/Charles%20River%20Laboratories%20International%20Inc_%20logo-%20by%20IgorGolovniov%20via%20Shutterstock.jpg)

Wilmington, Massachusetts-based Charles River Laboratories International, Inc. (CRL) is a contract research organization. It provides drug discovery, non-clinical development, and safety testing services. With a market cap of $7.6 billion, Charles Rivers operates through Research Models and Services (RMS), Discovery and Safety Assessment (DSA), and Manufacturing Solutions segments.

Companies worth between $2 billion and $10 billion are generally described as "mid-cap stocks." CRL fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size and influence in the diagnostics and research industry.

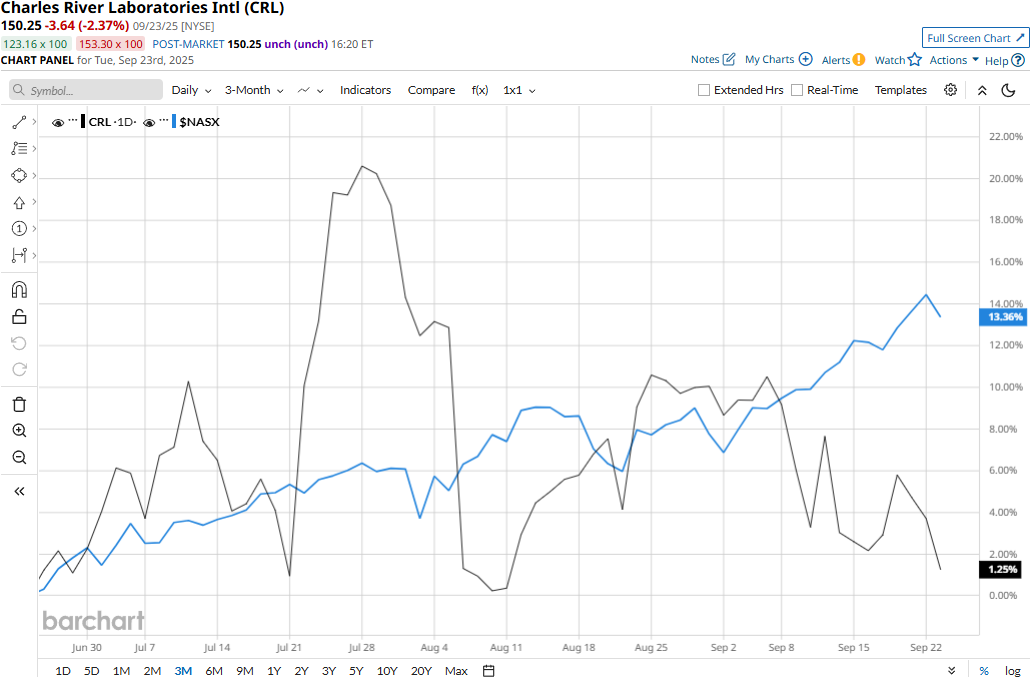

Despite its notable strengths, CRL stock has tanked 34.7% from its 52-week high of $230.02 touched on Nov. 6, 2024. Meanwhile, the stock has gained nearly 2% over the past three months, notably underperforming the Nasdaq Composite’s ($NASX) 15% surge during the same time frame.

CRL’s performance has remained grim over the longer term as well. The stock has plummeted 18.6% on a YTD basis and 26.3% over the past 52 weeks, underperforming NASX’s 16.9% gains in 2025 and 25.6% surge over the past year.

CRL has traded mostly below its 200-day moving average over the past year and above its 50-day moving average since mid-May, with some fluctuations, underscoring its longer-term bearish trend and recent upturn.

Charles River Laboratories’ stock prices plummeted 10.3% in a single trading session following the release of its disappointing Q2 results on Aug. 6. The company’s topline performance remained concerning during the quarter. Its consolidated organic sales dropped by 50 bps year-over-year. Although its overall topline increased by $6 million compared to the year-ago quarter to $1.03 billion, it was completely attributable to favourable currency movement.

Further, Charles River reported a sharp 12.8% surge in SG&A expenses to $191.5 million, bringing down the company’s already low profitability. The company removed several expenses in its calculation of non-GAAP earnings. However, on a GAAP basis, its bottom line declined 41.9% year-over-year to $52.3 million.

When compared to its peer, CRL has significantly underperformed Labcorp Holdings Inc.’s (LH) 22.1% surge on a YTD basis and 24.6% returns over the past 52 weeks.

Among the 17 analysts covering the CRL stock, the consensus rating is a “Moderate Buy.” Its mean price target of $174.71 suggests a 16.3% upside potential from current price levels.