/Cboe%20Global%20Markets%20Inc_%20logoon%20phone-by%20Piotr%20Swat%20via%20Shutterstoc.jpg)

With a market cap of $24.5 billion, Cboe Global Markets, Inc. (CBOE) is one of the world’s largest exchange operators and a leader in ETP trading. Through its subsidiaries, it offers trading across multiple asset classes, including options, futures, equities, FX, and digital assets, spanning North America, Europe, and Asia Pacific.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and Cboe Global Markets fits this criterion perfectly. The company operates through six business segments: Options; North American Equities; Europe and Asia Pacific; Futures; Global FX; and Digital, providing diverse trading, clearing, and data solutions to global market participants.

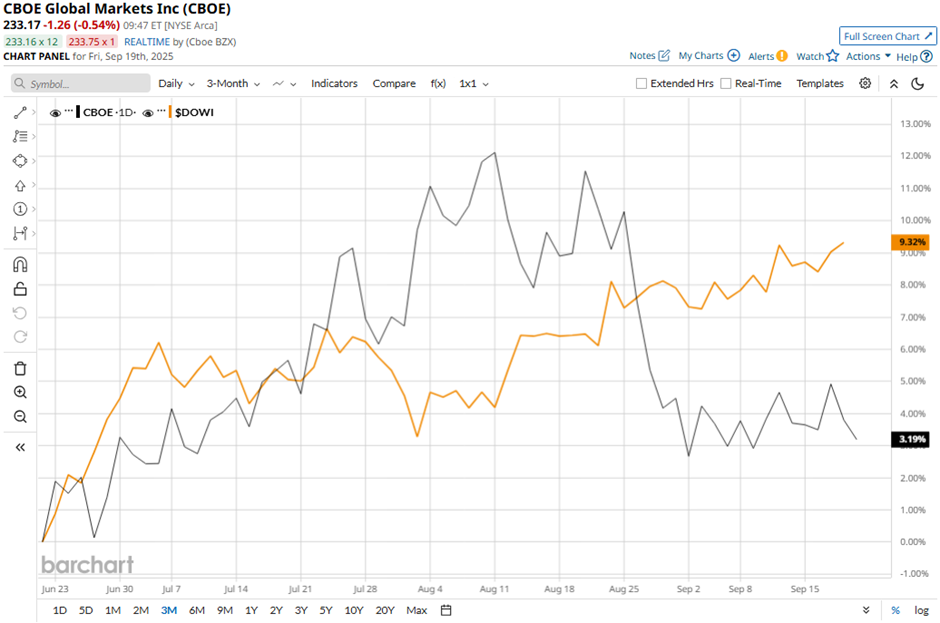

Shares of the Chicago, Illinois-based company have declined 8.2% from its 52-week high of $255.27. Over the past three months, its shares have risen 3%, underperforming the broader Dow Jones Industrials Average's ($DOWI) 9.5% return during the same period.

Longer term, CBOE stock is up nearly 20% on a YTD basis, outperforming DOWI's 8.6% gain. Moreover, shares of the company have returned 11.3% over the past 52 weeks, compared to DOWI’s 9.9% increase over the same time frame.

The stock has been in a bullish trend, consistently trading above its 200-day moving average since last year.

Shares of Cboe Global Markets rose 2.8% on Aug. 1 after the company delivered strong Q2 2025 results, with adjusted EPS of $2.46 beating the consensus estimate and rising 14.4% year-over-year. Revenues hit a record $587.3 million, up 14% and above estimates, driven by a 19% jump in options revenues and a 30% increase in Europe and Asia Pacific revenues, alongside solid growth in Global FX.

Investors were further encouraged by the updated guidance, with Cboe expecting high single-digit organic net revenue growth and lowering its expense outlook to $832 million - $847 million.

In contrast, rival Intercontinental Exchange, Inc. (ICE) has lagged behind CBOE stock. ICE stock has soared 14.8% YTD and 7.7% over the past 52 weeks.

Despite the stock’s outperformance over the past year, analysts remain cautious about its prospects. The stock has a consensus rating of “Hold” from 18 analysts in coverage, and the mean price target of $246.73 is a premium of 5.9% to current levels.