWI's 12% uptick over the same time period. Moreover, on a YTD basis, shares of CHTR are down 23.2%, compared to DOWI’s 7.4% return.

To confirm its bearish trend, the stock has been trading below its 200-day moving average since late July, and has remained below its 50-day moving average since mid-July.

On Jul. 25, shares of CHTR plunged 18.5% following its mixed Q2 2025 earnings release. While its commercial revenue showed growth, it was largely offset by declines in its residential revenue, driven by weaker video and voice sales. As a result, its total revenue edged up slightly year-over-year to $13.8 billion and came in marginally above the consensus estimates.

However, a significant loss of 117,000 internet subscribers raised red flags for investors. Adding to the concerns, its net income per share of $9.18 missed Wall Street's expectations by a notable margin of 8.7%, further weighing on investor sentiment

CHTR stock has also lagged behind its rival, Comcast Corporation (CMCSA), which declined 15.2% over the past 52 weeks and 10.3% on a YTD basis.

Despite CHTR’s underperformance, analysts remain moderately optimistic about its prospects. The stock has a consensus rating of "Moderate Buy” from the 25 analysts covering it, and the mean price target of $388.76 suggests a 47.6% premium to its current price levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.