Northbrook, Illinois-based CF Industries Holdings, Inc. (CF) manufactures and sells hydrogen and nitrogen products for energy, fertilizer, emissions abatement, and other industrial activities. Valued at $13.8 billion by market cap, the company provides clean energy to sustainably feed and fuel the world.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and CF perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the agricultural inputs industry. CF’s strengths lie in its scale, integration, and cost leadership in nitrogen fertilizer production, driven by efficient manufacturing and access to natural gas. Its strategic geographic footprint and commitment to operational excellence and sustainability further enhance its competitive advantage, enabling efficient distribution and responsiveness to demand fluctuations.

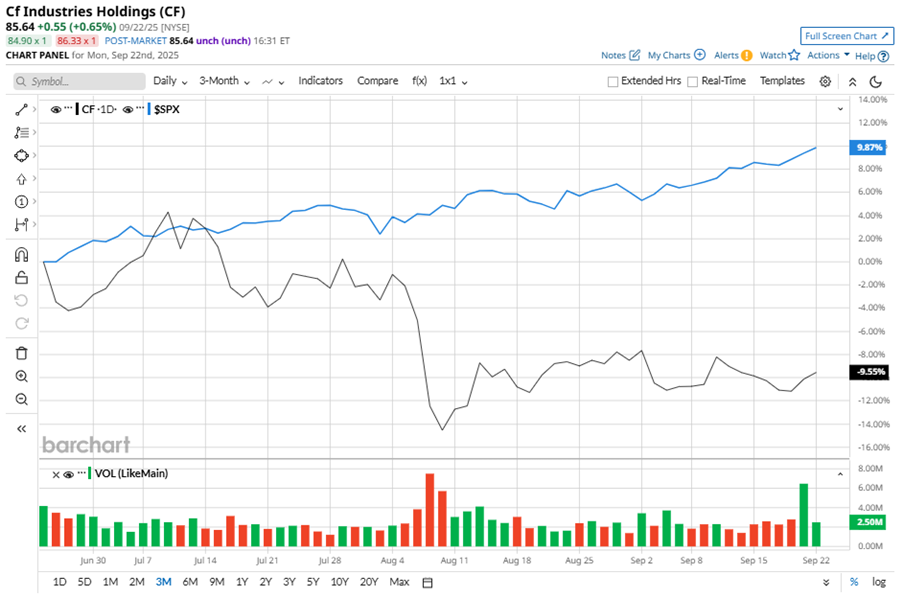

Despite its notable strength, CF slipped 18% from its 52-week high of $104.45, achieved on Jun. 16. Over the past three months, CF stock has declined 14.7%, underperforming the S&P 500 Index’s ($SPX) 12.2% gains during the same time frame.

In the longer term, shares of CF rose marginally on a YTD basis and climbed 4.9% over the past 52 weeks, underperforming SPX’s YTD gains of 13.8% and 17.4% returns during the same time frame.

To confirm the bearish trend, CF has been trading below its 50-day moving average since mid-July, with slight fluctuations. The stock is trading below its 200-day moving average since early August, with slight fluctuations.

On Aug. 6, CF shares closed down more than 3% after reporting its Q2 results. Its EPS of $2.37 surpassed Wall Street expectations of $2.35. The company’s revenue was $1.9 billion, topping Wall Street forecasts of $1.7 billion.

In the competitive arena of agricultural inputs, The Mosaic Company (MOS) has taken the lead over CF, showing resilience with a 36% uptick on a YTD basis and 30.8% returns over the past 52 weeks.

Wall Street analysts are cautious on CF’s prospects. The stock has a consensus “Hold” rating from the 17 analysts covering it, and the mean price target of $93.33 suggests a potential upside of 9% from current price levels.