The Charles Schwab Corporation (SCHW), headquartered in Westlake, Texas, operates as a savings and loan holding company. With a market cap of $174 billion, the company provides wealth and asset management, securities brokerage, banking, trading and research, custody, and financial advisory services.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and SCHW perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the capital markets industry. SCHW is a trusted financial services company with a strong brand reputation, offering a wide range of products and services. Its investments in technology provide a seamless digital experience, while its extensive branch network allows for personalized support, catering to diverse client needs.

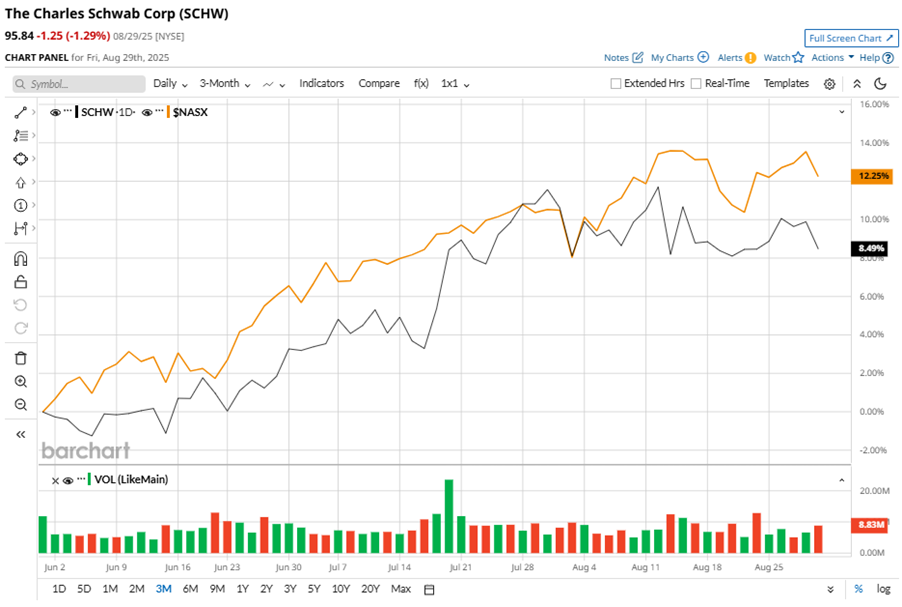

Despite its notable strength, SCHW slipped 3.8% from its 52-week high of $99.59, achieved on Jul. 29. Over the past three months, SCHW stock gained 9.2% underperforming the Nasdaq Composite’s ($NASX) 11.9% gains during the same time frame.

In the longer term, shares of SCHW rose 29.5% on a YTD basis and climbed 49.8% over the past 52 weeks, outperforming NASX’s YTD gains of 11.1% and 22.2% returns over the last year.

To confirm the bullish trend, SCHW has been trading above its 200-day moving average since mid-October, with slight fluctuations. The stock has been trading above its 50-day moving average since late April.

Strong asset management and trading revenues, higher net interest revenues, and solid brokerage account growth drive Charles Schwab's outperformance. Declining funding costs, strategic acquisitions, and increased advice solution fees also contributed to the positive results.

On Jul. 18, SCHW shares closed up by 2.9% after reporting its Q2 results. Its adjusted EPS of $1.14 beat the consensus estimate of $1.09. The company’s revenue was $5.9 billion, handily surpassing the consensus estimate of $5.7 billion.

In the competitive arena of capital markets, Morgan Stanley (MS) has lagged behind the stock, showing resilience with a 19.7% gain on a YTD basis and a 47.2% uptick over the past 52 weeks.

Wall Street analysts are reasonably bullish on SCHW’s prospects. The stock has a consensus “Moderate Buy” rating from the 22 analysts covering it, and the mean price target of $107.65 suggests a potential upside of 12.3% from current price levels.